The pharmaceutical industry continues to be a hotbed of innovation, with activity driven by the evolution of new treatment paradigms, and the gravity of unmet needs, as well as the growing importance of technologies such as pharmacogenomics, digital therapeutics, and artificial intelligence. In the last three years alone, there have been over 633,000 patents filed and granted in the pharmaceutical industry, according to GlobalData’s report on on Innovation in Pharmaceuticals: Transcription factors for AAV. Buy the report here.

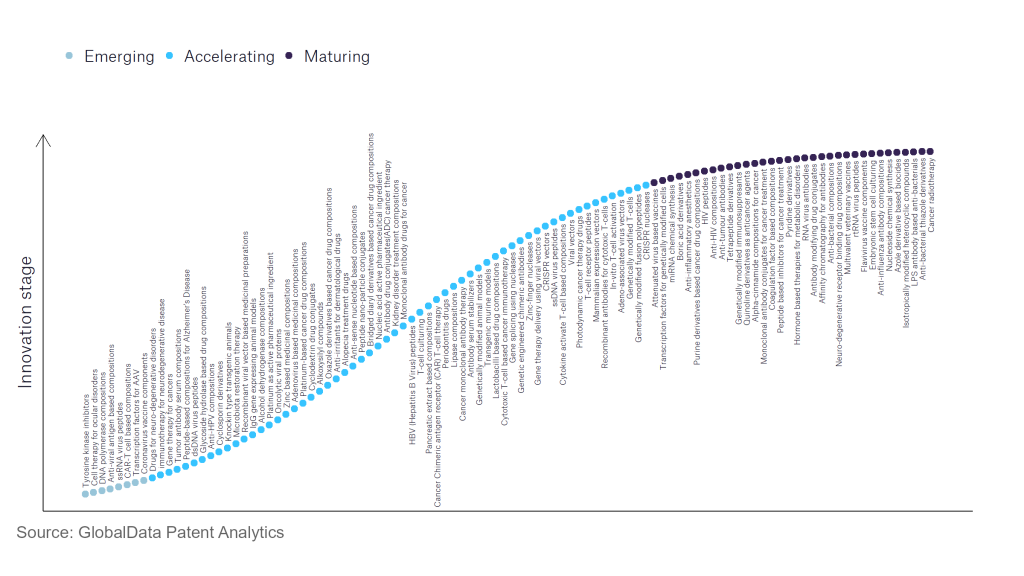

However, not all innovations are equal and nor do they follow a constant upward trend. Instead, their evolution takes the form of an S-shaped curve that reflects their typical lifecycle from early emergence to accelerating adoption, before finally stabilising and reaching maturity.

Identifying where a particular innovation is on this journey, especially those that are in the emerging and accelerating stages, is essential for understanding their current level of adoption and the likely future trajectory and impact they will have.

110 innovations will shape the pharmaceutical industry

According to GlobalData’s Technology Foresights, which plots the S-curve for the pharmaceutical industry using innovation intensity models built on over 756,000 patents, there are 110 innovation areas that will shape the future of the industry.

Within the emerging innovation stage, cell therapy for ocular disorders, coronavirus vaccine components, and DNA polymerase compositions are disruptive technologies that are in the early stages of application and should be tracked closely. Adeno-associated virus vectors, alcohol dehydrogenase compositions, and antibody serum stabilisers are some of the accelerating innovation areas, where adoption has been steadily increasing. Among maturing innovation areas are anti-influenza antibody compositions and anti-interleukin-1, which are now well established in the industry.

Innovation S-curve for the pharmaceutical industry

Transcription factors for AAV is a key innovation area in pharmaceutical

Adeno-associated virus (AAV) vectors are widely used for gene therapy. AAV genomes are highly compact, with overlapping coding regions, alternate splicing schemes, and multiple transcription initiation codons. There are two main genes in the AAV genome, rep and cap, which encode nine different proteins. Transcription of the rep gene is initiated from the p5 or p19 promoters to, respectively, produce the large (Rep78 and Rep68) and small (Rep52 and Rep40) nonstructural Rep proteins. Transcription of the cap gene is initiated from a single promoter termed p40. AAV virus infects cells to release ssDNA, and the virus then converts that ssDNA into a double-stranded DNA (dsDNA) template for transcription. Transfection of plasmids for rAAV production can initiate transcription directly from the dsDNA of these plasmids.

GlobalData’s analysis also uncovers the companies at the forefront of each innovation area and assesses the potential reach and impact of their patenting activity across different applications and geographies. According to GlobalData, there are 60+ companies, spanning technology vendors, established pharmaceutical companies, and up-and-coming start-ups engaged in the development and application of transcription factors for AAV.

Key players in transcription factors for AAV – a disruptive innovation in the pharmaceutical industry

‘Application diversity’ measures the number of different applications identified for each relevant patent and broadly splits companies into either ‘niche’ or ‘diversified’ innovators.

‘Geographic reach’ refers to the number of different countries each relevant patent is registered in and reflects the breadth of geographic application intended, ranging from ‘global’ to ‘local’.

Patent volumes related to transcription factors for AAV

| Company | Total patents (2021 - 2023) | Premium intelligence on the world's largest companies |

| Encoded Therapeutics | 77 | Unlock Company Profile |

| Takeda Pharmaceutical | 70 | Unlock Company Profile |

| Sanofi | 67 | Unlock Company Profile |

| Genethon | 67 | Unlock Company Profile |

| Esteve Pharmaceuticals | 67 | Unlock Company Profile |

| BioMarin Pharmaceutical | 56 | Unlock Company Profile |

| Centre National de la Recherche Scientifique | 46 | Unlock Company Profile |

| Children's Hospital of Philadelphia | 44 | Unlock Company Profile |

| Applied Genetic Technologies | 38 | Unlock Company Profile |

| Astellas Pharma | 36 | Unlock Company Profile |

| Nationwide Children's Hospital | 36 | Unlock Company Profile |

| Biogen | 33 | Unlock Company Profile |

| Sangamo Therapeutics | 32 | Unlock Company Profile |

| St. Jude Children’s Research Hospital | 29 | Unlock Company Profile |

| Fondazione Telethon | 27 | Unlock Company Profile |

| UniQure | 26 | Unlock Company Profile |

| Eyeserv | 26 | Unlock Company Profile |

| Pfizer | 25 | Unlock Company Profile |

| Adverum Biotechnologies | 23 | Unlock Company Profile |

| Massachusetts Eye and Ear Infirmary | 22 | Unlock Company Profile |

| Bayer | 21 | Unlock Company Profile |

| RegenxBio | 19 | Unlock Company Profile |

| Genepod Therapeutics | 18 | Unlock Company Profile |

| United States Of America | 16 | Unlock Company Profile |

| Life Sciences Research Partners VZW | 16 | Unlock Company Profile |

| Syncona | 15 | Unlock Company Profile |

| Regeneron Pharmaceuticals | 14 | Unlock Company Profile |

| Daiichi Sankyo | 14 | Unlock Company Profile |

| Decibel Therapeutics | 13 | Unlock Company Profile |

| Rocket Pharmaceuticals | 13 | Unlock Company Profile |

| AVROBIO | 12 | Unlock Company Profile |

| CLS Therapeutics | 12 | Unlock Company Profile |

| American Gene Technologies International | 12 | Unlock Company Profile |

| Cellectis | 12 | Unlock Company Profile |

| Vivet Therapeutics | 11 | Unlock Company Profile |

| Ultragenyx Pharmaceutical | 11 | Unlock Company Profile |

| Benitec Biopharma | 11 | Unlock Company Profile |

| Ecole Polytechnique Federale de Lausanne | 11 | Unlock Company Profile |

| ToolGen | 11 | Unlock Company Profile |

| SparingVision | 11 | Unlock Company Profile |

| Generation Bio | 10 | Unlock Company Profile |

| Voyager Therapeutics | 10 | Unlock Company Profile |

| Akouos | 10 | Unlock Company Profile |

| International Centre for Genetic Engineering and Biotechnology | 10 | Unlock Company Profile |

| Nemours Foundation | 9 | Unlock Company Profile |

| NanoScope Technologies | 9 | Unlock Company Profile |

| Precision Biosciences | 8 | Unlock Company Profile |

| Children's Healthcare of Atlanta | 8 | Unlock Company Profile |

| Lonza Group | 7 | Unlock Company Profile |

| Locanabio | 7 | Unlock Company Profile |

Source: GlobalData Patent Analytics

Encoded Therapeutics is the leading patent filer in transcription factors for AAV. Encoded Therapeutics develops gene therapies for the treatment of severe genetic disorders. The company’s drug ETX-101, comprising a recombinant adeno-associated virus (AAV9) vector, is under development for the treatment of Dravet syndrome. The company is headquartered in South San Francisco, California, US. Takeda Pharmaceutical and Sanofi are the other key patent filers in transcription factors for AAV.

In terms of application diversity, Coda Biotherapeutics is the top company, followed by NanoScope Technologies and CLS Therapeutics. By means of geographic reach, Esteve Pharmaceuticals holds the top position. Pfizer and Biogen stand in second and third positions, respectively.

To further understand the key themes and technologies disrupting the pharmaceutical industry, access GlobalData’s latest thematic research report on Pharmaceutical.

Data Insights

From

The gold standard of business intelligence.

Blending expert knowledge with cutting-edge technology, GlobalData’s unrivalled proprietary data will enable you to decode what’s happening in your market. You can make better informed decisions and gain a future-proof advantage over your competitors.