Health technology assessments (HTA) are a formalized process for evaluating the value of a given health intervention. The outcomes of these assessments help to support key stakeholders in decisions related to health policy by providing evidence about the technologies. For drug developers, the outcome controls the pricing and reimbursement of a product, and therefore its success.

GlobalData has taken the opportunity to analyse HTA decisions made for branded medicines in the five major European markets (Europe top-5) (France, Germany, Italy, Spain, and the UK) from 2018 to 2022, with a focus on oncology.

HTA decisions made in the Europe top-5 have grown by 27%

During 2018–22, more than 3,000 HTA decisions were made in the five major European markets, and they steadily increased at an average annual growth rate (AAGR) of 27%. These HTAs help to support policy decisions such as whether a drug will be included under a national reimbursement list, and if so, what percentage of the drug’s price will be reimbursed. A positive outcome could even give developers greater pricing flexibility through pricing negotiations with government authorities, rather than the developers being restricted to reference pricing.

84% of HTA assessments delivered in Italy during 2018–2022 were positive

In Figure 2 below, positive/neutral decisions represent medicines that are eligible for reimbursement. A neutral outcome accounts for decisions where products / indications are reimbursed for a restricted part of the population or where the pricing procedure is not as favourable when compared to a positive assessment.

Germany is the only country in the Europe top-5 where no negative outcomes are granted as all new technologies are automatically reimbursed. Instead, HTA decisions in Germany determine whether a drug will be either priced under negotiations with the Gesetzliche Krankenversicherung (GKV) (a positive outcome) or priced based on therapeutic reference pricing (a neutral outcome). Most assessed drugs (57%) go through therapeutic reference pricing while 43% of medicines will undergo pricing negotiations.

The rest of the five major European markets produces negative decisions whereby products and new indications are excluded entirely from the reimbursement list. For example, Spain and Italy have delivered the largest number of negative decisions, blocking certain drugs and indications from national reimbursement.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataItaly has also shown the highest overall volume of HTA decisions along with France over the last five years. Together, both countries comprise 47% of all HTA decisions made. In Italy, national legislation regulates a positive reimbursement list based on cost and efficacy. Fortunately, the majority of outcomes delivered in Italy are positive (84%), but this comes with major pressure on pharmaceutical companies to accept relatively low launch prices and even agree to price reductions at certain stages following launch.

In France, 93% of the medicines/indications assessed during 2018–22 are eligible for reimbursement. Despite delivering a high number of overall outcomes, France sees a much lower percentage of positive outcomes at 20%. HTAs in France are informed by the Service Médical Rendu (SMR) rating, which sets the reimbursement status and rate, and Amélioration du Service Médical Rendu (ASMR) rating, which sets the price policy. These outcomes are granted by the Transparency Commission (TC) and have resulted in a significant number of neutral decisions (73%) based on ratings of ASMR IV and ASMR V, which require medicines to be priced equivalent to alternative therapies or below the alternative, respectively. Among the indications that are eligible for reimbursement, only 20% have a positive outcome represented by ASMR ratings I–III, allowing them to be priced under an international reference price (IRP) procedure and prevent price cuts for five years.

In the UK, fewer assessments are performed by the National Institute for Health and Care Excellence (NICE). It is possible that the UK's lower ranking is linked to products and indications not requiring assessment, and that all new pharmaceuticals brought to the market are reimbursable in theory. However, in practice, products not recommended by NICE would not be fully accessible on the National Health Service (NHS) until they have received positive guidance.

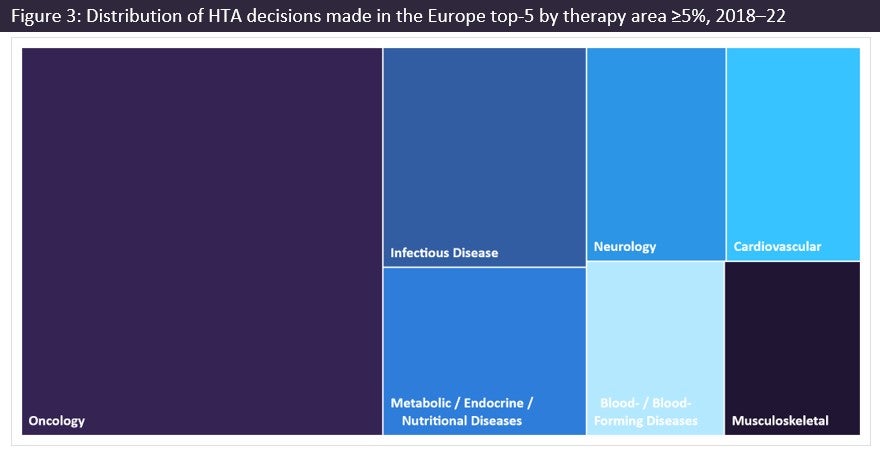

Oncology comprises 34% of HTA decisions made in the Europe top-5 during 2018–2022

Each country in the Europe top-5 delivers more positive decisions than it does negative decisions, with the percentage of negative decisions ranging between 0% and 16%. Receiving a negative or neutral decision in these markets can be detrimental for developers, as evident in the oncology market. The oncology market has seen firsthand the need for greater therapeutic options, which have successfully evolved from standard chemotherapy to advanced cell and gene therapies.

Subsequent HTA decisions have determined the advanced therapeutic treatment options available to patients under national health schemes. Therefore, HTA authorities have not only had to keep up with the challenges of the evolving oncology market, but also the significant volume of decisions to be filed, as evidenced by oncology comprising the largest percentage (34%) of HTA decisions made for any therapy area, followed by infection disease, metabolic disorders, and neurology.

The outcome of an HTA decision can determine the success of a drug at achieving its target price and being able to launch in notoriously difficult markets. When considering the HTA process and outcomes in the five major European markets over the last five years, it is clear that positive HTA outcomes typically come with the trade-off of entering a late-stage market and the maintenance of a two-tier reimbursement list in which a drug is or is not fully reimbursed.