Biopharmaceutical drug company venture financing witnessed a downturn in Q1 2025, with $6.5bn raised—a 20.2% decline from the $8.1bn raised in Q1 2024, according to GlobalData’s Pharma Intelligence Center Deals Database. This suggests that the biopharmaceutical venture financing environment remains challenging, mirroring a similar downturn seen in 2022 and 2023, with investors continuing to favour later-stage companies with clinical data.

Following a peak in 2021, biopharmaceutical venture financing witnessed a two-year decline that began in 2022. This downturn was driven by a wave of early-stage biotechs going public with inflated valuations, which led to a decline in investor confidence. Geopolitical challenges, rising inflation, and high interest rates further exacerbated this downturn, creating a more challenging funding environment. Signs of a recovery in biopharmaceutical venture financing emerged in 2024, characterised by an increase in total deal value and larger funding rounds. However, the momentum in venture financing activity was not sustained into Q1 2025, where a downturn was seen relative to Q1 2024, signalling persistent investor caution.

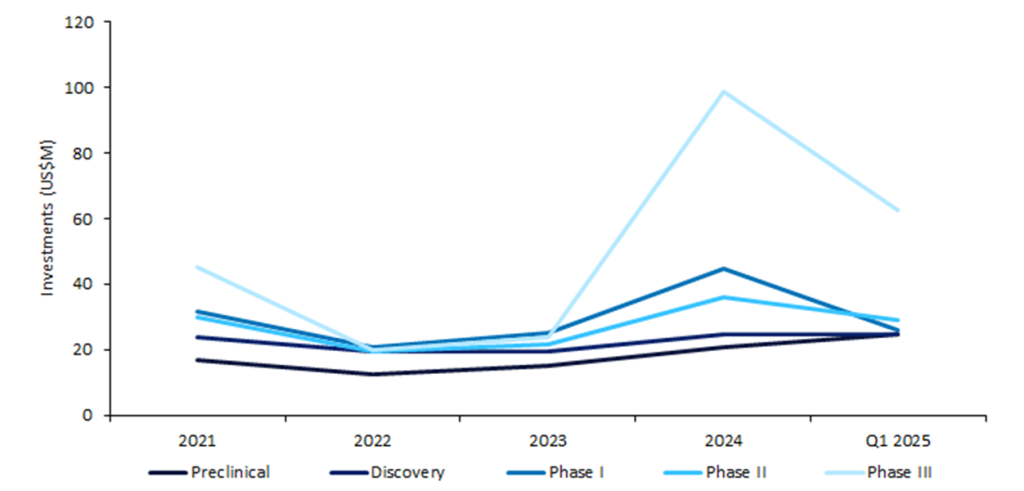

Phase III biopharmaceutical companies recorded the highest median deal value at $62.5m, marking a 38.9% increase from $45m in 2021 despite a peak in overall venture financing activity that year (Figure 1). This reflects a shift towards investors committing larger amounts of capital towards companies nearing potential commercialisation—a trend observed since 2024.

Figure 1: Median venture financing deal value for biopharmaceutical companies with drugs, by highest deal stage, 2021–Q1 2025

The largest venture financing deal reported in Q1 2025 was Isomorphic Labs, an AI biotech headquartered in London, which raised $600m. GlobalData’s recent State of the Biopharmaceutical Industry 2025 report revealed that healthcare industry professionals ranked AI as the most impactful technology in the pharmaceutical industry.

In January 2025, Verdiva Bio—another biotech headquartered in London—received $411m in series A financing towards the clinical development and expansion of its cardiometabolic portfolio. Verdiva Bio’s portfolio comprises three drugs with rights outside of greater China and South Korea in-licensed from China-based company Sciwind Biosciences, including a “Phase II ready” once-weekly oral GLPR agonist, VRB-101, as well as two preclinical amylin receptor agonists: oral VRB-103 and subcutaneous injectable VRB-102.

To view further insights into venture financing activity globally in Q1 2025 in the pharma sector, please see our Pharma Venture Capital Investment Trends – Q1 2025 report.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData