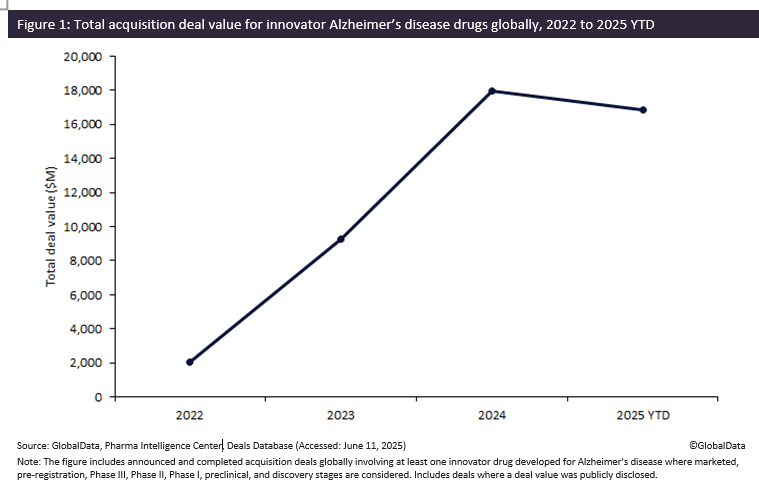

Biopharmaceutical companies developing Alzheimer’s disease innovator drugs have witnessed a flurry of acquisitions over the past few years, surging in total deal value by more than 780% from $2 billion in 2022 to almost $18 billion in 2024. The momentum in acquisition activity continued into 2025, with total deal value reaching $16.8 billion by May, highlighting Alzheimer’s disease as a key area of focus by biopharmaceutical companies in fueling their pipelines, according to GlobalData’s Pharma Intelligence Center Deals Database.

Alzheimer’s is a neurogenerative disease characterised by the accumulation of amyloid-beta (Aβ) plaques and neurofibrillary tau tangles within the brain, resulting in cognitive decline. Current treatments provide only moderate symptomatic relief for dementia and agitation without slowing disease progression, with oral Aricept — co-marketed by Eisai and Pfizer — as the top drug by global drug sales, totaling $165 million in 2024. Over the past few decades, Alzheimer’s research and development (R&D) has seen a low success rate due to failure to demonstrate efficacy in clinical trials.

The US Food and Drug Administration's approvals of anti-Aβ monoclonal antibodies Eisai and Biogen’s Leqembi (lecanemab) in January 2023, and Lilly's Kisunla (donanemab) in July 2024, have led to renewed interest amongst companies in developing Alzheimer’s drugs with improved efficacy and safety, including slowing or halting disease progression in its later stages.

Acquisitions involving innovator drugs for Alzheimer's disease have witnessed sustained year-on-year growth, with total deal value increasing eight-fold from $2 billion in 2022 to almost $18 billion in 2024. Of note, 2025 year-to-date (YTD) has already seen a total deal value of $16.8 billion, largely driven by Johnson & Johnson’s $14.6 billion acquisition of neurology biotech Intra-Cellular Therapies, completed in April 2025. The transaction includes oral small-molecule ITI-1284, currently in Phase II trials for agitation and psychosis associated with Alzheimer's.

In December 2024, AbbVie completed the $1.4 billion acquisition of Aliada Therapeutics, including its anti-pyroglutamate amyloid beta (3pE-Aß) antibody ALIA-1758, which is currently in Phase I trials for Alzheimer's disease. ALIA-1758 aims to differentiate itself through its novel delivery technology designed to overcome challenges of delivering drugs across the blood-brain barrier.

In May 2025, Sanofi announced its $470 million acquisition of Vigil Neuroscience, adding to Sanofi’s neurology pipeline oral TREM2 agonist VG-3927, which has a planned Phase II trial in Alzheimer’s disease. In June 2024, Sanofi invested $40 million in Vigil Neuroscience, securing an exclusive right of first negotiation to license VG-3927.

In light of the approvals of Leqembi and Kisunla, large pharmaceutical companies are increasingly investing in Alzheimer's disease through high-value acquisitions. The future Alzheimer’s disease treatment paradigm is anticipated to be combinatorial, where novel drugs targeting alternative disease mechanisms other than Aβ plaques must demonstrate additive efficacy alongside Leqembi and Kisunla — as well as improved safety — to achieve market success.