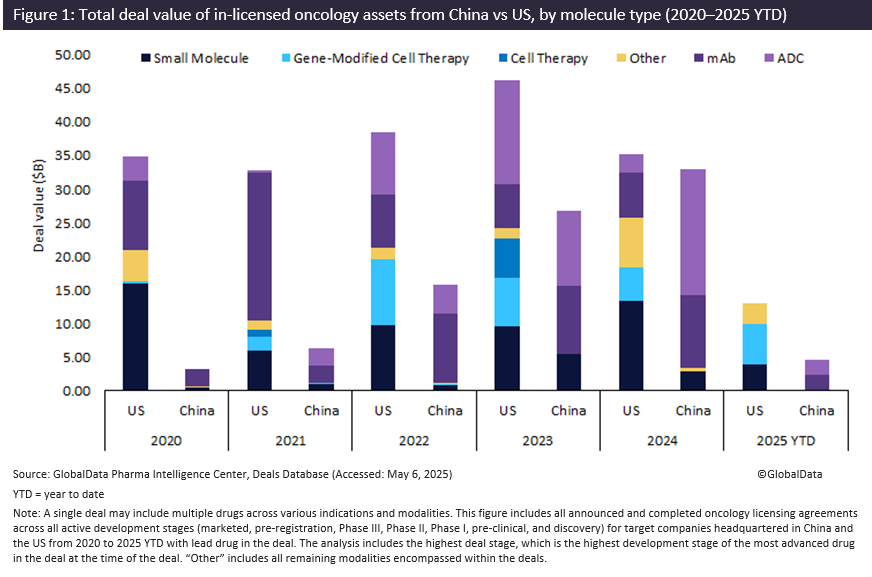

China’s biopharmaceutical sector saw a rise in oncology drug licensing deals in 2024, particularly for monoclonal antibodies (mAbs) and antibody-drug conjugates (ADCs), with the combined deal value reaching $30 billion. The mAbs and ADCs out-licensed from Chinese biopharmaceutical companies represented 89% of all molecule types, with the total deal value three times that of comparable deals licensed out from the US, according to GlobalData’s Pharmaceutical Intelligence Center deals database.

This momentum highlights the growing innovative capabilities of Chinese drugmakers, driven by government policies that prioritise innovation. China has significantly reformed its clinical development processes and regulatory review system, leading to accelerated drug approvals. As a result, the country is gaining recognition as a key source of novel therapies and a partner in innovative drug development.

However, recent developments in US-China trade relations continue to carry significant implications for the global economy. The new agreement announced on Monday, 12 May 2025, which lowered US President Trump’s tariffs from 145% to 30% on Chinese goods and reduced China’s retaliatory tariffs from 125% to 10% on US imports for an initial 90-day period, has eased immediate tensions. However, companies are expected to closely monitor upcoming negotiations, given lingering uncertainties. The persistence of elevated tariffs, coupled with ongoing supply chain disruption, may continue to dampen economic growth and impact cross-border licensing deals. Chinese companies may shift their focus toward alternative markets outside the US, seeking more stable and commercially viable opportunities.

In 2024, ADCs led oncology licensing activity in China, representing 56% of the total deal value ($19 billion), followed by mAbs at 33% ($11 billion) and small molecules at 9% ($4 billion). Notably, more half (52%) of these ADC deals involved bispecific ADCs, reflecting a shift toward more complex biologics and growing interest in China’s next-generation innovative assets.

From 2023 to 2024 alone, the total deal value of licensing oncology drugs from Chinese biopharmaceutical companies rose 24%, reaching $33 billion. In contrast, oncology drugs licensed from US biopharma witnessed a decline of 24% to $35 billion. This shift underscores China’s growing emphasis on innovation and the rising confidence among international partners in Chinese biopharmaceutical assets. Notably, non-Chinese companies accounted for 27 licensing deals for oncology drug assets from Chinese biopharma in 2024, worth $28bn — of which 68% (worth $18.7 billion) were licensed to US companies. This marks a 269% increase in deal value — up $13.7 billion — from 2023, reflecting the surge in US companies licensing oncology assets from Chinese innovators.

Despite the growing appeal of Chinese innovation, US-China trade tensions continue to cause uncertainty in the licensing landscape. While the recent easing of tariffs offers a temporary reprieve, companies remain exposed to heightened risks between the world’s two largest markets — from shifting trade policies and retaliatory measures to the threat of new restrictions. These factors could disrupt existing agreements and deter future partnerships, as parties grow increasingly cautious about the stability of cross-border deals.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataFor further insights into the latest deal trends in the pharma sector, please see our Venture Capital Investment Trends In Pharma – Q1 2025 and M&A Trends in Pharma – Q1 2025 reports.