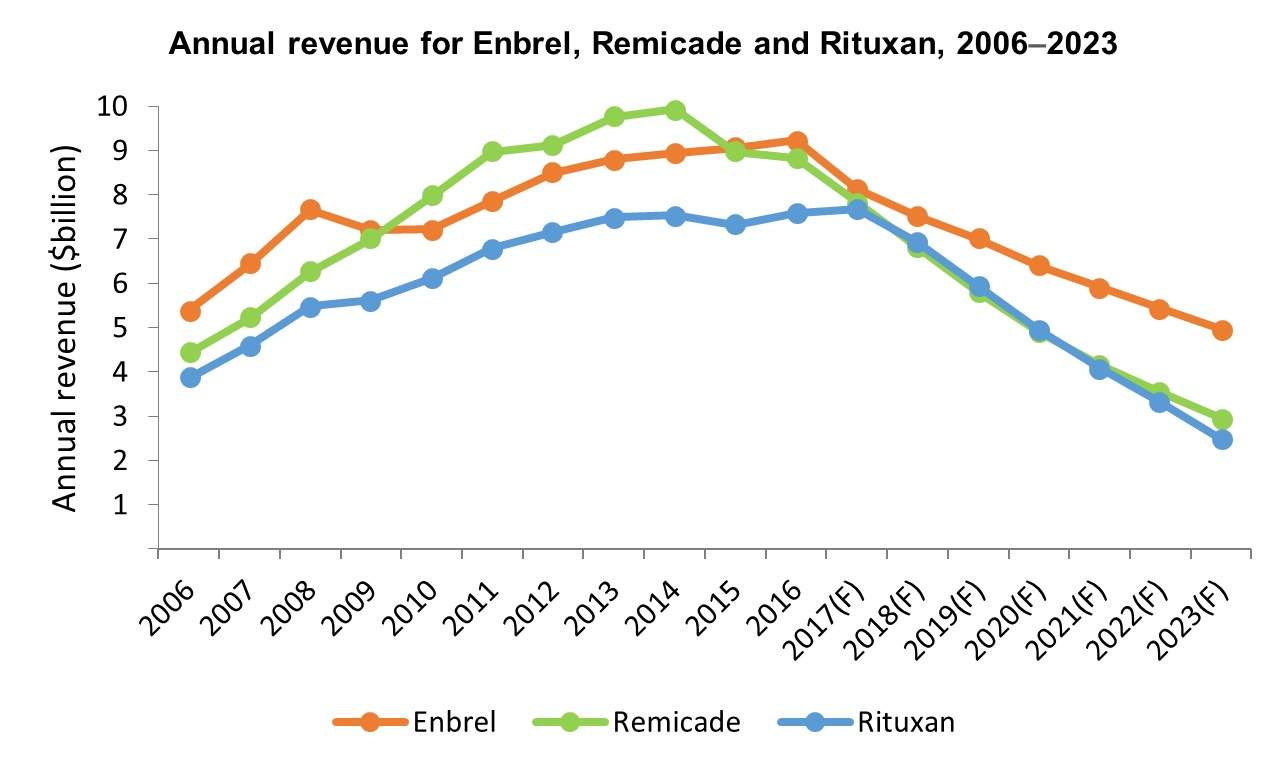

Despite the highly competitive nature of the immunology drugs market there are several well-established blockbuster drugs that dominate in terms of revenue. These include Humira (adalimumab), Enbrel (etanercept), Remicade (Infliximab) and Rituxan (rituximab).

However, due to several recent and upcoming patent expiries, these drugs will suffer from biosimilar erosion over the forecast period (2017–2023), resulting in revenue decline and reduced dominance. Rituxan’s patents expired in 2015, and Remicade’s patent will expire in the US in 2018, having already expired in Europe in 2015.

Resima and Inflectra are Remicade biosimilars that are approved in the EU, and Infelctra also has FDA approval for when Remicade’s patent expires in the US. These biosimilars will have a substantial impact on Remicade’s revenue, which peaked in 2014 at $9.9 billion but is expected to fall to $3 billion by 2023.

There are further biosimilars in development which, if approved, will amplify this effect and cause further decreases in revenue. For example, Amgen is developing ABP-798, a rituximab biosimilar expected to become a blockbuster drug by 2023.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataHumira is the exception

Humira generates the highest revenue in immunology, with an annual revenue of $18.9 billion in 2017.

The main patent for Humira expired in the US in December 2016, creating an opportunity for biosimilars to enter the market and create competition. However, in September 2017 Humira won a patent litigation battle with Amgen, stopping Amgen from marketing Amjevita in the US until January 2023. It also meant that other adalimumab biosimilars, such as Cyltzeo, cannot be marketed until then.

Consequently, instead of facing decreasing revenue, Humira is now expected to see revenue growth until 2023 and will maintain market dominance.

First-in-class drugs to see increasing market share

Many of the drugs that are expected to see an increase in revenue are first-in-class, with interleukin (IL) inhibitors in particular becoming more prominent within the immunology market.

Stelara, which targets IL-12/23, Actemra, which targets IL-6, and Cosentyx, which targets IL-17A, are all projected to experience steady increases in revenue over the forecast period.

For more insight and data, visit the GlobalData Report Store – Pharmaceutical Technology is part of GlobalData Plc.

Related Company Profiles

Amgen Inc