Pharmaceutical companies – like those in many other industries – are facing the challenges of shrinking pipelines, high development costs and credit squeezes. The fallout from these pressures has already been witnessed in the form of large-scale redundancies and companies looking to work both smaller and smarter. Ernst & Young senior pharmaceutical analyst Andrew Jones gives his views on where the industry is heading in 2009.

Nicola Boyes: How are companies looking to work more efficiently in 2009's economic slowdown and what business models are they adopting?

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

Andrew Jones: Most of the major pharmaceutical companies are in the process of removing between $1bn and $2bn of annual costs over the coming years and reviewing the way they allocate capital across their businesses.

Companies no longer see the need to own every element of the pharmaceutical value chain and are seeking greater flexibility in fixed-cost infrastructure while also focusing on core competencies.

To this end outsourcing processes and divesting non-core assets, like facilities and products, are key actions being taken to deliver leaner, more effective operating models.

NB: In your opinion, what was the biggest story to hit the industry in 2008?

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataAJ: I think the moves made by major pharmaceutical companies into the generics segment is a significant development.

GlaxoSmithKline's deal with Aspen, the acquisition of Ranbaxy by Daiichi Sankyo and Sanofi-Aventis' bid for Zentiva are pragmatic responses to challenging conditions in the business environment.

In addition to improving their risk profiles by diversifying the business mix to include more than just high-risk/high-reward patented pharmaceuticals, participating in the generics market will play a central role in unlocking the growth opportunities presented by emerging markets.

NB: What was the biggest safety or legislative issue the industry faced in 2008 and what impact will this have in the future?

AJ: The manufacturing-related safety issues that have impacted the heparin market are important. There is now far more scrutiny on the manufacturing supply chain and the role third parties play, particularly for products sourced from China.

Regulators and politicians have increased their scrutiny of the supply chain and are asking companies questions about the processes they have in place to manage risk internally and across their network of suppliers.

NB: Where do you think the industry's focus will be during this year?

AJ: Companies are managing significant change and this is leading to initiative overload. During 2009 management needs to speed up the pace of change by prioritising and allocating resources effectively as well as exercising rigour in project management.

Transformation of the finance function is an important first step in preparing to implement the significant business model changes that are needed.

NB: How are contact research organisations and contract manufacturing organisations benefiting from the industry's change in focus?

AJ: The pharma services segment has clearly benefited from cost-reduction strategies and outsourcing. In addition, a ground swell of biotech and small- to mid-tier pharmaceutical companies, often with limited resources and/or operating virtual business models, are relying on providers of outsourced services to support them in bringing their products to market.

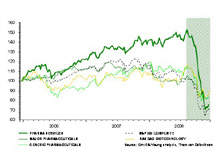

As a consequence of the uplift in demand for outsourcing pharma services, businesses have enjoyed high growth rates – in many cases double-digit quarter-on-quarter growth. Until the capital market collapse these companies outperformed adjacent industry sectors.

NB: Where are the hottest geographical markets in 2009, firstly for potential markets and secondly for drug discovery and development?

AJ: The markets of Latin America, Central and Eastern Europe, Russia and Asia are going to be a major feature of growth strategies and the market has seen a number of companies reconfigure their businesses in 2008 to reflect this. Although they present a major opportunity, operating in these markets does not come without risks. Third-party risk and compliance with local laws and regulations are major challenges.

For example, when dealing with third-parties companies need to ensure rigour around contracts and establish effective – as well as culturally acceptable – anti-bribery and corruption measures. Crucially, companies need to recognise that their behaviours and beliefs in relation to compliance are not always mirrored by their business partners. Companies also need to consider how they are interacting with healthcare professionals and particularly government officials to ensure that the nature of these interactions meet the high standards of compliance expected in traditional markets.