More than half of all cancer patients experience pain as a result of their cancer, current treatment options are lacking and can leave patients suffering with chronic pain, which can significantly reduce their quality of life by making it more difficult to sleep, exercise and work.

Current treatment options rely heavily on strong opioids such as morphine and fentanyl. Not only do these drugs fail to treat chronic pain in a large proportion of cancer patients, they also result in four times as many unintentional overdose deaths as heroin.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

Unintentional overdose deaths were thrust into the public eye following the death of the singer Prince, in early 2016, who was found dead in his home at the age 57 having accidentally overdosed on Fentanyl, which is described as being between 50 and 100 times more potent than morphine.

In 2013 Eli Lilly and Pfizer entered into a $1.8 billion co-development deal for the fully humanized monoclonal antibody nerve growth factor (NGF) targeting tanezumab, which they believe will provide a safer and more effective treatment option for patient suffering with chronic pain. Prior to 2010 30 studies involving 11,079 participants had been completed, but in 2010 the FDA placed a partial hold on Tanezumab due to an increased incidence of osteonecrosis that lead to an increased need for joint replacements.

The partial hold was lifted in 2015 due to a review of nonclinical data and since then Pfizer and Eli Lilly have resumed the Phase III chronic pain program and plan to recruit 7000 participants over a range of indications. Dependent on positive results Tanezumab is expected to be approved in 2018, six years later than was initially forecast prior to the clinical hold being put in place.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

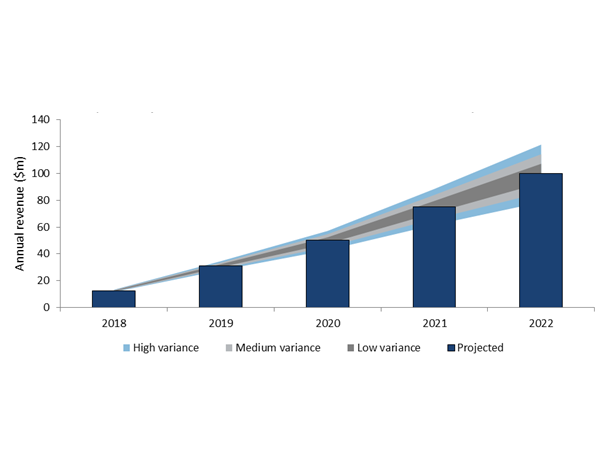

By GlobalDataIn 2013 the Anti-NGF drug class was estimated to be worth $11 billion, but safety concerns are likely to reduce this figure dramatically. Tanezumab is currently at Phase III for cancer pain, an indication which suffers from a relatively high level of unmet need, but despite this tanezumab is unlikely to generate considerably high revenue from the indication. In 2022 four years after its anticipated approval Eli Lilly will generate $100 million from the indication whilst Pfizer earn a much more modest $40 million.

The relatively low forecast revenue can be attributed to the large number of opioids available in new formulations and alternative application methods, the risk of severe adverse effects still remains for opioids but so will the uncertainty surrounding tanezumabs safety profile.