Biopharmaceutical firm Celgene has signed a definitive agreement to buy Impact Biomedicines for an upfront payment of about $1.1bn.

The agreement also involves around $1.25bn in contingent payments depending on regulatory approval milestones for myelofibrosis and additional payments for approvals in other indications.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

It also includes potential sales-based milestone payments of around $4.5bn in the future, if global annual net sales would be more than $5bn.

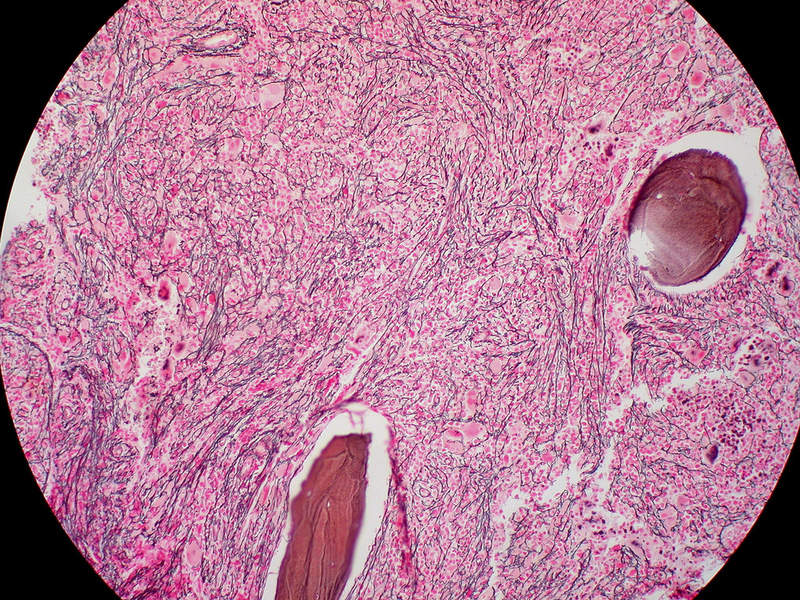

Impact Biomedicines is currently developing a selective JAK2 kinase inhibitor called Fedratinib for the treatment of myelofibrosis.

The drug candidate is currently being studied in a total of 877 subjects across 18 clinical trials, and reported to have shown a statistically significant improvement in splenic response and total symptom score during the pivotal Phase III JAKARTA-1 trial performed in treatment-naïve patients.

Similar improvements were also observed in a multi-centre, single-arm Phase II JAKARTA-2 trial conducted in subjects who were ruxolitinib-resistant or intolerant.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataA clinical hold that was placed by the US Food and Drug Administration (FDA) on the fedratinib programme due to potential cases of Wernicke’s encephalopathy (WE) in eight out of the 877 participants was lifted in August last year.

Celgene Haematology and Oncology president Nadim Ahmed said: “Myelofibrosis is a disease with high unmet medical need as the number of patients who are ineligible for or become resistant to existing therapy continues to increase.

“We believe fedratinib is uniquely positioned as a potential treatment for myelofibrosis and it provides strategic options for us to build leadership in this disease with luspatercept and other pipeline assets.”

Subject to customary closing conditions, the acquisition is set to be closed in the first quarter of this year.