South Korea’s biopharmaceutical sector has seen a surge in innovator drug licensing agreements, reaching a total deal value of $7.86bn in 2025 year-to-date (YTD), at a 113% increase from 2024, according to GlobalData’s Pharmaceutical Intelligence Center Deals Database. This recovery is driven by billion-dollar agreements with large pharma companies such as Eli Lilly and GSK, and follows a dip to $3.67bn last year due to broader macroeconomic challenges.

The strong momentum reflects the sector’s resilience and growing international appeal. Much of this is supported by proactive government initiatives. In January 2025, the National Bio Committee – an advisory body guiding South Korea’s biotech and life science industry – was launched to strengthen the country’s global competitiveness in novel drug and advanced biopharmaceutical technology development. This move builds on ongoing reforms as the government aims to reduce drug development timelines from 13.7 years to six years, and to reduce costs from Won2tn to Won1tn.

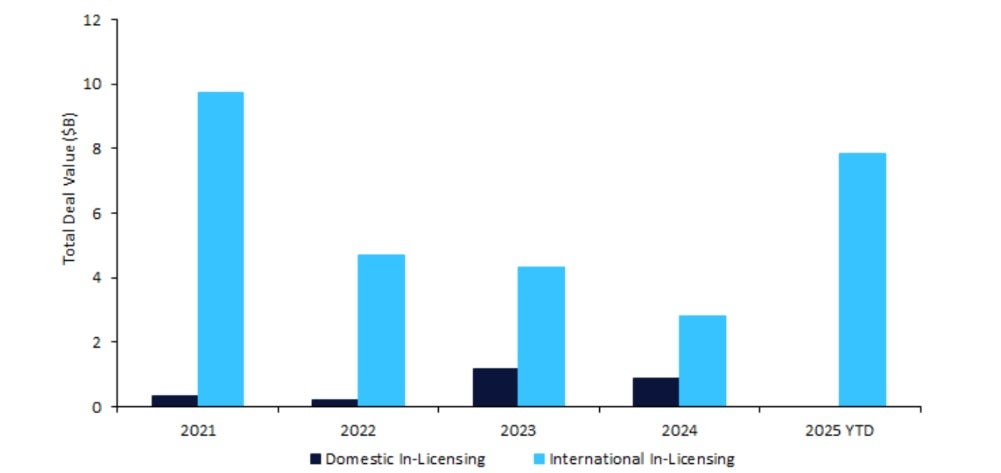

International biopharmaceutical companies in-licensed a significant share of South Korean drugs, with a total licensing agreement deal value of $29.4bn over the past five years, as Western companies retained the largest proportion at 79% ($23.3bn). This emphasises South Korea’s strategic position as a gateway to other Asian markets and a source of innovative drugs. While the out-licensing of South Korean drugs to international companies has grown 180% ($5.1bn) in value from 2024 to 2025 YTD, domestic licensing has declined 100% ($879m) over the same period, reflecting a shift toward cross-border collaboration.

Key transactions this year emphasise the global demand for Korean biopharma innovation. Valued at up to $2.78bn, GSK partnered with ABL Bio to license its Grabody-B platform, which targets neurodegenerative diseases with programmes across antibodies, polynucleotides, and oligonucleotides. Similarly, Eli Lilly licensed Rznomics’ trans-splicing ribozyme platform for treating hearing loss in a $1.3bn agreement. These transactions highlight Korea’s growing influence in drug delivery and advanced therapeutics on a global scale.

South Korea is also gaining attention as a hub for antibody-drug conjugates (ADCs). From 2021 to 2024, the licensing of ADCs from South Korean biotechs grew by 39%, reaching $1.4bn. All ADCs were licensed from global companies. LigaChem Biosciences (formerly LegoChem Bioscience), known for its focus on ADCs, secured partnerships with companies such as Janssen, Amgen, and Ono Pharmaceutical, reflecting the country’s role in next-generation oncology treatments.

Once known primarily for generic drug production, South Korea is now transitioning into a global hub for novel innovative drug discovery and advanced drug technologies. Backed by government support, the country is attracting increased international investment and forming high-value partnerships, as seen in recent deals, thus solidifying its position as a strategic bridge between Western and Asian markets.

For further insights into the latest Deal Trends in the Pharma Sector, please see GlobalData’s Pharma Venture Capital Investment Trends, Q2 2025 and M&A Trends in Pharma, Q2 2025 reports.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData