The US had the largest pharmaceutical market revenue in 2017, and is expected to continue to do so for the foreseeable future. Cell therapies are among the most expensive molecule type due to the labour-intensive and complex nature of their manufacture. As more cell therapies gain approval and are increasingly used, they will have an ever-growing influence on global pharma market size.

To market cell therapies in the US, they need to be manufactured in facilities registered in the FDA’s Human Cell and Tissue Establishment Registration (HCTERS). This applies to both domestic facilities and facilities looking to import products to the US.

In August 2017, the FDA announced it would introduce a new regulatory framework to better regulate cell therapies in light of certain unscrupulous providers offering products that were unapproved, unproven, and potentially dangerous.

Cell therapy is still a relatively new form of treatment. As such, few related CMOs currently exist in the US, but they should become far more commonly used in the future. However, the development and manufacture of cell therapies could be severely hindered unless a greater number of associated facilities are opened and an adequate volume of staff is trained. There are already signs that CMOs will adapt to try to bridge the gap between supply and demand, as Lonza officially opened its new cell and gene therapy manufacturing plant on 10 April in Pearland, near Houston, Texas. At 300,000 square feet, Lonza’s new facility is the world’s largest manufacturing plant for cell therapies.

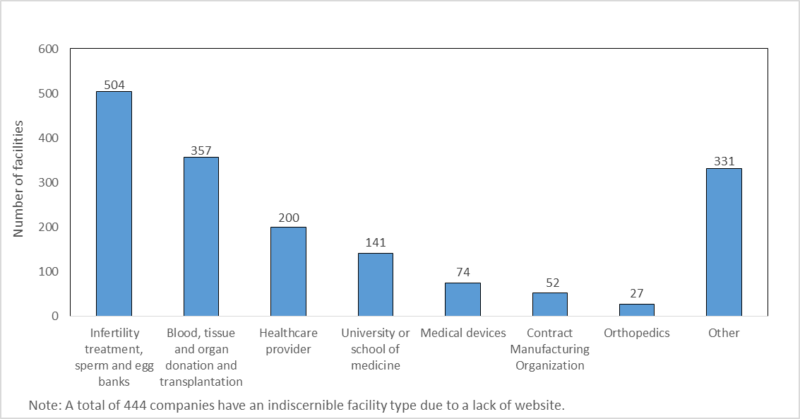

There are 2,262 registered facilities in the HCTERS, of which 52 are pharma CMOs (2.30%) and 22.28% are related to infertility treatments, sperm or egg banks, with most involved in administering in vitro fertilization (IVF) to patients. A significant number of facilities are related to blood, tissue, or organ donation. As is to be expected, healthcare providers and universities/medical schools have a large number of cell and tissue facilities, at 200 and 141, respectively. Academic institutions often conduct the early stages of cell therapy research.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataActive somatic cell therapy facilities in the FDA HCTERS database

Source: GlobalData; FDA. © GlobalData

Industry updates such as this one are covered in the Bio/Pharma Outsourcing Reports from PharmSource, a GlobalData product. If you do not subscribe to PharmSource or the Bio/Pharmaceutical Outsourcing Report, please contact a GlobalData sales representative to gain access.

References

Bio/Pharmaceutical Outsourcing Report (B/POR) (2018) ‘Current State of US Somatic Cell Therapy Facilities’, PharmSource, 23(4).

FDA (2018) Tissue Establishment Registration (accessed 21 April 2018).

Related Company Profiles

Pharmsource LLC

Lonza Ltd.