The obesity therapeutics market has gone from a standing start to the story of the year in biopharmaceuticals – and it’s only just getting started. The arrival of powerful GLP-1 receptor agonists like semaglutide and tirzepatide has reshaped expectations for weight loss outcomes and triggered a seismic shift in how biopharmaceutical companies think about treatment development. Originally developed for type 2 diabetes, these drugs have shown unexpected benefits in treating – among others – cardiovascular risk, sleep apnoea severity and even early signs of cognitive decline. The result has been a movement toward multi-indication strategies, where a single drug is developed and approved to treat multiple, interlinked conditions.

“More and more companies are investing in developing GLP-1R agonists, including dual and triple agonists and combination therapies, to maximize their benefits and reduce side effects,” says Costanza Alciati, a healthcare analyst at GlobalData. “Excitement around these molecules is high in the scientific and medical community, because of their success in the diabetes and obesity markets, which is likely to translate to other metabolic diseases markets.”

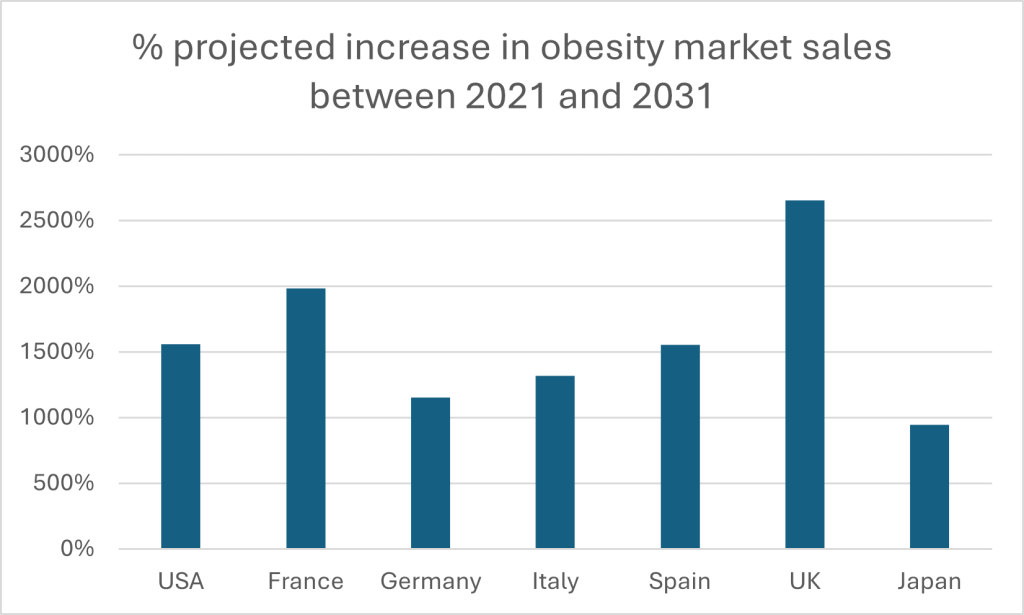

The numbers tell a striking story. The global obesity pharmacotherapy market – worth $10.5 billion in 2021 – is expected to balloon to $173.5 billion by 2031, according to projections by GlobalData. It represents a compound annual growth rate (CAGR) of 32.3%. The US will continue to dominate, but Europe is catching up fast. Analysis of five major European markets suggests they will exceed $20 billion by 2031. Their growth will be dramatic: the UK stands out as the fastest-expanding market, poised for a staggering 2,654% surge. France isn’t far behind, with nearly 20-fold growth, while Germany, Italy and Spain are all set to multiply several times over. Even Japan, long a more reserved market in the space, will see sales in its obesity market multiply nearly tenfold.

There are caveats to consider. Drug shortages are an issue, and one that will grow as treatments continue to gather popularity. Treatment discontinuation often leads to rapid weight regain – a stark reminder that GLP-1s are no silver bullet. Side effects, cost, and limited specialist access continue to hamper uptake. For all the commercial excitement, unmet clinical needs persist. But it means there is fertile ground underfoot for innovators seeking to navigate the challenges and exploit the opportunities stemming from multi-indication therapies.

Pharmaceutical firms in the mood for multi-indication

The biopharmaceutical world’s embrace of multi-indication drug development is rapid and ongoing. A recent survey from leading biotechnology and pharmaceutical clinical research organisation ICON, covering 155 industry professionals working on obesity and related diseases, reveals a sector in full transition. A robust 95% of respondents have some experience with multi-indication development, and 83% already have an active strategy in motion.

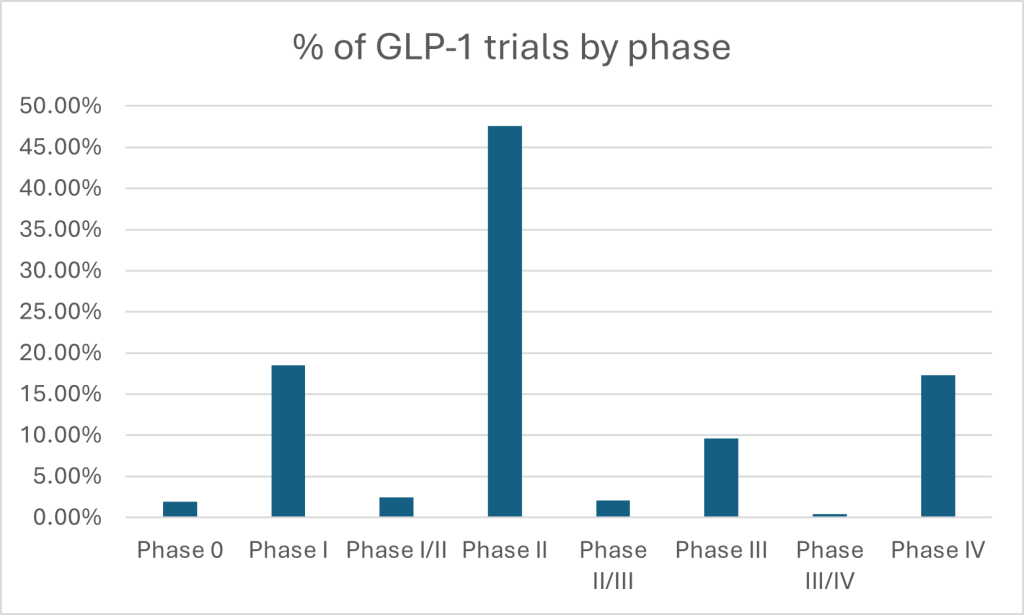

According to GlobalData’s clinical trials database, nearly half of all GLP-1 trials are concentrated in Phase II — a clear signal that developers are aggressively probing new indications and refining dose-response before advancing to larger, costlier studies. With only 9.6% in Phase III and just 17.3% in post-marketing, the data shows a field still in acceleration mode, with enormous room for pipeline maturation — and corresponding commercial upside. This is borne out by ICON’s survey results, which showed nearly two-thirds of respondents were still in preclinical or early-stage development. A further half of respondents said they now pursue parallel or synergistic development pathways, meaning they are designed to validate a therapy’s impact across multiple diseases in one go. Drug developers are clearly taking the opportunity to embed multi-indication approaches at the blueprint stage — not bolt it on later. Unlike traditional trials, where drugs were shepherded through one indication at a time, today’s developers are building for scale from the outset.

The drivers are a mix of hard economics and smarter science. In ICON’s survey, half of developers working on the “metabolic triad” (obesity, diabetes and CVD) said funding availability tipped their decision toward a multi-indication approach. Meanwhile, developers working outside these areas (such as inflammation or neurology) were more likely to cite improved understanding of mechanisms of action as their key trigger. But ambition alone doesn’t guarantee success. The survey reveals potential pitfalls too. Despite broad adoption, only 14% of respondents say they’ve used longitudinal data to inform multi-indication strategy, with under half of survey respondents who are actively pursuing multi-indication development strategies pursuing long-term follow-up surveys. This is understandable given the logistical and data collection burdens. But it may represent a missed opportunity when it comes to uncovering new indications, proving real-world benefits and cementing regulatory approval. Endpoint selection is another critical consideration. Although 43% of developers rated it the most important factor for multi-indication success, traditional BMI-centric inclusion criteria are under scrutiny. Does it distinguish adequately between subcutaneous and other types of fat? Should multiple endpoints be used in multi-indication trials, and if so, what should they be? Trial designers must evolve to answer these questions, or risk missing meaningful subpopulations and revealing results.

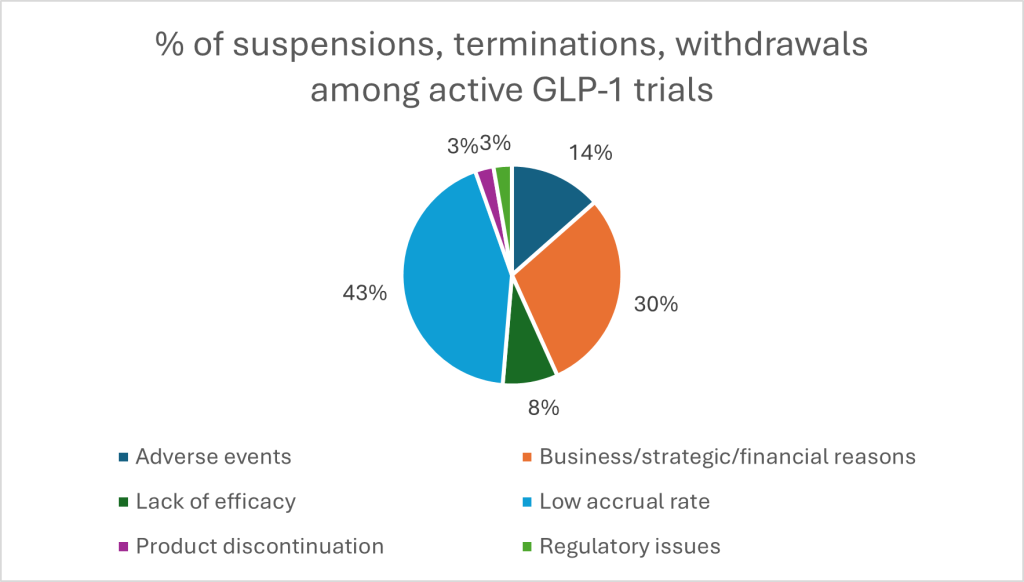

Looking at available data on suspensions, terminations and withdrawals among GLP-1 trials from GlobalData, one major threat to thriving trials is recruitment. A striking 43% of study suspensions stem from low accrual rates, dwarfing concerns like adverse events (14%) or efficacy shortfalls (8%). Combined with 30% halted for financial or strategic reasons, it is a sharp reminder that even the most promising molecules can falter without robust trial infrastructure and long-term planning. And developers are split on post-trial commercial strategy: ICON results find some favour launching in a broad population to maximise impact, while others prefer niche strategies that command higher prices and cleaner data. There is no one-size-fits-all model — and this variability only sharpens the need for experienced partners who have navigated the regulatory and operational terrain before.

Picking the right partner

If the promise of multi-indication development is vast, so too is the complexity. From stratifying patients by comorbidity profiles to selecting endpoints that satisfy regulators and payers, success requires a combination of scientific expertise and robust discipline. The ICON survey lays bare the hurdles: underpowered enrolment, fuzzy endpoints, sluggish adoption of real-world evidence and a hesitancy to embrace adaptive trial models. These are not failures of innovation, but of execution. And they are fixable.

The companies best placed to navigate this evolving terrain are those that build with breadth in mind. That means recruiting patients who reflect the true spectrum of disease burden. It means moving past broad metrics and embracing precision phenotyping – something ICON, for instance, has embraced by developing a network of 100 research sites with an in-development database of 10,000 pre-screened patients across the breadth of obesity comorbidities. This approach is based on prior success from tapping site networks that specialise in overlapping conditions like metabolic liver disorders. With more than 5,800 cardiometabolic-focused sites and access to over 50,000 MASH patients, ICON has helped sponsors reach the populations most likely to benefit from novel therapies.

Trial design is another area ripe for improvement. Adaptive designs, master protocols and the intelligent use of historical controls remain underused across the industry — yet these tools can slash timelines and boost flexibility in multi-indication programmes. ICON’s methodological expertise supports sponsors in understanding when such approaches make sense, and how to implement them without losing rigour.

Likewise, while digital health technologies are now part of the standard toolkit – 52% of survey respondents already use or plan to use them – the challenge lies in selecting and validating the right ones. ICON’s in-house device and digital endpoint teams ensure that such tools don’t just collect data, but capture meaningful outcomes.

Finally, no multi-indication programme is complete without a thoughtful commercial strategy. Whether launching narrow-first to maximise price, or broad-first to drive access, ICON’s commercial experts help sponsors plan for pricing, reimbursement, and product positioning in a landscape that’s as politically charged as it is scientifically dynamic.

While the road to multi-indication success is lined with obstacles, none are insurmountable – especially with the right partners. With deep therapeutic insight, global reach, and hard-earned operational know-how, ICON is helping turn promising molecules into multi-market successes – and reshaping the future of obesity treatment in the process. Download the whitepaper on this page to learn more.