Drug prices remain at the centre of pharmaceutical companies’ strategies and concerns. The global environment surrounding drug prices is highly regulated in many markets, which no longer gives the industry much room for manoeuvre. The situation has also been exacerbated with the global Covid-19 crisis, which has significantly increased healthcare expenditure in all markets. Governments have used lowered pricing as one strategy to reduce expenditures, among others, and therefore the pharmaceutical industry remains under increased pressure.

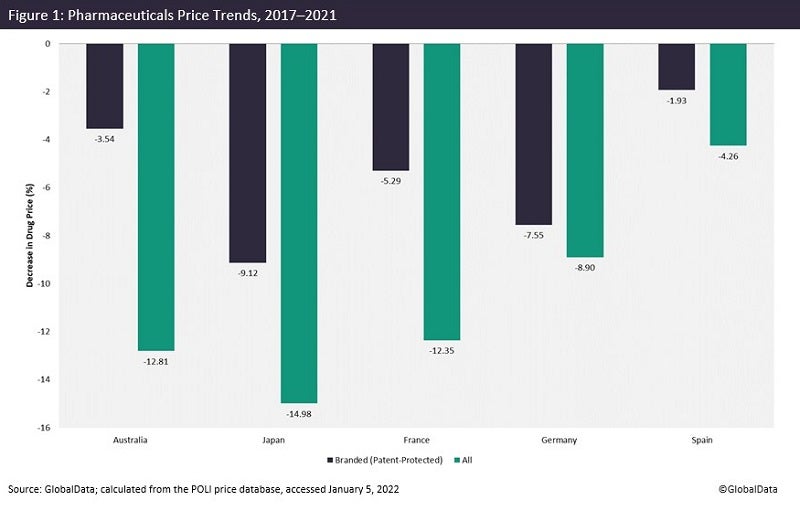

GlobalData’s POLI data shows that prices of both patent-protected and genericized medicines have largely decreased over time in major pharmaceutical markets. For instance, in Japan, prices of branded medicines have declined by more than 9% over the past five years. It reaches almost -15% when all marketed products are taken into account (Figure 1).

Because governments are aiming to lower drug expenditure, the pharmaceutical industry is trying to compensate for revenue loss by increasing prices (as well as setting relatively high prices at launch) in the few countries where prices are regulated by market forces, including the US of course.

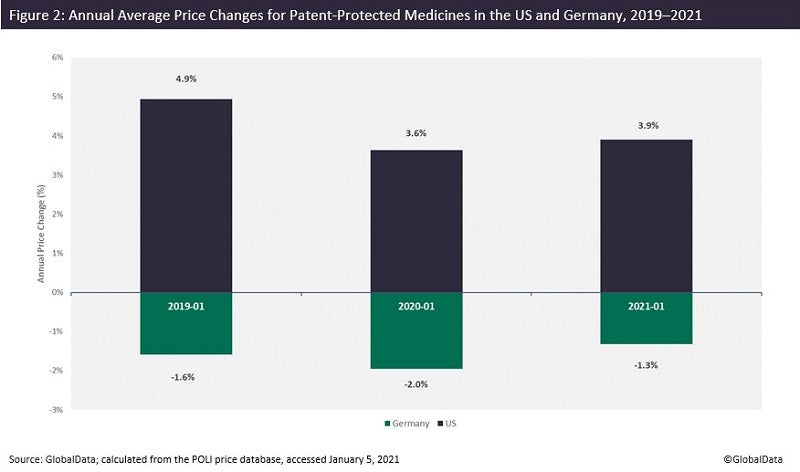

The US is one of the few large pharmaceutical markets where prices keep increasing—at least at the list price level. If the price changes of patent-protected medicines are compared between two major pharmaceutical markets, the US and Germany for instance, the data shows that while year-on-year prices of medicines increased in the US, the trend is opposite in Germany (Figure 2). Annual price increases at the beginning of January are no longer a surprise in the US, and 2022 is not an exception. According to Fierce Pharma, prices of 434 branded drugs experienced an average increase of 5.2% on January 1, 2022.

Still, regulation of drug pricing has been discussed more than ever over the past few years in the US, and the debate around price transparency and “unsupported” price increases is gaining ever more traction.

In 2020, President Trump issued several executive orders aiming at lowering prices; current President Joe Biden has also promised to introduce drug price reforms. In 2021, four bills aimed at tackling high drug prices were approved by the US House Judiciary Committee. Also, there are strong negotiations around the Build Back Better Act, which contains provisions to allow Medicare to negotiate prices for Part B and Part D drugs. There has also been plenty of activity at the state level.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataAdditionally, when medicinal costs are considered to be too high, bad public press commonly can have an impact on prices. For instance, in 2021, Biogen’s Alzheimer’s disease treatment Aduhelm (aducanumab) was highly criticized. First, Alzheimer’s associations commented on the high launch price of the medicine. Then, the US Institute for Clinical and Economic Review (ICER) published a report that concluded that its annual list price should be significantly reduced in order to meet standard cost-effectiveness thresholds.

The House Committee also opened an investigation into the price of the medicine. Subsequently, at least three major medical centres declined to administer the medicine and the US Veterans Health Administration refused to fund it. Finally, in late December, Biogen reacted and applied a 50% price cut to increase uptake of the drug following poor sales. For example, the cost of a single 300mg vial was reduced from $1,680 to $840, while a 170mg vial was reduced from $952 to $476. This would reduce the annual cost of a maintenance dose for an average weight patient from $56,000 to $28,200. However, this is again at the published list level—at the discount level, there are other trends that have been observed where drug prices are not increasing at the same rate.

Despite the discussions around legislating drug prices in the US, it is very likely that it will apply to Medicare Part B and Part D drugs, which does not account for all medicines on the market. Additionally, a reform on drug pricing will face strong opposition and will be heavily challenged in court.

With this in mind, GlobalData still expects that prices will continue to rise in the US at least at the list price level, while more competitive bidding dynamics ensure that the discounted net prices experience different trends.