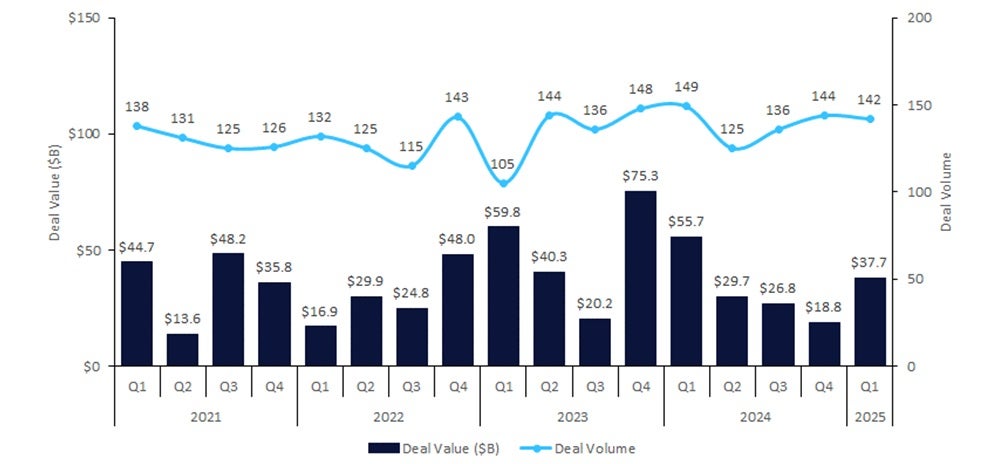

Mergers and acquisitions (M&As) in the biopharmaceutical industry surged 101% in total deal value in the first quarter (Q1) of 2025 from $18.8bn in Q4 2024 to $37.7bn, according to leading data and analytics company GlobalData’s Pharmaceutical Intelligence Center Deals Database. However, drugmakers remain hesitant to pursue larger-scale transactions, which are viewed as high risk due to the ongoing uncertainty surrounding the US political landscape. As a result, total deal values in Q1 2025 were 32% lower compared to Q1 2024.

Apart from four billion-dollar deals valued at $1bn or more driven by large pharma, the industry remains cautious given the uncertainty surrounding US President Donald Trump’s as-yet-unspecified policies. The start of 2025 continues to be shaped primarily by bolt-on transactions, as companies steer clear of riskier, sizeable M&As.

These large deals were Johnson & Johnson’s $14.6bn acquisition of Intra-Cellular Therapies, Novartis’ $3.1bn acquisition of Anthos Therapeutics, GSK’s $1.15bn buy of IDRx, and AstraZeneca’s $1bn purchase of EsoBiotec. Notably, oncology remains the leading therapeutic area in Q1 2025, with most of the deals targeting cancer-related assets.

The aforementioned caution stems from a combination of economic instability and evolving regulatory challenges. Global pharmaceutical stocks have declined following Trump’s commitment to implement pharmaceutical tariffs while recent cuts across federal health agencies have contributed to delays in US Food and Drug Administration (FDA) drug approvals. These conditions have further dampened the appetite for larger deals. Nonetheless, with limited FDA resources delaying regulatory approvals of drugs, smaller biotechs may struggle to secure funding and may opt for M&As as a strategic lifeline.

In response to the uncertain political landscape, dealmakers are closely monitoring further details of new policies and awaiting greater clarity on forthcoming regulations. Some companies may adopt a wait-and-see approach, holding off on transactions until there is more insight into how Trump’s tariffs will affect the industry, while others are awaiting what the administration will say on M&As. Given that deregulation was a defining feature of Trump’s first term, it is anticipated that the administration will pursue measures to ease regulatory constraints. Such efforts aim to accelerate the M&A regulatory process, sparking more mega deals and an overall increase in M&A activity. To view further insights into M&A activity globally in Q1 2025 in the pharma sector, please see GlobalData’s Pharma M&A Trends – Q1 2025 report.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData