The pharmaceutical industry continues to be ahotbed of patent innovation. Activity is driven by the evolution of treatment paradigms, and the gravity of unmet needs, as well as the growing importance of technologies such as pharmacogenomics, digital therapeutics, and artificial intelligence. In the last three years alone, there have been over 787,000 patents filed and granted in the pharmaceutical industry, according to GlobalData’s report on Innovation in pharma: peptide pharmacophores. Buy the report here.

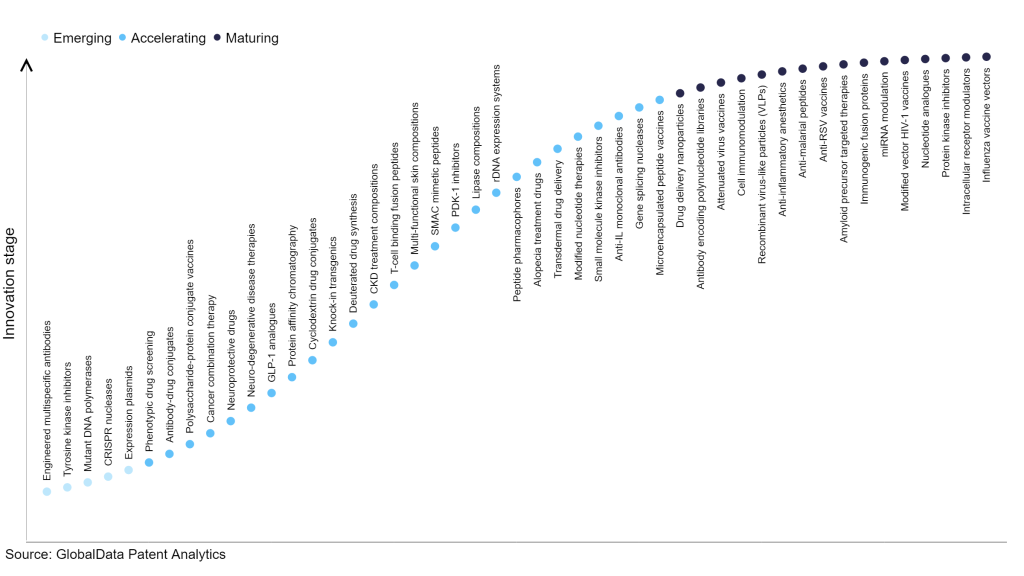

However, not all innovations are equal and nor do they follow a constant upward trend. Instead, their evolution takes the form of an S-shaped curve that reflects their typical lifecycle from early emergence to accelerating adoption, before finally stabilizing and reaching maturity.

Identifying where a particular innovation is on this journey, especially those that are in the emerging and accelerating stages, is essential for understanding their current level of adoption and the likely future trajectory and impact they will have.

80+ innovations will shape the pharmaceutical industry

According to GlobalData’s Technology Foresights, which plots the S-curve for the pharmaceutical industry using innovation intensity models built on over 668,000 patents, there are 80+ innovation areas that will shape the future of the industry.

Within the emerging innovation stage, engineered multi-specific antibodies, tyrosine kinase inhibitors, and mutant DNA polymerases are disruptive technologies that are in the early stages of application and should be tracked closely. Phenotypic drug screening, antibody-drug conjugates, and polysaccharide-protein conjugate vaccines are some of the accelerating innovation areas, where adoption has been steadily increasing. Among maturing innovation areas are drug delivery nanoparticles and antibody encoding polynucleotide libraries, which are now well established in the industry.

Innovation S-curve for the pharmaceutical industry

Peptide pharmacophores is a key innovation area in the pharmaceutical industry

Peptide pharmacophores, also known as peptide-based pharmacophores or peptidomimetics, are molecules or structures that mimic the binding properties and functions of peptides in drug design and development. They are designed to interact with specific biological targets, such as proteins or enzymes, similarly to natural peptides, but with enhanced properties like improved stability, bioavailability, or selectivity. Peptide pharmacophores have gained significance in drug discovery due to their potential therapeutic applications and versatility.

GlobalData’s analysis also uncovers the companies at the forefront of each innovation area and assesses the potential reach and impact of their patenting activity across different applications and geographies. According to GlobalData, there are 80+ companies, spanning technology vendors, established pharmaceutical companies, and up-and-coming start-ups engaged in the development and application of peptide pharmacophores.

Key players in peptide pharmacophores – a disruptive innovation in the pharmaceutical industry

‘Application diversity’ measures the number of applications identified for each patent. It broadly splits companies into either ‘niche’ or ‘diversified’ innovators.

‘Geographic reach’ refers to the number of countries each patent is registered in. It reflects the breadth of geographic application intended, ranging from ‘global’ to ‘local’.

Patent volumes related to peptide pharmacophores

| Company | Total patents (2021 - 2023) | Premium intelligence on the world's largest companies |

| Hangzhou DAC Biotech | 148 | Unlock Company Profile |

| Pfizer | 77 | Unlock Company Profile |

| F. Hoffmann-La Roche | 31 | Unlock Company Profile |

| Ipsen | 31 | Unlock Company Profile |

| Vascular BioSciences | 28 | Unlock Company Profile |

| Ellipses Pharma | 20 | Unlock Company Profile |

| Massachusetts General Hospital | 19 | Unlock Company Profile |

| Bristol-Myers Squibb | 19 | Unlock Company Profile |

| SignalChem Lifesciences | 18 | Unlock Company Profile |

| Canget BioTekpharma | 18 | Unlock Company Profile |

| W. L. Gore & Associates | 16 | Unlock Company Profile |

| Johnson & Johnson | 15 | Unlock Company Profile |

| Samjin Pharm | 13 | Unlock Company Profile |

| BerGenBio | 12 | Unlock Company Profile |

| Beijing Electronics | 12 | Unlock Company Profile |

| Curegenix | 11 | Unlock Company Profile |

| Council of Scientific and Industrial Research | 10 | Unlock Company Profile |

| Novartis | 9 | Unlock Company Profile |

| E. Merck | 9 | Unlock Company Profile |

| Purinomia Biotech | 8 | Unlock Company Profile |

| G1 Therapeutics | 7 | Unlock Company Profile |

| Verastem | 7 | Unlock Company Profile |

| Chang Gung Memorial Foundation | 7 | Unlock Company Profile |

| Mayo Clinic | 7 | Unlock Company Profile |

| Nekonal Sarl | 6 | Unlock Company Profile |

| Atara Biotherapeutics | 6 | Unlock Company Profile |

| Bayer Pharma (Bayer Schering Pharma) | 6 | Unlock Company Profile |

| WellMarker Bio | 6 | Unlock Company Profile |

| Bayer | 6 | Unlock Company Profile |

| Gilead Sciences | 6 | Unlock Company Profile |

| Regeneron Pharmaceuticals | 6 | Unlock Company Profile |

| Arterez | 5 | Unlock Company Profile |

| Enanta Pharmaceuticals | 5 | Unlock Company Profile |

| Incanthera | 5 | Unlock Company Profile |

| IncellDx | 4 | Unlock Company Profile |

| The Center for Molecular Medicine and Immunology | 4 | Unlock Company Profile |

| General Hospital | 4 | Unlock Company Profile |

| Cedars-Sinai Health System | 4 | Unlock Company Profile |

| AI Therapeutics | 4 | Unlock Company Profile |

| Oncozyme Pharma | 4 | Unlock Company Profile |

| The Corporation For Penn State | 4 | Unlock Company Profile |

| Memorial Sloan Kettering Cancer Center | 4 | Unlock Company Profile |

| Signablok | 4 | Unlock Company Profile |

| 20/20 GeneSystems | 3 | Unlock Company Profile |

| Helmholtz Association of German Research Centres | 3 | Unlock Company Profile |

| Lunella Biotech | 3 | Unlock Company Profile |

| Beijing Bio-Targeting Therapeutics Technology | 3 | Unlock Company Profile |

| Molecure | 3 | Unlock Company Profile |

| HUYA Bioscience International | 3 | Unlock Company Profile |

| Merrimack Pharmaceuticals | 3 | Unlock Company Profile |

Source: GlobalData Patent Analytics

Hangzhou DAC Biotech is one of the leading patent filers in Peptide pharmacophores. Hangzhou DAC Biotech, a biopharmaceutical company, focuses on developing conjugate of monoclonal antibody and small molecular cytotoxic drugs. The company has multiple PCT international applications and more than 500 patent applications, of which 23 have been authorized in the US alone. Pfizer and Ipsen are some of the other key patent filers in peptide pharmacophores.

In terms of application diversity, Nekonal leads the pack, while E. Merck and Beijing Electronics stood in the second and third positions, respectively. By means of geographic reach, F. Hoffmann-La Roche held the top position, followed by Ellipses Pharma and SignalChem Lifesciences.

To further understand the key themes and technologies disrupting the pharmaceutical industry, access GlobalData’s latest thematic research report on Pharmaceutical.

Data Insights

From

The gold standard of business intelligence.

Blending expert knowledge with cutting-edge technology, GlobalData’s unrivalled proprietary data will enable you to decode what’s happening in your market. You can make better informed decisions and gain a future-proof advantage over your competitors.