2021 has been a record year for orphan drugs, with subsequent brain-racking at stake for payers willing to provide access to orphan medicines without destabilising their funding system. In particular, gene therapies with orphan drug status – such as Zolgensma and Libmeldy – are definitely causing budget concerns and will require payers to accelerate their transition towards innovative funding models.

In this blog, the Poli team looks back at the 2021 pricing and reimbursement trends in the orphan drug space in seven countries: Europe-5 (France, Germany, Italy, Spain and the UK), Japan and the US.

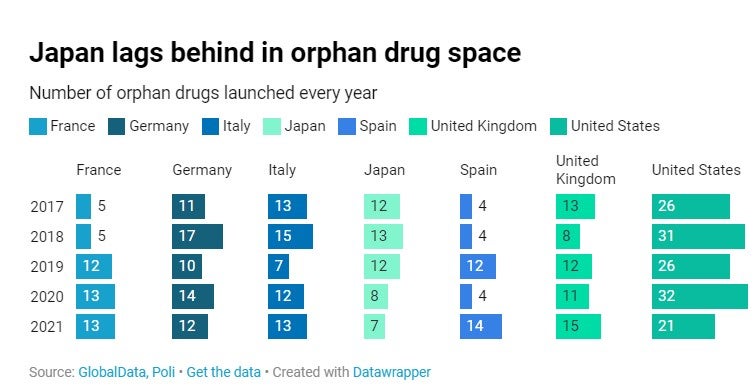

Steady rise in orphan drug launches

Our Poli data suggests a steady rise in the number of orphan drugs launched in Europe-5 over the last five years. Overall, in 2021, between 12 and 15 orphan medicines were launched in these markets, compared to 21 in total in the United States. With only seven orphan drugs reaching the market in 2021 – versus 12 in 2017, Japan lags clearly behind other big pharma markets. The country is bearing the consequences of an access policy that has become more stringent over time, not only for orphan drugs but for all innovative medicines in general.

While the United States remains a market of predilection for launching orphan medicines to ensure a high initial price tag and successful launch sequence, funding conditions remain much more favourable in the other markets, with 100% of orphan drugs launched in 2021 being reimbursed in France, Germany, Spain, the UK and Japan. In Italy, only 77% of orphan medicines launched in 2021 are currently reimbursable, mainly because their funding is still being evaluated by AIFA.

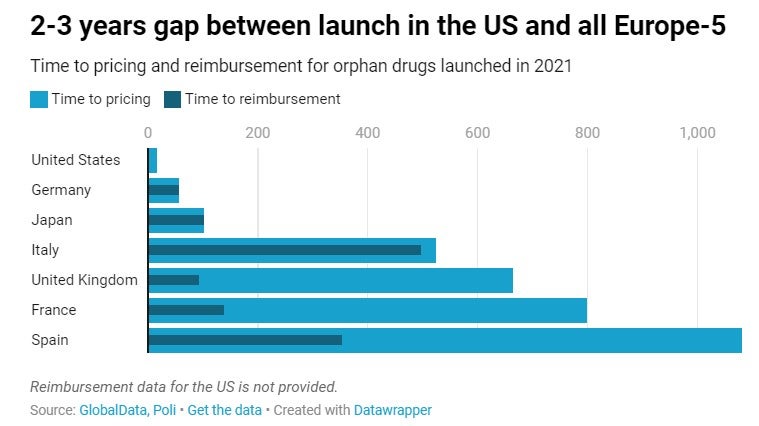

Time to launch greatly varies between countries

The different regulatory environment surrounding pricing and reimbursement partly explains why 2 to 3 years can pass by between launch in the US market and commercialisation in all Europe-5 markets. Except for Germany, where launch of orphan medicines occurs relatively quickly after market authorisation due to advantageous pricing and funding conditions at launch time, other EU markets follow a process that can take up to an average of three years in the case of Spain and two years in the case of France. In Japan, time to reimbursement and pricing is relatively short but time to marketing authorisation is generally longer than in the US or Europe, which means that orphan drugs come to the Japanese market with a significant delay.

While reimbursement and launch of orphan drugs occur almost simultaneously in Germany, Japan and Italy, it can take an average of 1.5 to 2 years after a positive reimbursement decision for orphan drugs to get priced and launched in the UK (572 days), France (660 days) and Spain (730 days).

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataInnovative payment models

Keeping payer budget afloat while ensuring equitable access to therapeutic innovations is a very balancing act that require innovative approaches. In the US and other parts of the world, payers are inclined to find new payment models to grant access to the latest orphan drugs coming to the market. For example, Novartis’ gene therapy Zolgensma, initially launched in the US with a list price tag of $2.125 million, is subject to performance-based risk-sharing contracts in at least five countries worldwide – Italy, France, Germany, Australia and the US. Other innovative approaches imply the creation of cross border alliances aimed at increasing the bargaining power when negotiating drug prices. These are among the few challenges that are set to remain for the next generations of orphan drugs coming to the market.