MSD has entered a definitive agreement to acquire US-based Harpoon Therapeutics for $680m, strengthening its immunotherapy portfolio for cancer treatment.

Via a subsidiary, MSD will acquire all of Harpoon’s shares at a price per share of $23.00 in cash. MSD has paid over a 100% premium to the stock’s pre-announcement market close on Friday 5 January. The deal is expected to close in H1 2024, according to an 8 January press release.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

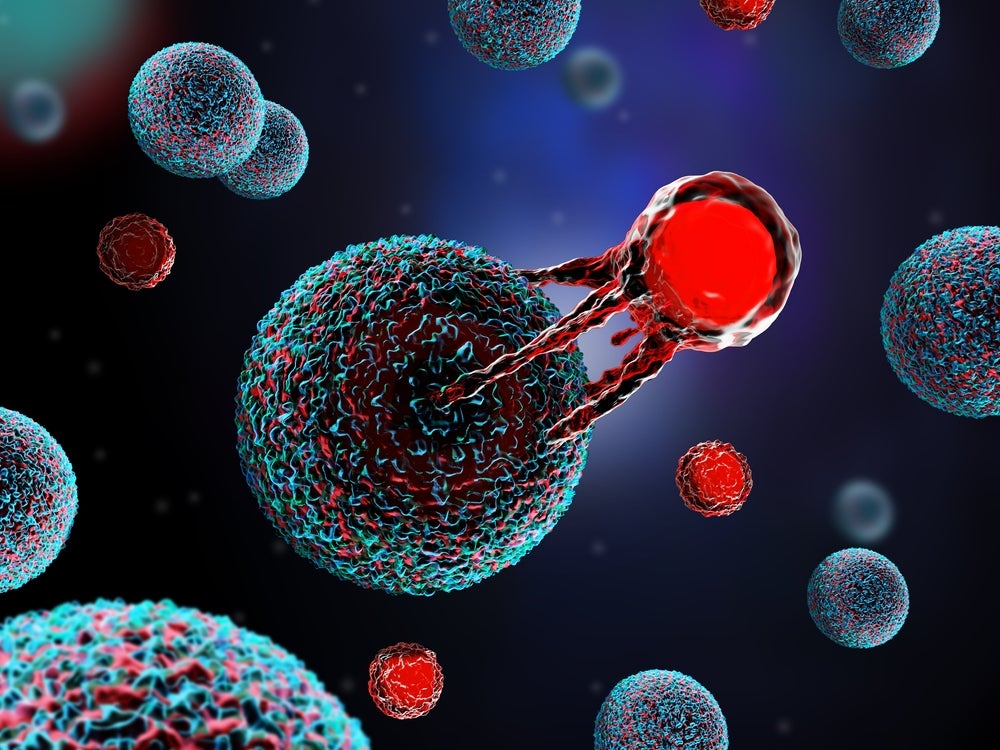

MSD will acquire Harpoon’s T-cell engagers – engineered antibodies that redirect T cells to attack cancer cells. The redirection uses Harpoon’s TriTAC platform while its ProTriTac platform adds a prodrug for therapeutic application. The molecules have an extended half-life, designed to remain inactive until they reach tumours.

HPN328 is Harpoon’s lead T-cell engager candidate targeting delta-like ligand 3 (DLL3). DLL3 is expressed at high levels in small cell lung cancer (SCLC) and neuroendocrine tumours. HPN328 is currently being tested as a monotherapy and in combination with Roche’s Tecentriq (atezolizumab) in patients with DLL3-expressing cancers in a Phase I/II trial (NCT04471727). The US Food and Drug Administration (FDA) granted orphan drug designation to HPN328 for the treatment of SCLC in March 2022.

MSD Research Laboratories’ president Dr Dean Li said: “We look forward to further evaluating HPN328 in innovative combinations with other pipeline candidates.”

Currently, there are no FDA-approved therapeutic options for third-line treatment of advanced SCLC. The FDA granted accelerated approval for MSD’s blockbuster immunotherapy Keytruda (pembrolizumab) in SCLC, but the company later withdrew the application due to the FDA’s crackdown on post-marketing data requirements.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataWhile Harpoon’s positive interim HPN328 data generated buzz in the industry when announced in October 2023, Amgen’s anti-DLL3 candidate tarlatamab remains in pole position for market approval. Last month, the FDA granted priority review to tarlatamab for advanced SCLC – the drug’s Prescription Drug User Fee Action (PDUFA) date is set for 12 June 2024.

Along with HPN328, Harpoon has a B-cell maturation antigen (BCMA) candidate HPN217 currently in a Phase I trial for the treatment of relapsed/refractory multiple myeloma. On the preclinical side, the company has a candidate, HPN601, for the treatment of epithelial cell adhesion molecule (EpCAM) expressing tumours.

The deal comes as MSD gets closer to losing its Keytruda patent protection in 2028. Upon expiration, the market will likely become flooded with biosimilars, echoing what happened with AbbVie’s Humira (adalimumab). In 2022, Keytruda generated $20.9bn in sales for MSD, up 22% from the year before.