GSK has signed a licensing deal with Empirico for its respiratory disease-focused silent interfering RNA (siRNA), EMP-012.

The UK-based big pharma purchased the oligonucleotide, which is currently in Phase I trials for chronic obstructive pulmonary disease (COPD), for an $85m upfront payment.

However, Empirico will be eligible to claim up to $660m in development, regulatory and commercial milestone payments moving forward, boosting the total deal value to $745m. If EMP-012 reaches the market, Empirico will also receive tiered royalties on net global sales.

EMP-012 is a first-in-class siRNA that targets an undisclosed, distinct inflammatory pathway, which GSK notes could offer a novel therapeutic approach that is “agonistic of baseline type 2 inflammation, smoking or co-morbid disease”.

According to GSK, the oligonucleotide’s unique mechanism of action could offer benefits to patients who experience non-type 2 inflammation – a subgroup with very few treatment options.

Type 2 inflammation is characterised by an overactive immune response, which is driven by cells such as mast cells and eosinophils that secrete pro-inflammatory cytokines.

By acquiring the commercialisation rights to EMP-012, GSK could bolster its clinical COPD portfolio, which recently saw the addition of blockbuster asthma medication, Nucala (mepolizumab).

Nucala, which analysts at Pharmaceutical Technology's parent company GlobalData estimate will bring in $3.4bn for GSK in 2034, obtained approval from the US Food and Drug Administration (FDA) for COPD in May 2025.

Following its regulatory approval, Nucala joins Sanofi and Regeneron’s biologic Dupixent (dupilumab) on the market, which a patient-based forecast from GlobalData predicts will peak at sales of $6.57bn in 2033.

siRNAs take big pharma’s fancy

GSK has become one of a line of big pharma companies to bet on siRNAs, with Novartis recently penning deals with Arrowhead Pharmaceuticals and Argo Biopharma over two consecutive days in September 2025.

AbbVie has also jumped on the siRNA bandwagon, having signed a $335m deal with US-based ADARx Pharmaceuticals for its platform in May 2025. This follows the Illinois-based pharma’s $1.4bn acquisition of Aliada Therapeutics in 2024.

Meanwhile, Eli Lilly and insitro have banded together to develop siRNAs for metabolic diseases in the preclinical stage. Through this deal, Lilly will provide insitro with its GalNAc delivery technology while gaining access to royalties if any siRNA molecules make it to market.

Licensing deals on the up

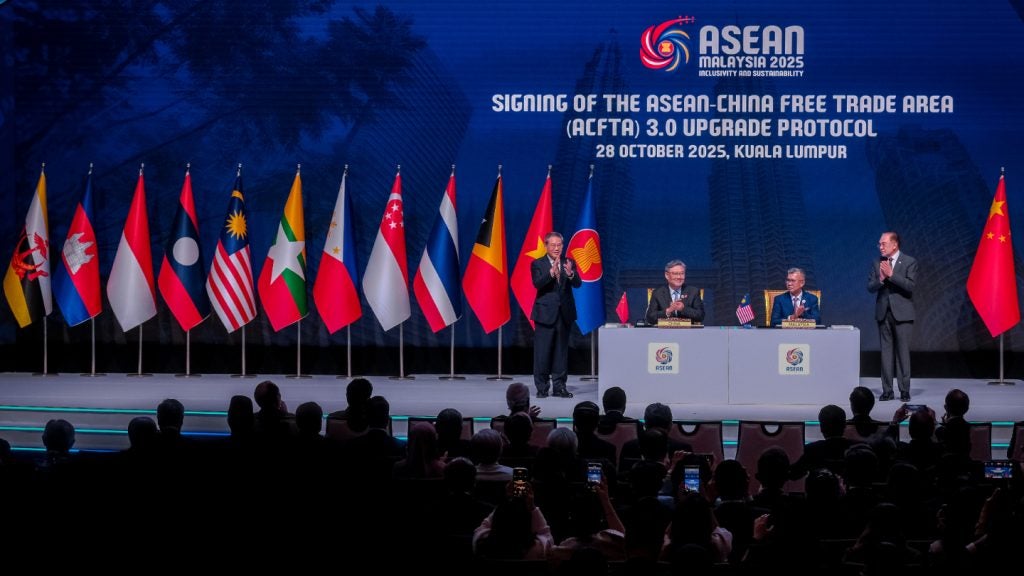

Beyond siRNAs, the prevalence and value of licensing deals across the pharma sector are on the rise – especially for assets created in Asian countries. This year, the total deal value of innovator drug licensing agreements signed with Chinese companies shot up 66%, reaching a value of $41.5bn in 2024.

South Korea is emerging as a key player, with licensing deals surging 113% in 2025 following the introduction of proactive government schemes like the National Bio Committee.

GlobalData reports that there have been 612 M&A deals in the pharma sectorso far this year. This compares with a record 2024, which saw the most M&A deals since 2013, where 829 deals were signed.