Orphan drugs are therapeutics developed to address rare diseases typically defined by patient population thresholds that vary across regions: fewer than 20,000 patients in the US (FDA); no more than five in 10,000 in the EU (EMA) and the UK (Medicines and Healthcare Products Regulatory Agency (MHRA)), and fewer than 50,000 in Japan (National Institutes of Biomedical Innovation, Health and Nutrition (NIBIOHN)). GlobalData explores the pricing and reimbursement (P&R) landscape for orphan drugs compared to treatments for common disorders in the seven major markets (7MM): the US, Japan, and the five largest European markets (France, Germany, Italy, Spain, and the UK). The key areas of focus include average launch sequencing, health technology assessment (HTA) outcomes, and a case study.

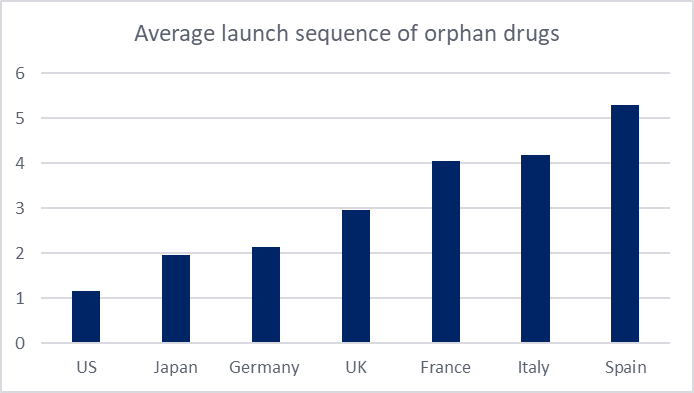

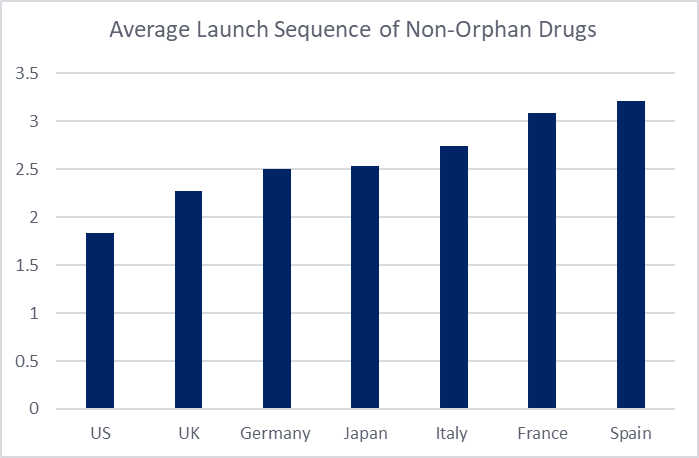

Average launch sequence: Orphan drugs versus non-orphan drugs

Average launch sequence was determined by considering the position of the first presentation available (regardless of reimbursement status) of each on-patent medicine. The sequence for each drug was then averaged. For orphan drugs across the 7MM, the US is observed as the first market of entry, followed by Japan in second position. Comparison with the average launch sequence of non-orphan drugs reveals a similar pattern for the US, which remains as the first-choice market for launch, likely due to its large patient population, high pricing potential, and accelerated regulatory pathways. Spain appears to rank last for both orphan and non-orphan drugs across the 7MM.

The main distinction between the launce sequencing of orphan and non-orphan drugs appears to be in the positioning of Japan: second for orphan launches but fourth for non-orphan drugs. Japan continues to face its long-standing problem with drug lag, with delays in product approvals, arising from the lack of local clinical trials. Nevertheless, Japan has become an attractive market for orphan drugs. Japan’s 2024 reforms have had a crucial influence, including a revision to orphan drug designation criteria to broaden eligibility (early 2024), and the establishment of new guidelines allowing manufacturers to submit new drug applications (NDAs) without Japanese clinical data under specific conditions (late 2024). Additionally, in the most recent FY2025 off-cycle revision, new post-launch price premium incentives were granted for the first time for several orphan drugs. Collectively, these policies help reinforce Japan’s position as the second most attractive market for orphan drugs across the 7MM.

Figure 1: Average launch sequence of orphan and non-orphan drugs across the 7MM

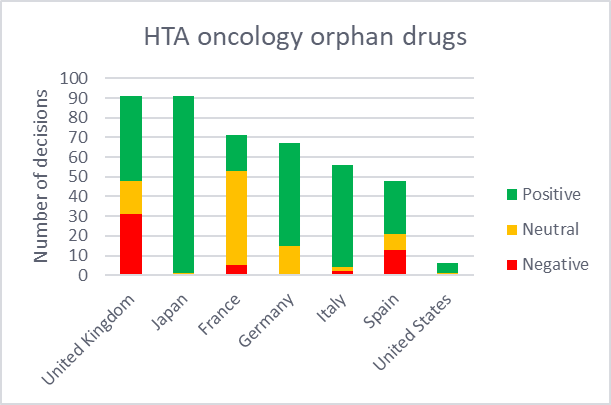

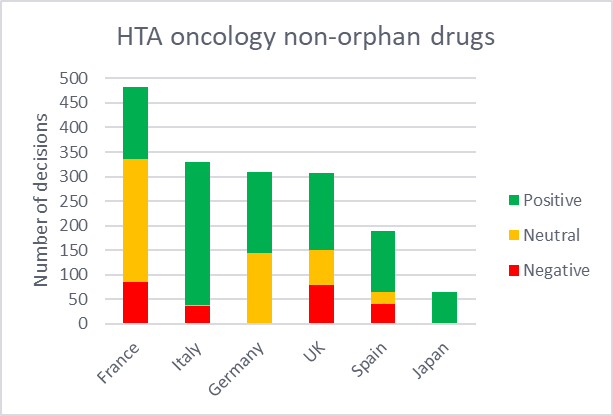

Comparison of HTA outcomes of oncology orphan drugs versus non-orphan treatments

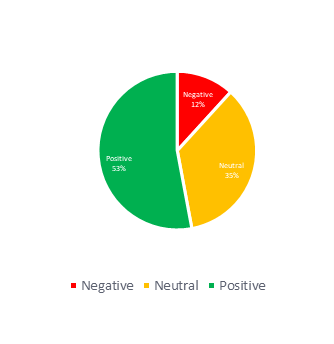

HTA decisions for oncology medicines were compared between orphan and non-orphan drugs across the 7MM. These HTA outcomes are categorized as either positive, negative, or neutral. Positive refers to medicines that qualify for reimbursement without restriction, while a negative decision indicates those that received a rejection for reimbursement. Neutral outcomes include cases where reimbursement is limited to a restricted part of the population or where the pricing procedure is less favorable. HTA outcomes for the US were not included in this analysis since they are non-binding.

According to GlobalData’s Price Intelligence (POLI), Japan provided the highest number of HTA decisions for orphan drugs, with 99% being positive. While non-orphan drugs underwent a far lower proportion of assessments, they all received positive outcomes. This reaffirms Japan’s favorable HTA environment, particularly for orphan oncology drugs. Within the 5EU,

Germany and Italy reported the highest proportion of positive ratings for both orphan drugs and non-orphan drugs. In contrast, Spain had the fewest HTA evaluations for orphan drugs and the second fewest for non-orphan drugs with a mixture of outcomes. Notably, the country appears to have slightly more negative outcomes for orphan drugs (27%) compared to non-orphans (22%).

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataFrance appears to have adopted a more conservative stance towards orphan drugs, where the majority (68%) of its decisions were classified as neutral. This can be attributed to the nature of orphan drugs, which often lack the comparative data required to gain higher ASMR ratings. The UK had the highest volume of assessments for orphan drugs across the 5EU, but also issued the highest proportion of negative decisions for orphan drugs, exceeding those for non-orphan drugs, likely driven by strict cost-effectiveness thresholds. While the UK offers special pathways, such as the ultra-orphan highly specialized technology (HST) pathway, it is highly selective.

Figure 2: Distribution of HTA decisions of orphan and non-orphan oncology drugs in the 7MM

While the broader data highlights the key trends in orphan drug launches and market access, a closer look at the drug Lenvima will provide a more granular perspective on how these dynamics translate into practice. Eisai’s Lenvima (lenvatinib mesylate) was first granted an orphan drug designation in 2013 for the treatment of thyroid carcinoma (DTC), refractory to radioactive iodine (RAI). Its orphan drug designation was later extended to also include endometrial carcinoma (EC). Lenvima first entered the US market, followed by Japan, with subsequent launches across Europe between 2015–2017 in an order that closely mirrored the average launch sequence identified for orphan drugs.

Across the 7MM, 88% of the HTA decisions for Lenvima were classified as positive or neutral, with markets such as the UK, Spain, Germany, and Japan granting favorable outcomes for all available packs. The remaining 12% of the negative decisions come from France and Italy. Notably, in 2018, the EU withdrew Lenvima’s orphan drug designation, highlighting the potentially limited and less favorable incentives available for orphan drugs in Europe. In contrast, both the US and Japan have maintained Lenvima’s orphan drug status, suggesting that there are stronger benefits associated with the status.

Figure 3: Distribution of HTA outcomes and average launch sequence of Lenvima across the 7MM

The orphan drug landscape across the 7MM is largely dictated by market size, regulatory pathways, and unique reimbursement frameworks for orphan medicines. While the US is the primary launch market for both orphan and non-orphan drugs, Japan has become an increasingly attractive market for orphan drugs. The 5EU markets show greater variability, with some markets making strides to increase access to these medicines, whilst others battle with cost containment. Lenvima’s launch trajectory signifies how regulatory incentives and market dynamics vastly influence the access and adoption of orphan drugs.

This article is produced as part of GlobalData’s Price Intelligence (POLI) service, the world’s leading resource for global pharmaceutical pricing, HTA and market access intelligence integrated with the broader epidemiology, disease, clinical trials and manufacturing expertise of GlobalData’s Pharmaceutical Intelligence Center. Our unparalleled team of in-house experts monitors P&R policy developments, outcomes and data analytics around the world every day to give our clients the edge by providing critical early warning signals and insights. For a demo or further information, please contact us here.