The pharmaceutical industry continues to be a hotbed of innovation, with activity driven by the evolution of new treatment paradigms, and the gravity of unmet needs, as well as the growing importance of technologies such as pharmacogenomics, digital therapeutics, and artificial intelligence. In the last three years alone, there have been over 633,000 patents filed and granted in the pharmaceutical industry, according to GlobalData’s report on Innovation in Pharmaceuticals: HIV peptides. Buy the report here.

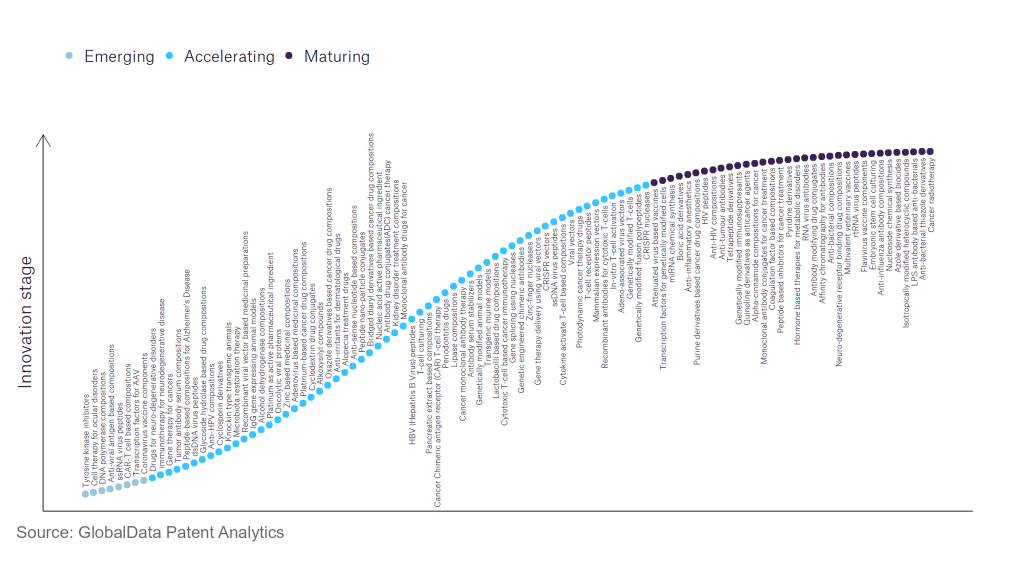

However, not all innovations are equal and nor do they follow a constant upward trend. Instead, their evolution takes the form of an S-shaped curve that reflects their typical lifecycle from early emergence to accelerating adoption, before finally stabilising and reaching maturity.

Identifying where a particular innovation is on this journey, especially those that are in the emerging and accelerating stages, is essential for understanding their current level of adoption and the likely future trajectory and impact they will have.

110 innovations will shape the pharmaceutical industry

According to GlobalData’s Technology Foresights, which plots the S-curve for the pharmaceutical industry using innovation intensity models built on over 756,000 patents, there are 110 innovation areas that will shape the future of the industry.

Within the emerging innovation stage, cell therapy for ocular disorders, coronavirus vaccine components, and DNA polymerase compositions are disruptive technologies that are in the early stages of application and should be tracked closely. Adeno-associated virus vectors, alcohol dehydrogenase compositions, and antibody serum stabilisers are some of the accelerating innovation areas, where adoption has been steadily increasing. Among maturing innovation areas are anti-influenza antibody compositions and anti-interleukin-1, which are now well established in the industry.

Innovation S-curve for the pharmaceutical industry

HIV peptides is a key innovation area in pharmaceuticals

HIV peptides are fragments derived from HIV envelope gp160 protein, the HIV matrix/capsid proteins, and the HIV gag, pol and env gene products. HIV proteins or peptides are very immunogenic, and when utilised as experimental immunogens, they can elicit strong cellular and humoral immune reactions. A piece of an HIV protein, an epitope from an HIV protein, or a mixture of several HIV proteins or fragments of them can all act as the antigenic polypeptide and produce an immune response. These can serve as an important component of a vaccine.

GlobalData’s analysis also uncovers the companies at the forefront of each innovation area and assesses the potential reach and impact of their patenting activity across different applications and geographies. According to GlobalData, there are 70+ companies, spanning technology vendors, established pharmaceutical companies, and up-and-coming start-ups engaged in the development and application of HIV peptides.

Key players in HIV peptides – a disruptive innovation in the pharmaceutical industry

‘Application diversity’ measures the number of different applications identified for each relevant patent and broadly splits companies into either ‘niche’ or ‘diversified’ innovators.

‘Geographic reach’ refers to the number of different countries each relevant patent is registered in and reflects the breadth of geographic application intended, ranging from ‘global’ to ‘local’.

Patent volumes related to HIV peptides

| Company | Total patents (2021 - 2023) | Premium intelligence on the world's largest companies |

| Johnson & Johnson | 200 | Unlock Company Profile |

| CareGroup | 159 | Unlock Company Profile |

| International AIDS Vaccine Initiative | 79 | Unlock Company Profile |

| AECOM | 79 | Unlock Company Profile |

| Solon Eiendom | 72 | Unlock Company Profile |

| GSK | 64 | Unlock Company Profile |

| Esteve Pharmaceuticals | 62 | Unlock Company Profile |

| Altimmune | 56 | Unlock Company Profile |

| Mymetics | 50 | Unlock Company Profile |

| Children's Medical Center | 50 | Unlock Company Profile |

| Fundacion IrsiCaixa | 47 | Unlock Company Profile |

| Pfizer | 47 | Unlock Company Profile |

| Inovio Pharmaceuticals | 45 | Unlock Company Profile |

| US Department of Health and Human Services | 41 | Unlock Company Profile |

| Mitsubishi Chemical Group | 40 | Unlock Company Profile |

| Curevac | 40 | Unlock Company Profile |

| U.S. Department of Defense | 37 | Unlock Company Profile |

| AGC | 37 | Unlock Company Profile |

| Mount Sinai Health System | 34 | Unlock Company Profile |

| United States Of America | 33 | Unlock Company Profile |

| Triad National Security | 32 | Unlock Company Profile |

| Academia Sinica | 31 | Unlock Company Profile |

| Centre National de la Recherche Scientifique | 31 | Unlock Company Profile |

| SEEK Group | 31 | Unlock Company Profile |

| American Gene Technologies International | 29 | Unlock Company Profile |

| Providence St. Joseph Health | 23 | Unlock Company Profile |

| Merck & Co | 22 | Unlock Company Profile |

| EpitoGenesis | 20 | Unlock Company Profile |

| Henry M. Jackson Foundation for the Advancement of Military Medicine | 16 | Unlock Company Profile |

| Globeimmune | 15 | Unlock Company Profile |

| Minka Therapeutics | 14 | Unlock Company Profile |

| US Government | 14 | Unlock Company Profile |

| Sanofi | 14 | Unlock Company Profile |

| Calder Biosciences | 13 | Unlock Company Profile |

| Novo Nordisk Foundation | 13 | Unlock Company Profile |

| Compagnie Merieux Alliance | 13 | Unlock Company Profile |

| Mayo Clinic | 12 | Unlock Company Profile |

| Grifols | 12 | Unlock Company Profile |

| Los Alamos National Security | 12 | Unlock Company Profile |

| United States Army Reserve | 12 | Unlock Company Profile |

| Thermo Fisher Scientific | 12 | Unlock Company Profile |

| UAB Research Foundation | 12 | Unlock Company Profile |

| ICREA | 12 | Unlock Company Profile |

| Mupharma | 11 | Unlock Company Profile |

| I'rom Group | 11 | Unlock Company Profile |

| Gilead Sciences | 11 | Unlock Company Profile |

| Profectus BioSciences | 11 | Unlock Company Profile |

| Precigen | 11 | Unlock Company Profile |

| Japan Science and Technology Agency | 9 | Unlock Company Profile |

| Life Sciences Research Partners VZW | 9 | Unlock Company Profile |

Source: GlobalData Patent Analytics

Johnson & Johnson is the leading patent filer in HIV peptides. Johnson & Johnson researches, develops, manufactures, and sells pharmaceutical products, medical devices, and consumer products. The company provides pharmaceuticals for immune diseases, cancer, neurological disorders, infectious diseases, cardiovascular and metabolic diseases, consumer products in oral care, baby care, beauty, over the counter (OTC) medicines, women’s health and wound care categories, and medical devices for use in the cardiovascular, orthopaedic, general surgery and vision care fields. CareGroup and International AIDS Vaccine Initiative are the other key patent filers in HIV peptides.

In terms of application diversity, Novo Nordisk Foundation is the top company, followed by Minka Therapeutics and GSK. By means of geographic reach, Pfizer holds the top position, while SEEK Group and Profectus BioSciences stand in second and third positions, respectively.

To further understand the key themes and technologies disrupting the pharmaceutical industry, access GlobalData’s latest thematic research report on Pharmaceutical.

Data Insights

From

The gold standard of business intelligence.

Blending expert knowledge with cutting-edge technology, GlobalData’s unrivalled proprietary data will enable you to decode what’s happening in your market. You can make better informed decisions and gain a future-proof advantage over your competitors.