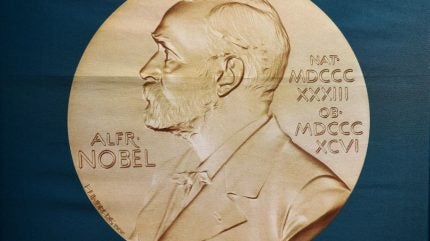

Sweden’s place on the frontier of science has a long history, with the capital Stockholm coming to a standstill every year since 1901 in eager anticipation of the Nobel Prize award announcements.

The latest prize – the 2025 Laureates being announced in October – came after work on peripheral immune tolerance. Mary E. Brunkow, Fred Ramsdell and Shimon Sakaguchi identified the immune system’s security guards, regulatory T cells, laying the foundation for a new field of research.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

A portion of that progress is being made in the country the prizes are awarded still to this day. Sweden is cementing itself as a hub of drug innovation over its Nordic neighbours, despite Europe’s second most valuable company being based in Denmark. But being home to a few big pharma superpowers does not necessarily equate to superpower innovation.

Benefits of big pharma vacuum

Sweden’s life science sector provides almost 10% of the country’s total product export. Since 2014, the net sales of Sweden’s life science industry have more than doubled, reaching an impressive 474 billion SEK ($50bn) in 2022, as per a report by trade body SwedenBIO.

Meanwhile, the Swedish Innovation Agency identified 3,838 companies within the life science sector in 2022.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataThere were 1,660 companies in Denmark’s life science industry in 2020, the last publicly available year of data. Three of these include big pharma companies: weight loss developer Novo Nordisk, neuroscience specialist Lundbeck, and the dermatology-portfolio company Leo Pharma.

Sweden used to be familiar territory for industry heavyweights at the turn of the millennium. Astra AB, a major pharmaceutical company in the country, merged with England’s Zeneca Group to form AstraZeneca in 1999. There was also Pharmacia, a large company acquired by Pfizer for $60bn in 2003.

“Having had two global major players where a lot of us worked means there is a great amount of experience in Sweden,” says David Westberg, CEO of Nanexa, and a former global project manager at Pharmacia.

“This not just within the Nordic or Scandinavian community but also working internationally on other aspects of drug development,” he adds.

While Denmark boasts the headquarters of big pharma players, the diversity of biotechs does not reach Sweden’s level. The plethora of Sweden’s biopharma startup scene has partly led to the country’s high-ranking in the 2025 Global Innovation Index. Measured across various innovation parameters against 138 other countries, Sweden is placed second only to Switzerland.

“Sweden has been starved of a big pharma company for many years. Big industry players pull and lift the entire ecosystem. Without that you must roll up your sleeves and do more yourself,” says Klaus Langhoff-Roos, CEO of Swedish biotech BioLamina.

Langhoff-Roos used to work at Novo Nordisk and led the company’s global commercialisation of Ozempic (semaglutide), meaning he has a good handle on the nuances between Sweden and Denmark’s environments.

Novo Nordisk underpins much of the money flowing in and out of Denmark – the company’s peak market capitalisation of $604bn even surpassed the country’s GDP in 2024.

“Sweden had big pharma, and that means that you still have great competences and smart people. When you then close manufacturing sites or you offshore processes, you still have great scientists and great manufacturing expertise. All those ideas need to go somewhere,” Langhoff-Roos comments.

One such example is showcased with CDMO NorthX. The company acquired a Stockholm-based site from French vaccine specialist Valneva in 2023, with 30 staff making the move too. Janet Hoogstraate, then head of Valneva Sweden, was later appointed CEO of NorthX.

Hoogstraate says: “It’s all about the people – they make it work.”

In Denmark, a divestment of Novo’s facilities and staff could yield similar results.

Langhoff-Roos says: “If the same vacuum were to hit Denmark, I would expect that the innovation index would go up there as well. Right now, that expertise is being sucked into Novo Nordisk. That’s the dynamic difference between Sweden and Denmark.”

Novo is undergoing a volatile period in an otherwise successful decade, having fallen behind Eli Lilly in the weight loss and type 2 diabetes treatment market. This culminated in 9,000 jobs being cut in September 2025. Just over half the amount to be axed are based in Denmark.

“After Novo reduces its employees, there will be a lot of startups in Denmark that start to come through. There’s so much experience there waiting to be harnessed,” Westberg forecasts.

Investment not matching innovation

One of the biggest fragilities in the Swedish pharma landscape is the lack of investment. Despite a pipeline that ranks fifth in Europe as per another report by SwedenBIO, biopharmaceutical companies in the country have been unable to match the level of funding from European peers.

According to GlobalData analysis, pharmaceutical venture capital (VC) deals between 2020-2022 in Sweden totalled $173m. This pales in comparison to $712m across the same period in Denmark.

“We have a lack of VCs that invest in seed funding and so on. That means the valuation of Swedish companies compared to, if we were say in the US, is a factor of 10 or even lower,” Westberg notes.

A large proportion of money instead comes via licensing deals. Big pharma companies are known for plugging the gap that investors do not fill, and Sweden’s lacklustre investor scene creates ample opportunity for that.

Westberg’s Nanexa is one of those companies, signing a deal worth up to SEK 63.3m ($6.6m) with Novo Nordisk in 2022. The Danish drugmaker was enticed by Nanexa’s PharmaShell platform that enables longer acting injectables while maintaining low injection volume. At the same time, Novo Nordisk also acquired a 16% stake in Nanexa, a rare move for the company whose sister business, Novo Holdings, usually decides equity outlay.

One of Sweden’s most recent success stories came from Stockholm-based BioArctic. Professor Lars Lannfelt founded the company together with Pär Gellerfors in 2003 to develop an antibody treatment based on the former’s groundbreaking discoveries of the role of amyloid-beta protein in Alzheimer’s disease. BioArctic ultimately codeveloped Leqembi (lecanemab) with Eisai, the first approved drug in a new wave of Alzheimer’s therapies.

Since then, Novartis and Bristol Myers Squibb have signed licensing deals worth $800m and $1.35bn respectively for other programmes in BioArctic’s portfolio. However, BioArctic’s financial success remains an anomaly amid a weaker investment scene in Sweden.

“Investment is where the risk of the Swedish ecosystem is at. Capital makes sure your idea isn’t taken by someone else,” Langhoff-Roos says.

Government and institute backing

The Swedish government has long touted the importance of the life sciences sector in the country’s growth plans. In late 2024, ministers published a report with updated objectives in achieving growth amid poor investment trends.

One of the long-range infrastructure investments that could help is SciLife Lab, a national centre in Stockholm that provides researchers in fields such as biomedicine, ecology, and evolution with access to advanced technologies and expertise.

Pharmaceutical Technology met with SciLife Lab’s Anna Frejd, who urged the importance of collaborating closely with academic institutions in order to spur early-stage, promising research.

Nearby is the famous Karolinska Institute, Sweden’s largest research centre. The university’s incubator system oversees the START programme, a framework to help scale projects out of academia and into start-ups capable of commercialisation.

These are the kind of initiatives that Westberg would like to see more of.

“We are extremely good at innovation, but we could be better at commercialisation of those innovations,” he says.

Meanwhile, on the Eastern edge of the Karolinska Institute campus lies the Nobel Forum. It is in this unassuming brick building where the winners of the Nobel Prizes are decided each year.

It is in this section where Sweden’s life science scene is perhaps best characterised. The all-glass research laboratories reflected in the Nobel Forum’s secretive windows mirror both the legacy and future of science in the country.