The Norwegian pharmaceutical sector is preparing for long-awaited adjustments to the country’s cost-effectiveness willingness to pay (WTP) thresholds for medicines.

Controversially, Norway’s current baseline WTP values have not been adjusted to reflect economic changes or inflation rates since 2015. The current informal WTP value is set at a minimum of Nkr275,000 ($27,500) and a top range of Nkr825,000 per quality-adjusted life year, with the higher value linked to disease severity.

The cost-effectiveness threshold range has not gone unchallenged. The policy featured fairly prominently in September 2025’s parliamentary election campaign debates, and WTP thresholds were brought up in discussion by the Association of the Pharmaceutical Industry (LMI) during a recent parliamentary health committee hearing on the state’s 2026 budget.

The question of Norway raising its WTP thresholds is also being influenced by similar policy developments in the UK, where momentum is building to urgently increase cost-effectiveness thresholds in response to economic and geopolitical challenges.

The parliamentary health committee now broadly acknowledges that after a decade of non-adjustment, current WTP values are outdated. Norway’s Directorate for Medical Products (DMP) has therefore been given a deadline of December 2025 to consider new threshold values. However, there is significant uncertainty over the process. It is unclear whether the new levels will be index linked to inflation in the future. The pharmaceutical industry is advocating for a sharp upwards adjustment in 2026, followed by updates to the mechanism at fixed intervals. Questions have also been raised about how quickly the technical adjustments will be reflected in health technology assessment (HTA) outcomes.

While the pharmaceutical industry is pushing for rapid implementation, regulators have signaled that a more cautious pace of change is potentially on the agenda. Stakeholders are reluctant to publicly speculate about how much the thresholds should be increased and are watching the UK policy debate with interest, as it may have a significant influence on the eventual direction that Norway will take. Elsewhere, there is concern from the pharmaceutical industry that the seven-person working group appointed to advise the DMP on potential updates to the threshold values largely comprises academics and health economists, and fails to include any pharmaceutical industry or patient organisation representatives.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

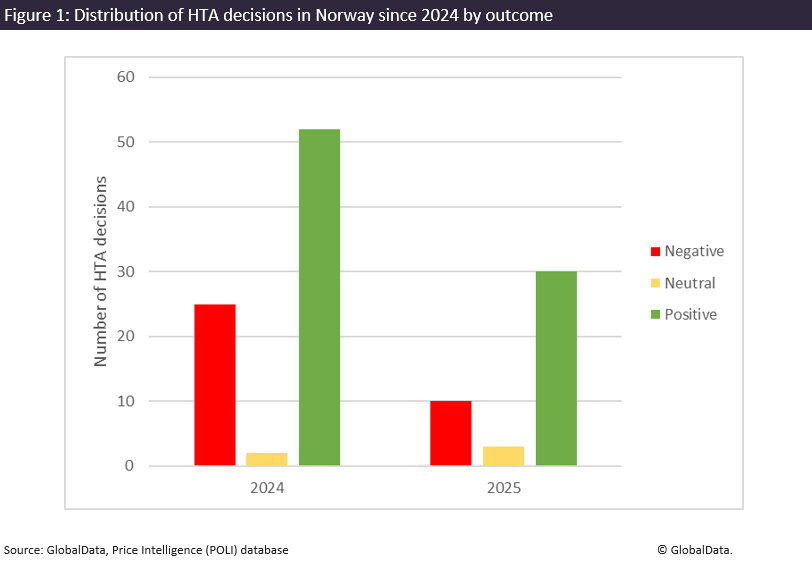

By GlobalDataIn 2025, 79% of completed health technology assessments in Norway were evaluated as positive. Setting WTP thresholds higher may help to improve access conditions.

Norway’s WTP thresholds have been static for many years, while the price of medicines and medical inflation has continued to rise. This has prompted increasing calls from both pharmaceutical companies and patient groups to significantly raise thresholds to ensure that high-cost innovative medicines can be made available in the healthcare system.

Over time, significant increases would lead to a greater share of the healthcare budget being allocated to medicines, and additional funding would be needed to support this.

In oral hearings, the CEO of LMI, Leif Rune Skymoen, claimed that Norway’s existing low WTP thresholds and “culture” of saying no in HTA evaluations are primary factors in Norwegian patients waiting an average of 524 days from the date of a European Union marketing authorisation to a medicine becoming available in the public healthcare system. These figures compare to an analysis conducted by GlobalData POLI, which found that the average time to reimbursement in Norway decreased slightly from 444 days in 2024 to 403 days in 2025.

This article is produced as part of GlobalData’s Price Intelligence (POLI) service, the world’s leading resource for global pharmaceutical pricing, HTA and market access intelligence integrated with the broader epidemiology, disease, clinical trials and manufacturing expertise of GlobalData’s Pharmaceutical Intelligence Center. Our unparalleled team of in-house experts monitors P&R policy developments, outcomes and data analytics around the world every day to give our clients the edge by providing critical early warning signals and insights. For a demo or further information, please contact us here.