The top 20 biopharmaceutical companies witnessed a promising first quarter (Q1) this year amid ongoing macroeconomic uncertainties, fluctuating interest rates, and evolving Medicare drug price negotiations.

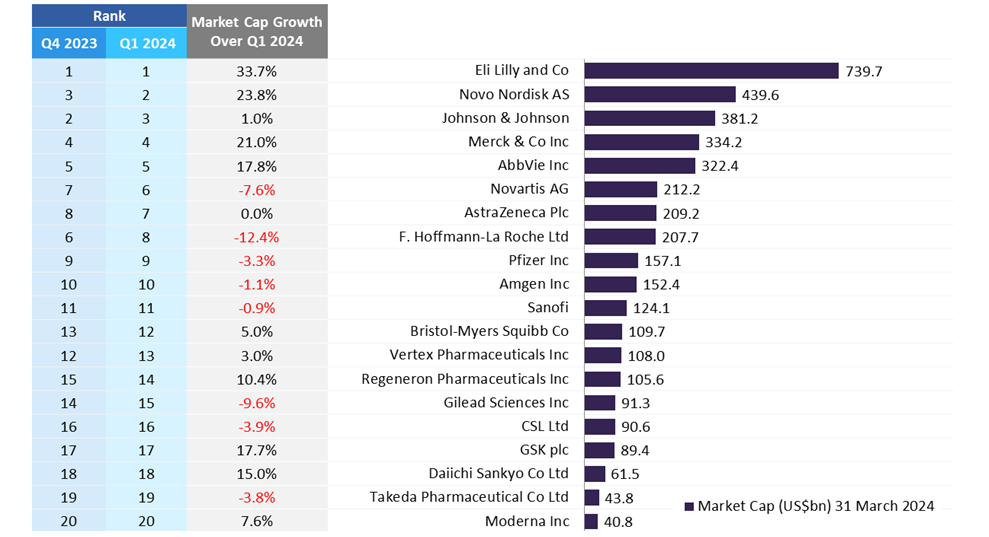

According to GlobalData, a leading data analytics and research company, these companies reported a total increase of 9.6% in market capitalisation, from $3.67trn on 31 December 2023 to $4trn on 31 March 2024.

Eli Lilly experienced the largest market capitalisation growth of 33.7% over Q1 2024, driven by the strong sales performance of Mounjaro, its glucagon-like peptide 1 (GLP-1) drug for Type 2 diabetes.

Furthermore, the US Food and Drug Administration’s (FDA) approval of Zepbound in November 2023, aimed at obesity treatment, further fuelled Lilly’s growth.

Lilly continues to lead the weight-loss market as Mounjaro’s global sales reached $5.3bn in 2023 and a global analyst consensus sales forecast of $12.3bn for 2024, as per GlobalData’s Drugs Database in its Pharma Intelligence Center.

Lilly’s GLP-1 agonist rival, Novo Nordisk, also witnessed a high market capitalisation growth of 23.8%, outpacing Johnson & Johnson to take second place, as shown in Figure 1.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataIn Q1 2024, Novo Nordisk announced its acquisition of three manufacturing sites from Catalent for an upfront payment of $11bn.

This strategic move aims to expand manufacturing capacity to meet the surging demands for its diabetes and obesity drugs, Ozempic and Wegovy, which generated sales of $13.5bn and $4.4bn, respectively, in 2023, as reported by GlobalData’s Drugs Database.

Merck & Co’s market capitalisation growth of 21% was fuelled by the FDA’s approval of Winrevair, a breakthrough treatment for pulmonary arterial hypertension (PAH).

Notably, this marks the first FDA-approved activin-signalling inhibitor therapy for PAH.

Additionally, during Q1 2024, Merck & Co finalised the acquisition of Harpoon Therapeutics, a developer of T-cell engagers, further enhancing its oncology pipeline.

AbbVie and GSK reported similar market capitalisation growth, with AbbVie achieving 17.8% and GSK 17.7% from Q4 2023 to Q1 2024.

Abbie announced the acquisitions of ImmunoGen for $10.1bn and Cerevel Therapeutics for $8.7bn, which is set to strengthen AbbVie’s oncology and neuroscience portfolios.

GSK market capitalisation growth was fuelled by its robust pipeline progress with the approval of four drugs: the RSV vaccine Arexvy, Apretude for human immunodeficiency virus (HIV) prevention, Ojjaara for myelofibrosis, and Jemperli for endometrial cancer.

These advancements aim to offset the impact of the impending patent loss of exclusivity for GSK’s HIV blockbuster drug, dolutegravir, starting in 2028.

However, Roche’s market capitalisation fell by 12.4%, largely attributed to the decline in demand for Covid-19-related drugs.

Nonetheless, Vabysmo, approved for wet macular degeneration in 2022, reported a tripling of drug sales to $2.5bn in 2023, as recorded by GlobalData’s Drugs Database.

Vabysmo, positioned as a treatment with more extended dosing intervals than its competitor Eylea, faces competition from a high-dose version of Eylea approved in August 2023, which required fewer injections.

Gilead Sciences also reported a market capitalisation decline, of 9.6%, in Q1 2024, primarily due to Trodelvy falling short of meeting the primary endpoint of overall survival in the Phase III EVOKE-01 trial for previously treated advanced non-small cell lung cancer.

However, the drug’s safety profile was well-tolerated and Gilead Sciences is exploring further the role of its Trop-2-directed antibody conjugate in these patients.

Big Pharma remains resilient amid uncertainty over interest rate cuts and the Biden-Harris Administration’s efforts to lower prescription drug prices through the Inflation Reduction Act in the US.

With ongoing Medicare negotiations, the industry is adjusting by raising drug prices in anticipation of future Medicare rates, set to be enforced in the US by September 2024.

Despite these uncertainties, companies are bolstering their portfolios to address impending patent cliffs and are remaining adaptable to navigate the evolving market landscape.