The recent European Medicines Agency (EMA) approval of the first rituximab biosimilar has placed a top selling cancer drug, Roche’s Rituxan/Mabthera (rituximab), under threat. The total sales for Rituxan/MabThera in 2016 was $7.4 billion, out of which revenue that was generated from blood cancers, non-Hodgkin’s lymphoma, and chronic lymphocytic leukemia contributed $5.8 billion. Sales of Rituxan alone are bigger than the total market size of most Oncology indications. Since the patent for Rituxan expired in the EU in 2013 and is soon to expire in the US in 2018, companies are intensively targeting the lucrative market with the development of numerous rituximab biosimilars.

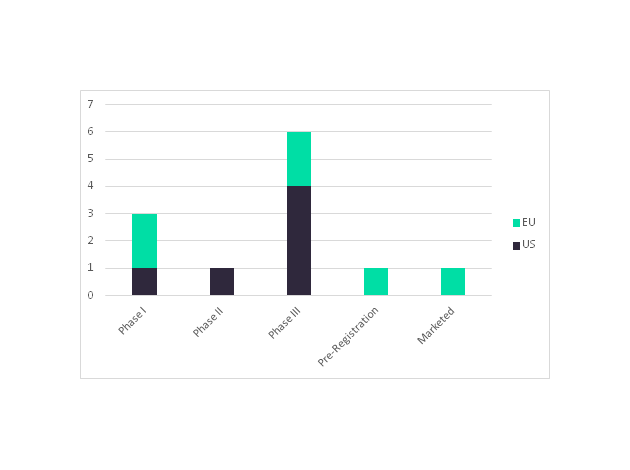

Celltrion and its marketing partners Teva Pharmaceuticals (US) and MundiPharma’s (EU) have a rituximab biosimilar, Truxima, which is the first to launch in the EU market. A second rituximab biosimilar is also due to launch this year from Sandoz (a Novartis division); the company is currently awaiting an approval decision from the EMA regarding their rituximab biosimilar. In an added bonus to companies developing rituximab biosimilars, biosimilar approval will extend to all indications included in Rituxan’s current label, such as rheumatoid arthritis, based on clinical data establishing equivalence to the originator in a single indication. Once the Rituxan’s US patent expires, the launch of rituximab biosimilars in the EU market will be followed by launches in the US market. In the US, Celltrion, Sandoz, Pfizer, and Amgen each have a rituximab biosimilar in Phase III, while Dr. Reddy’s Laboratories has one in Phase II.

Developing rituximab biosimilars is not a guaranteed strategy for success, however. Several rituximab biosimilars have already been discontinued during clinical development. Safety requirements in the EU and US forced Samsung Bioepis to repeat studies on its rituximab biosimilar SAIT101, which is now being developed by Archigen Biotech (a joint venture between AstraZeneca and Samsung Biologics). Teva Pharmaceuticals suspended the development of its rituximab biosimilar TL011 in Phase III due to concerns about how to meet the FDA and EMA requirements, before eventually discontinuing its development. Boehringer Ingelhelm also terminated its rituximab biosimilar development programs.

Figure 1: Number of Rituximab Biosimilars in Development for the US and EU Markets

See Also:

When Remicade (infliximab) biosimilars launched in the EU, they were priced at a 30% discount compared with the originator. GlobalData expects that a similar level of discount will be applied to rituximab biosimilars. This will force Roche to slash the price of its branded Rituxan or face losing patient share to the cheaper biosimilars. Either way, the rituximab biosimilars will start to erode Rituxan’s sales.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataIt is not just Rituxan’s sales figure that is under threat. Given how treatment choices are becoming increasingly cost-driven, rituximab biosimilars could increase the overall use of rituximab in some markets, eroding the patient share of drugs that currently compete with Rituxan.