US Senator Bernie Sanders has proposed price caps on drugs developed with federal funds from the Centers for Disease Control and Prevention (CDC) or the Biomedical Advanced Research and Development Authority (BARDA), following a political career battling against high drug prices. Given that big pharma is already challenging price cuts in the Inflation Reduction Act, even if Sanders’s legislation passes, it may not be successfully implemented in the face of legal opposition from the industry.

Sanders’s proposed bill could be another hit on the profitability of US drugs following the Inflation Reduction Act of August 2022, which aims to lower prescription drug prices by setting prices for medicines covered by Medicare. The trade organization PhRMA claims that lowering drug prices will discourage innovative drug development.

Bernie Sanders proposes, in a 3 July Senate draft bill with bipartisan support (‘‘the 2023 Reauthorization of the Pandemic and All-Hazards 6 Preparedness Act), that the US price of a product developed with support from the CDC or BARDA must not exceed the lowest price charged for it in Canada, France, Germany, Italy, Japan, or the UK. Outside the US, national health authorities such as the UK’s NICE assess the cost-benefit of new drugs and negotiate prices with companies, driving prices substantially lower than in the US. Sanders’s proposal would essentially move towards standardizing drug prices globally but might also reduce pharma companies’ desire to seek US government funding.

Big pharma fights back against revenue loss

Pharma companies are already mounting legal challenges to price reduction efforts. In June 2023, Merck & Co. (Kenilworth, NJ, US) filed a lawsuit against the US government in response to the Inflation Reduction Act. Merck stated that “once the Department of Health and Human Services unilaterally selects a drug for inclusion in the program, its manufacturer is compelled to sign an ‘agreement’ promising to sell the drug to Medicare beneficiaries at whatever ‘fair’ price the agency dictates, which must represent at least a 25% to 60% discount. If a manufacturer refuses to participate in this ‘negotiation’ or declines to ‘agree’ to sell at the mandated price, it incurs a ruinous daily excise tax amounting to multiples of the drug’s daily revenues”.

In a separate lawsuit related to the Inflation Reduction Act, Bristol Myers Squibb (New Jersey, NJ, US) and the US Chamber of Commerce are also suing the US government. PhRMA, the Global Colon Cancer Association, and the National Infusion Center Association have similarly filed a lawsuit stating the Inflation Reduction Act’s Drug Price Negotiation Program is a government mandate disguised as negotiation and is unconstitutional. The effect of these, if successful, will be to delay or entirely stop the Medicare drug price negotiation program. The US government can try to curb high drug prices with other measures, such as Sanders’s bill, but is likely to face legal opposition to those measures as well.

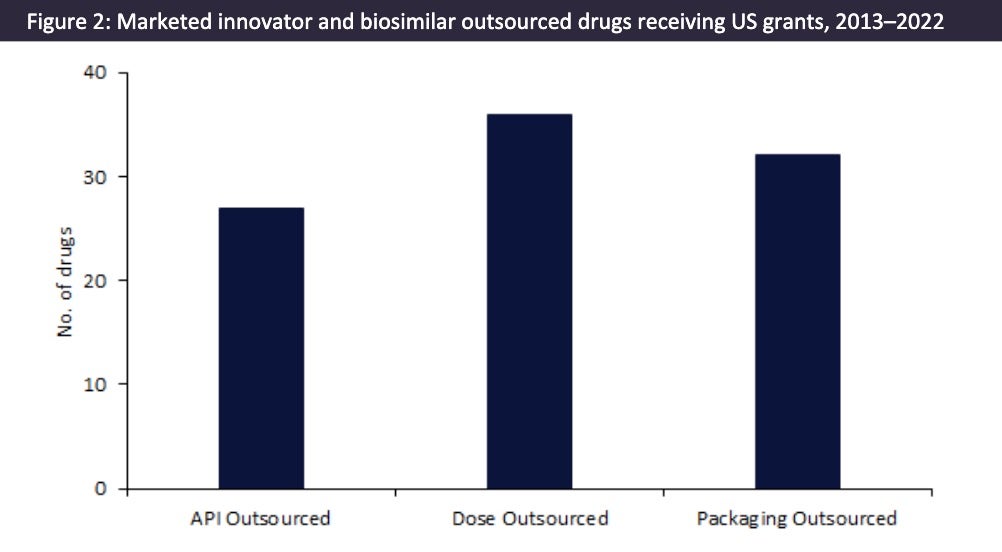

As shown in Figure 1, a substantial number of US grants have been issued to pharma companies with marketed innovator and biosimilar drugs during 2013–22. These grants had a combined grant value of $4m. The largest of these grants was awarded by The National Institute of Allergy and Infectious Diseases (Bethesda, WI, US) to SIGA Technologies (New York, NY, US) in 2008 for $1m to fund SIGA-246, a smallpox antiviral.

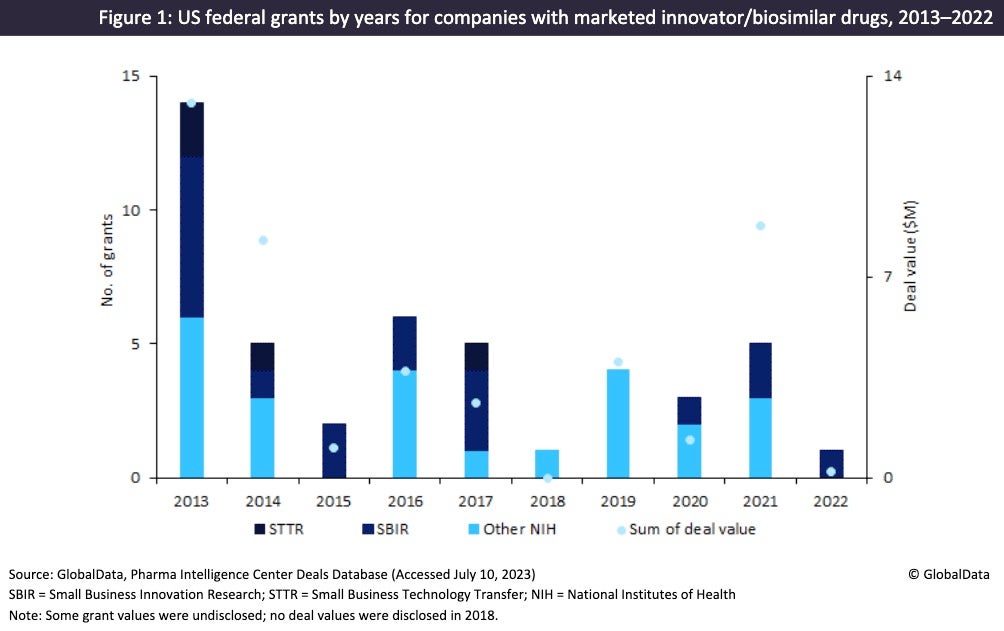

Figure 2 shows that a large proportion of marketed innovator and biosimilar drugs receiving US grants during 2013–2022 have outsourced their manufacture. These include blockbuster drugs such as AstraZeneca’s (Cambridge, UK) Evusheld and Moderna’s (Cambridge, MA, US) Spikevax, which are manufactured in high volumes. This group of marketed drugs is outsourced to the largest CMOs, such as Catalent (Somerset, NJ, US), Lonza (Visp, Switzerland), Patheon (Waltham, MA, US), and Vetter Pharma (Ravensburg, Germany). For Covid-19 vaccines that received grants, there tended to be multiple CMOs involved in the API and dose manufacturing, as well as the packaging.