Two of the world’s largest pharmaceutical companies, Pfizer (New York, US) and Roche (Basel, Switzerland), have unveiled more than $10bn in biotech acquisitions within days of each other, emphasising the intensifying competition in obesity and liver disease therapies and highlighting how US policy on manufacturing, tariffs, and drug pricing may be reshaping global pharma strategy.

On 24 September, Pfizer revealed a $7.3bn acquisition of Metsera (New York), a US biotech focused on metabolic diseases. Shares of Metsera soared nearly 60% in premarket trading, emphasising investor enthusiasm. The acquisition gives Pfizer access to incretin-based therapies. This is the same type of drug that underpins Novo Nordisk’s Wegovy and Eli Lilly’s Zepbound, positioning Pfizer to directly compete in the rapidly growing obesity treatment landscape.

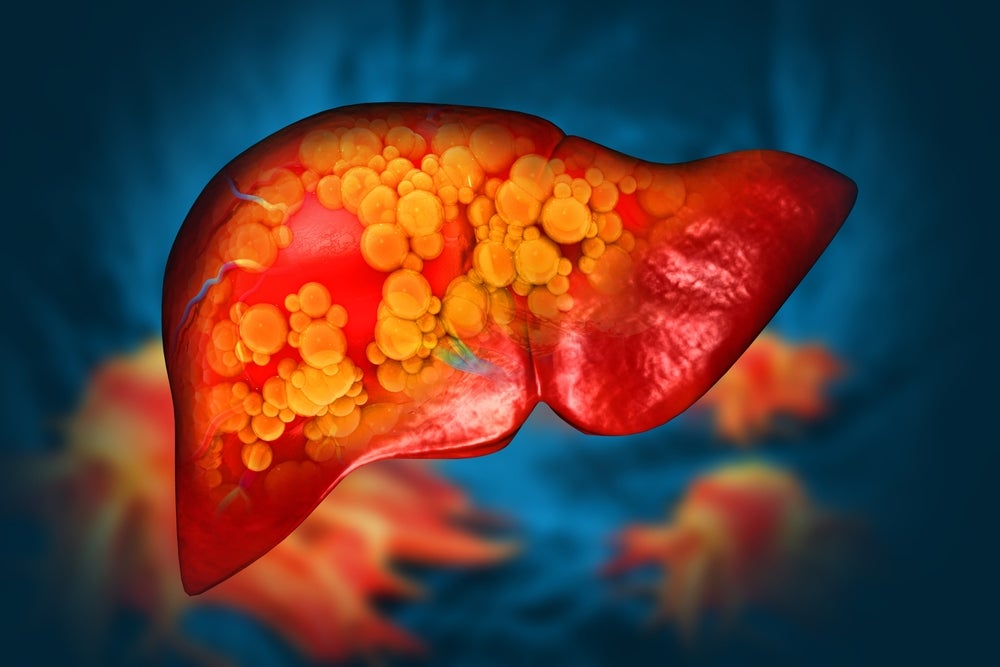

Meanwhile, Roche announced its own strategic play on 18 September, agreeing to acquire 89bio (San Francisco, US) for up to $3.5bn. The deal, which drove 89bio’s shares up 83%, centres around its pegozafermin, a late-stage fibroblast growth factor 21 analogue being developed for metabolic dysfunction-associated steatohepatitis (MASH), a progressive liver disease closely tied to obesity. Currently, only Madrigal’s Rezdiffra is approved for MASH in the US and EU. As such, the acquisition positions Roche as a serious contender in a field projected to reach billions in annual sales.

The deals come against a backdrop of sweeping trade and pricing policies from US President Donald Trump’s administration that are redefining the economics of drug development. Beginning 1 Octobr, the US government proposed a 100% tariff on branded or patented pharmaceutical imports coming into the country, unless the foreign company was actively building a manufacturing plant on US soil. The measure could fundamentally reshape how pharmaceutical companies manage supply chains and production.

The move will put pressure on global pharma companies to invest in US-based manufacturing. Major players such as Roche may be well-placed to withstand such pressure, having committed $50bn to US operations through its Genentech (San Francisco) unit. This means that Roche’s acquisition of 89bio gives the company a dual edge: scientific innovation coupled with manufacturing resilience.

Meanwhile, Pfizer struck a separate agreement with the Trump administration on 2 October, securing a three-year exemption from pharma-specific tariffs. In exchange, the company pledged to lower US drug prices and expand domestic manufacturing. As part of the deal, Pfizer will sell its existing medicines at the lowest price offered in other developed nations and commit to further investment in US manufacturing facilities.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataThe Pfizer deal aligns with Trump’s broader Most-Favored-Nation (MFN) pricing initiative, which aims to bring US drug costs in line with the lowest costs paid abroad. On 12 May 2025, Trump signed an executive order directing federal agencies to enforce MFN pricing, declaring that “foreign nations can no longer use price controls to freeride on American innovation.”

Together, these policy shifts may mark a turning point for the pharmaceutical industry. Future deals may no longer be driven solely by scientific pipelines, but also by manufacturing footprints, supply chain flexibility, and pricing concessions. Assets without scalable or geographically diversified production may increasingly struggle to command premium valuations.

The battle for next-generation obesity and liver disease drugs is now playing out on two fronts. Pfizer and Roche are not just racing to develop the next blockbuster therapies, but also to secure the factories, pricing strategies, and supply chains that will bring those therapies to market.