The UK pound has fallen against the US dollar consistently over the last year, causing many companies to suffer inflationary pressures and related hardships. Despite this, there is also a silver lining for British companies that export to countries like the US and others with currencies strengthening against the pound.

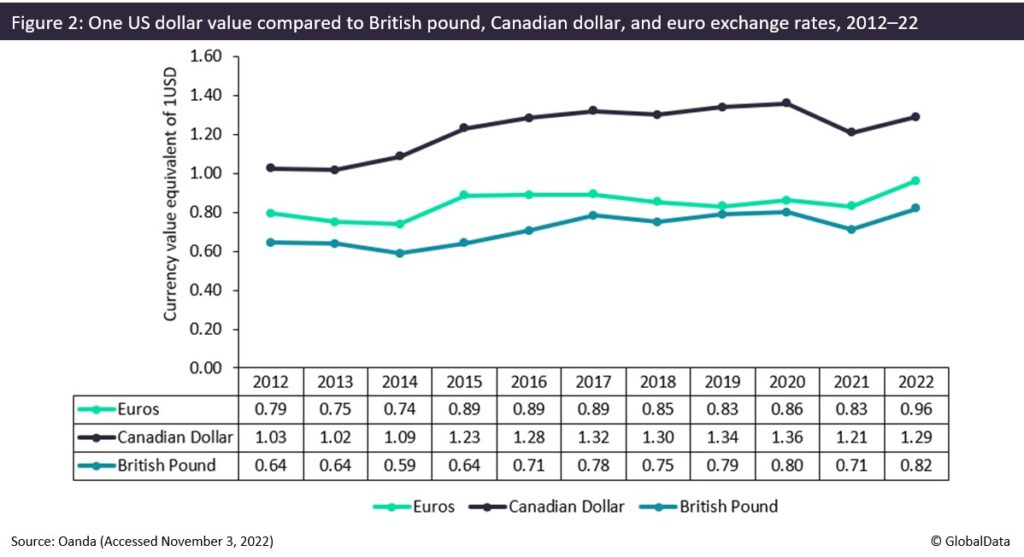

Figure 1 shows the equivalent of one US dollar in British pounds, Canadian dollars, and euros on the 15th of each month for the last year. In the last year, the value of the US dollar has fluctuated relative to the currencies of other developed countries, but overall the value of the dollar has strengthened considerably compared to the other three currencies.

The British pound fell to its lowest level ever against the dollar on September 26, 2022, in reaction to the former UK chancellor Kwasi Kwarteng’s £45bn tax-cutting package, when one dollar equated to £0.92. Since the 1970s, there has been a consistent depreciation of the UK pound against the US dollar, which was due to higher inflation in the UK than in the US, requiring a lower exchange rate to equalise price levels between the countries. However, recent drops in the pound are related to a problematic perception of the UK’s currency and investor dismay regarding the former UK prime minister’s ‘Trussonomics’ approach, which promotes the widely discredited trickle-down economics approach. The pound recovered after the current UK chancellor Jeremy Hunt essentially reversed unfunded tax cuts on October 17, but it is still of a lower value compared to the dollar than was seen earlier in the year. Rishi Sunak became the British prime minister on October 25, 2022. It remains to be seen if Sunak and Hunt will pursue more fiscally responsible policies that the markets will react favourably to and that will potentially increase the British pound’s value, although early indications suggest that taxes will increase to deal with the national deficit.

The value of the euro against the US dollar has also fallen in 2022, primarily due to sharply rising inflation caused by higher energy prices associated with the Russia-Ukraine war and low-interest rate rises compared to the dollar. Since April 2022, the Chinese yuan has also fallen against the dollar, caused by tightening Covid-19 controls. The US, having its own plentiful reserves of oil and gas, is relatively insulated against supply issues caused by the conflict.

Exchange rate trends cause trouble for US manufacturers that export

British, European, and Canadian companies with significant exports to the US are benefiting from currency depreciation. On November 2, 2022, GSK (Cambridge, UK) reported strong Q3 2022 sales of £7.8bn ($9m). Its financial reporting indicated a favourable currency impact, which primarily reflected the weakening of the UK pound against the US dollar, partly offset by the strengthening of the UK pound against the Japanese yen. Contracts paid in US dollars are favourable to UK companies in the current climate. Other British drug manufacturers that export to the US are also seeing favourable conversion effects; for instance, the pharma and consumer health company Haleon PLC (Brentford, UK) reported in its interim results for six months ended June 30, 2022, that favourable foreign exchange added £112m ($136m) to total revenue, mainly due to strengthening of the US dollar against the UK pound. Other UK-based international manufacturing players include companies like Abzena Ltd (Cambridge, UK), AstraZeneca (Cambridge, UK), and Almac Group Ltd (Craigavon, UK). Almac is involved in manufacturing 35 known drugs (innovator and/or biosimilar) that are marketed in the US, according to GlobalData’s Drugs by Manufacturer database.

For US manufacturers that export a significant proportion to the British, European, and Canadian markets, the US dollar’s currency appreciation is detrimental to overall sales figures. Thermo Fisher Scientific (Waltham, MA, US) reported a 14% increase in Q3 2022 revenue on October 27, 2022, but also stated that currency translation decreased revenue by 5%. US companies in this situation might see a decline in product demand from clients seeking less costly alternatives; however, cancelled contracts are unlikely as supply chains are long-term for the pharma industry, with changes to supply chains requiring high costs and a long period of time to implement.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataOne US dollar could have been worth €0.86–€1.03, C$1.24–C$1.38, or £0.73–£0.89, depending on the exact time and date it was exchanged over the last year. Although these may look like small differences, when multinational CMOS gain multi-million dollar revenues or acquire companies or facilities for large sums from abroad, these fluctuations can produce a big difference in the companies’ profitability or expenditure. For this reason, exchange rates play a major role in executive decision-making, as they will impact the asset’s price and the financing available for the deal; companies use financial instruments such as currency swaps and forward contracts to hedge the risks posed.

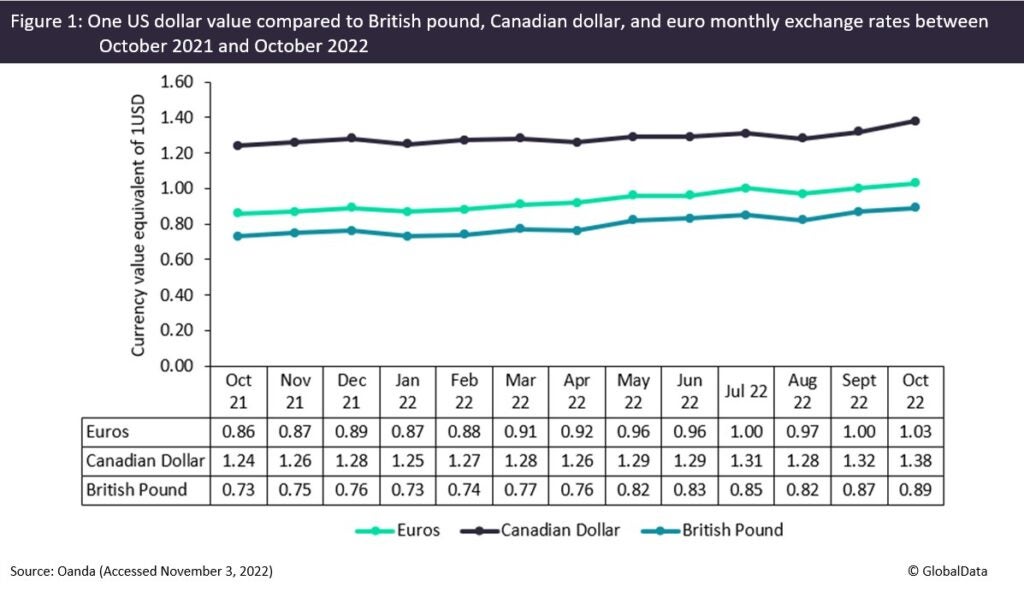

Figure 2 shows the equivalent of one US dollar in British pounds, Canadian dollars, and euros on June 15 of every year for the last decade. Across the period of 2012 to 2022, although there have been fluctuations, generally, the US dollar’s value is significantly higher than it was ten years ago, indicating that these trends are long-running and not necessarily tied to events in the short term. Foreign exchange rates are influenced by a range of factors, including interest rates, inflation, economic growth, and geopolitical events. A stronger national currency generally tends to mean there is good economic growth and higher interest rates. Political events can produce severe and uncharacteristic fluctuations in the currency exchange rates within minutes of occurring.