Between 2005 and 2018, Bayer’s tyrosine kinase inhibitor (TKI) Nexavar (sorafenib) was the only targeted therapy approved for first-line hepatocellular carcinoma (HCC). Currently the standard of care for unresectable HCC, it prolongs survival by just three months, therefore better alternative treatment options are needed. 2018 has seen a wave of approvals of Eisai and Merck’s TKI Lenvima (lenvatinib) in Japan, the US, the EU, South Korea, and China in first-line HCC, which means that Bayer is now at risk of losing a significant slice of this market.

While TKIs dominate in the first line, the second-line setting includes drugs with other mechanisms of action (MOAs) such as Bristol-Myers Squibb’s PD-1 inhibitor Opdivo (nivolumab). The market for targeted therapies in HCC is still relatively sparse and homogeneous in terms of MOAs and combinations, providing an opportunity for pharma and biotech developers to capture some of this market with diverse novel agents.

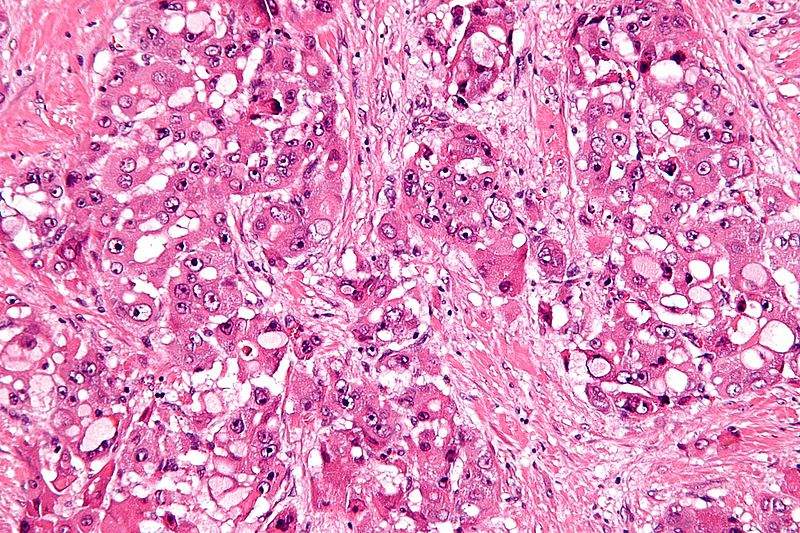

Image: Clinical Trials in Hepatocellular Carcinoma Globally, by Company. Credit: GlobalData.

Big pharma has been the dominant type of clinical trial sponsor since 1995, with Bayer having conducted the most clinical trials of any company (see Figure A). Other top sponsors include Eli Lilly, Novartis and Eisai. In terms of numbers of active clinical trials (see Figure B), Bristol-Myers Squibb takes the top spot, followed closely by Eisai, Merck, and Incyte. Eisai’s trials include testing Lenvima in combination with either Opdivo or Merck’s PD-1 inhibitor Keytruda (pembrolizumab), as well as various other small molecules including novel TKIs, while Merck has ongoing trials of Keytruda combinations and small molecules, including a MEK inhibitor.

This suggests that Eisai and Merck, who are now in direct competition with Bayer, are aiming to consolidate their latest success in this field. Interestingly, Bayer is the only large pharma developer undertaking active Phase IV trials, which will help it to reinforce the long-term safety of its approved products and defend its leading position in the HCC market.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataWhile GlaxoSmithKline has conducted a total of six clinical trials in HCC since 1995, there are currently no active GlaxoSmithKline-sponsored clinical trials, suggesting that the company is investing elsewhere. On the other hand, Incyte has six clinical trials in HCC that are all currently active, demonstrating its focus in this disease and potential to challenge Bayer in future.

With big pharma still active in HCC clinical trials and with new combinations and new MOAs in the mix, competition in HCC is only set to rise.