PD-1 inhibitors have become a paramount achievement in the oncology space and have revolutionised cancer treatment over the last decade. Their success is attributed to two of the first PD-1 inhibitors to be approved, Keytruda (pembrolizumab) and Opdivo (nivolumab). Ten years on from their approval, GlobalData reviews their market entry strategies, pricing dynamics over time, and respective health technology assessment (HTA) evaluations. A particular focus will be given to the eight major markets (8MM: US, France, Germany, Italy, Spain, UK, China, Japan, and China).

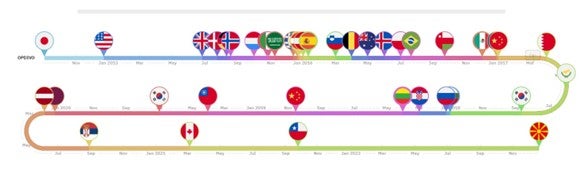

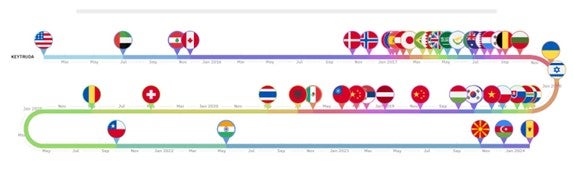

Over ten years Keytruda and Opdivo have entered over 50 markets, averaging a new market roughly every two months

Keytruda was first approved by the US FDA in September 2014, launching onto the US market four days later. Opdivo received FDA approval three months later; however, the drug had already received approval in Japan in July 2014, which influenced its subsequent launch sequence. Keytruda first launched in the US market followed by the United Arab Emirates roughly six months later. Nearly a decade since its first approval, Keytruda has become available in 59 countries, with an entry into a new market every 63.5 days on average. Across the 59 markets, its reimbursed in 60% and has been approved across 40 indications. For Opdivo its early approval in Japan led to it to being the first market the drug launched in followed by the US three months later. A decade later, this brand has entered 53 countries, is reimbursed in 68% of these markets, and has entered a new market at nearly the same rate as Keytruda, 64.5 days on average. Opdivo is approved however in significantly fewer indications compared to Keytrdua’s 40 approvals, with a total of 13 approvals.

Keytruda and Opdivo received their lowest launch prices in Asian markets

To consider launch prices, the price per strength unit (USD) of the most common pack across the 8MM was compared for Keytruda and Opdio. At launch, Keytruda’s lowest price per strength unit was for the Japanese market while Opdivo’s lowest price was in China. Both drugs had their lowest launch price in Asian markets, with Keytruda priced at $23.82 per unit/mg in Japan and Opdivo priced at $13.04 per unit/mg in China. Opdivo was approved in China in June 2018 and to be included in China’s National Reimbursement Drug List (NRDL), the drug underwent price negotiations. In China, participating in national pricing negotiations is a trade-off for developers that can result in faster market access compared to the usual channels. The ultimate result was a launch price 70% lower than its launch price in the US. Alternatively, Keytruda’s low launch price in Japan reflected the challenging pricing landscape for branded treatments in Japan in 2017. Keytruda was first priced and included in the National Health Insurance (NHI) reimbursement list for Japan in February 2017. However, its pricing decision showed the more stringent stance being taken for allocating pricing premiums. At the time, Japan’s Central Social Insurance Medical Council (Chuikyo) had granted Keytruda a daily National Health Insurance (NHI) price of JPY39,099 ($347.74) (the same as that for Opdivo during this period), while the request from Merck Sharp & Dohme (MSD, US) for an additional 5%–30% utility premium (II) was refused by Japan’s Drug Pricing Organization (DPO).

Keytruda’s and Opdivo’s prices have eroded in three of the 8MM since their launch

Across the 8MM, both Keytruda and Opdivo have undergone list price erosion over the last decade in three of the eight major markets. Opdivo specifically has also seen significant price cuts in an additional market. Since its launch, Keytruda’s price has declined by a range of 7.52% to 48% across Japan, Germany, and France while Opdivo’s price since its launch has dropped by 23% to 82% across the same markets plus Italy. Keytruda and Opdivo’s prices have dropped the most significantly in Japan. Biennial price reviews whose frequency cycle then increased to annual off-cycle revisions in 2022 as part of Japan’s pricing and reimbursement landscape have applied downward pricing pressure as a method of cost containment. This downward pressure has meant a series of price cuts for both products in Japan. Keytruda has undergone between two and four price cuts across its different packs in Japan while Opdivo has received between two and six price cuts depending on the pack. In Spain, the UK, and China, neither drug has changed its list price since launch and the US is the only market of these eight where both drugs have received price increases over time as is typical of the US market trend.

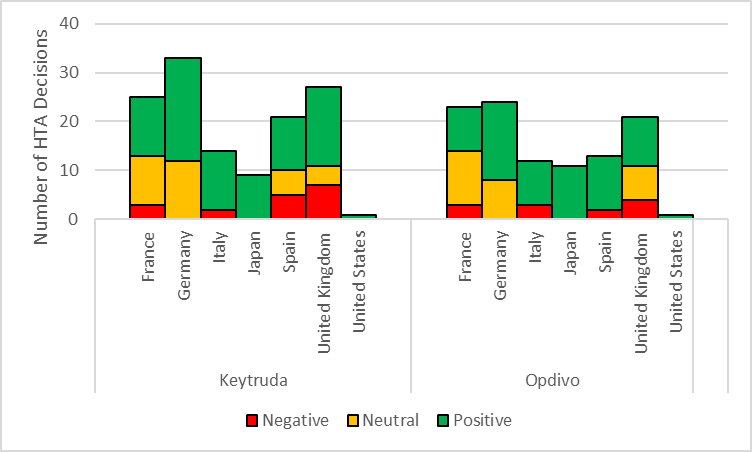

Keytruda and Opdivo follow a similar distribution of HTA outcomes across the major markets

According to GlobalData’s Price Intelligence (POLI), there are 130 HTA evaluations for Keytruda and 105 HTA assessments for Opdivo based on their latest outcome per indication. Both drugs follow a similar distribution across the 8MM based on the proportion of negative, neutral, and positive HTA assessments. In France, Keytruda and Opdivo have been rejected for three indications over the last decade. In both cases, two decisions were based on an insufficient SMR rating and subsequent rejection for reimbursement and one refusal for early access. Of the rejected indications across the major markets, the most common indications Keytruda received negative outcomes for included bladder cancer (Italy, Spain, and the UK) and head and neck cancer/soft tissue sarcoma (France, Spain, and the UK). Similarly, the most common indication that Opdivo has received a negative outcome is in bladder cancer across France, Italy, Spain and the UK. Keytruda and Opdivo continue to expand their indications and patient populations with certain profiles and indications still to be assessed in 8MM. Most of these assessments are to be within lung cancer for Keytruda and bladder cancer for Opdivo. Based on the rejections seen already within bladder cancer, GlobalData feels it may be possible that Opdivo may see further negative outcomes within bladder cancer.

Keytruda’s and Opdivo’s journeys reflect their success, challenges and expansion strategies that have culminated in each product launching in over 50 markets. Cost containment policies have affected these products resulting in lower prices being achieved in Asian markets and signification erosion of their prices in Japan. However, both drugs have been able to maintain their launch price in at least four of the eight major markets despite growing competition in the PD-1 inhibitor space over the last decade.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataThis article is produced as part of GlobalData’s Price Intelligence (POLI) service, the world’s leading resource for global pharmaceutical pricing, HTA and market access intelligence integrated with the broader epidemiology, disease, clinical trials and manufacturing expertise of GlobalData’s Pharmaceutical Intelligence Center. Our unparalleled team of in-house experts monitor P&R policy developments, outcomes and data analytics around the world every day to give our clients the edge by providing critical early warning signals and insights. For a demo or further information, please contact us here.