In this article, GlobalData investigates key reimbursement trends that reflect the current delays to patient access across the European region. Analysis includes innovative medicines with approved indications or indication extensions that were reimbursed since 2021. Patient profiles were counted distinctly. Factors assessed include the ratio of approved medicines to those that are reimbursed, volume of products reimbursed per year, and time to pricing and reimbursement. Overall, the delays in market access in individual EU member states have been an obstacle to the industry, with few improvements in access conditions compared to previous years.

On average, 58% of branded drugs approved between 2021 and 2024 in Europe have either fully or restricted reimbursement.

First, the access landscape for 220 originator medicines approved by the EMA between 2021–2024 was assessed. Reimbursement status for each brand per European market was analysed during this period. The percentage of brands that are reimbursed in each market for at least one indication was then determined and averaged. On average, roughly 58% of brands approved by EMA between 2021 and 2024 are either partially or fully reimbursed in at least one European market. However, there is a significant disparity between markets. Smaller pharmaceutical markets, such as Cyprus (7%), Croatia (27%), and Lithuania (19%), reimbursed much smaller percentages of innovative medicines approved since 2021, while the five major European markets (5EU: France, Germany, Italy, Spain, and the UK) included a much larger portion of these approved products onto their reimbursement list, for example the UK included 85%, France 62%, and Germany 85%.

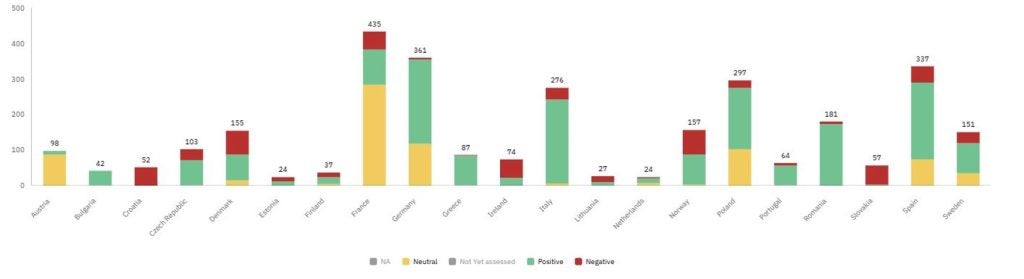

Furthermore, the number of HTA outcomes delivered in Europe per indication and patient profile for these brands was considered. For the assessed indications, most were granted either a positive or a neutral outcome, meaning the product has been included on the reimbursement list. Neutral outcomes represent indications that were reimbursed with restrictions or had less favourable pricing procedures. However, the largest portion of indications (40%) for brands approved between 2021–2024 are not yet assessed, and access to these treatments is therefore limited.

Figure 1: Distribution of HTA outcomes for branded medicines in Europe approved between 2021–2024

A clear disparity in reimbursement volumes sits between the 5EU and the European average

The number of new brands reimbursed (regardless of approval date) across Europe has ranged between 25 and 33 products between 2021–2024. GlobalData reviewed the number of branded medicines whose first reimbursement date fell between 2021–2024 in each European market. These values were then averaged to understand the overall European trend for reimbursement inclusions. However, many European markets fall short of the 5EU average, with the number of reimbursed products per year for the 5EU being 2.7 times greater on average. In certain cases, products approved over 17 years ago are seeing their reimbursement inclusion. For example, Recordati’s Cystadane (betaine) was centrally approved in 2007 but did not see its first reimbursement in Poland until 2023. In Romania, Novartis’s Atriance (nelarabine) was also centrally approved in 2007 but did not receive its first reimbursement in Romania until 2021. This further highlights the unequal access to medicines across Europe.

The worsening access conditions for originator medicines in the EU are highlighted in the graph below. The European average time between market authorisation and patient access between 2020 and 2024 was defined according to the time (in days) between approval and pricing as well as the time (in days) between approval and reimbursement. Both of these metrics follow a parallel trajectory. The average time between market authorisation to reimbursement in 2024 was 881 days, up 2.3% compared to 861 days in 2023. Markets largely influencing this slowdown in the time to access are heavily concentrated in the Nordic regions and include Switzerland, Sweden, and Denmark. These three markets have seen time to reimbursement increase by 83%, 27%, and 32%, respectively, since 2020. Switzerland has acknowledged the lag in access known as the “reimbursement gap” and consequently, Interpharma has pushed a series of solutions to help narrow the time delays between reimbursement of innovative medicines in Switzerland. Proposals have cited cumbersome bureaucratic steps, lack of transparency around regulatory legislation, and uncertainty around launches in the market as several key elements impacting the delays.

Other key markets that GlobalData has identified as contributing to this slowdown rate include Greece (46%), Luxembourg (38%), Belgium (35%), Slovakia (26%), and Ireland (21%). In Denmark, lack of access has been partially due to the country’s goals of alternative access models not coming to fruition, since turning applications down has been based on an alternative competitor product being available for patients or health technology assessment (HTA) evaluators not recommending a medicine as a standard treatment. In Slovakia, reforms in 2022 were to introduce improvements to the reimbursement rates in the market by creating a systemic pathway for negotiations and managed-entry agreements.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataDespite there being an initial uptick in the number of products reimbursed, there is a clear signal that the impact is still to catch up, and there are questions on the sustainability of the system for high-cost treatments. While most European markets have seen time to reimbursement grow, Norway, Portugal, Romania, Austria, and Serbia have seen time to access improve since 2020, with time to reimbursement decreasing by 21%, 5%, 9%, 2%, and 6%, respectively, since 2020.

The analysis highlights the deterioration of patient access to originator medicines in European markets between 2021 and 2024. The average time to pricing and reimbursement, common measures of availability, recorded the highest values in 2024, including an annual increase of 2.3% compared to 2023. Furthermore, the unequal access to innovative medicines across Europe has been indicated by the number of products reimbursed per year, with the 5EU typically reimbursing 2.7 times more products than the overall European average. While some markets have made strides to address these delays, several EU markets will likely face increasing budget pressure in 2025, triggering further cost-containment policies, restrictions for reimbursement, and subsequent delays to patient access.

This article is produced as part of GlobalData’s Price Intelligence (POLI) service, the world’s leading resource for global pharmaceutical pricing, HTA and market access intelligence integrated with the broader epidemiology, disease, clinical trials and manufacturing expertise of GlobalData’s Pharmaceutical Intelligence Center. Our unparalleled team of in-house experts monitor P&R policy developments, outcomes and data analytics around the world every day to give our clients the edge by providing critical early warning signals and insights. For a demo or further information, please contact us here.