The past decade has witnessed a growing acceptance of precision therapies, also termed as genomic medicine or personalised medicine, because of the promise it holds in targeting specific genetic abnormalities to provide customised treatment solutions to patients (1). According to Precedence Research, the global personalised medicine market was valued at $548.72 billion in 2022 and is expected to reach over $988.72bn by 2030, poised to grow at a notable CAGR of 7.6% from 2023 to 2030 (2).

These precision therapies include:

- mRNA-based therapies

- Viral vector-based gene therapies

- Gene-modified cell therapies

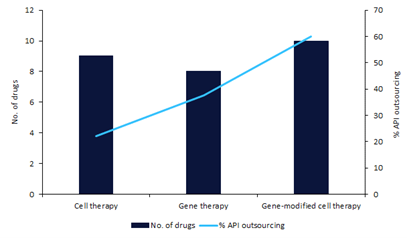

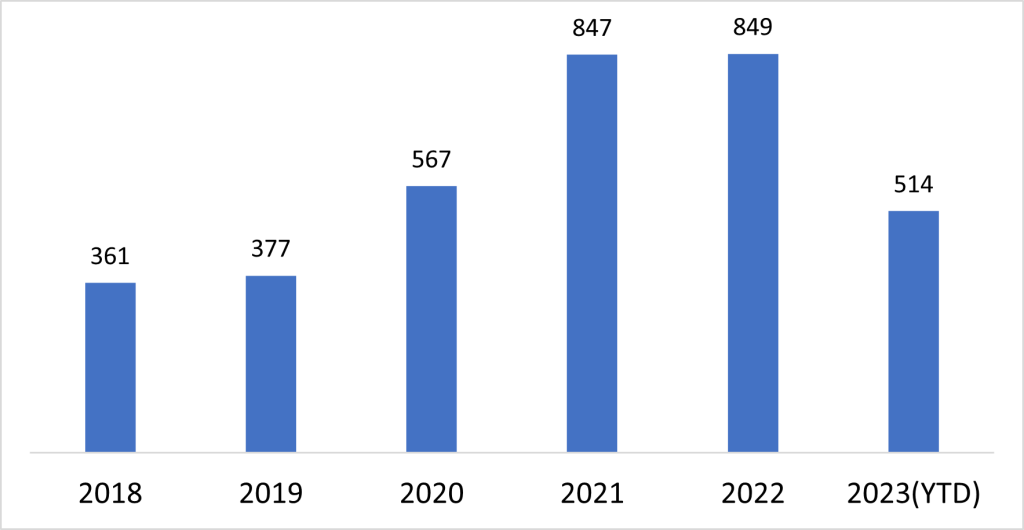

What is common across these therapies is the raw material required to manufacture them—plasmid DNA (pDNA). With rising demand for pDNA, contract development and manufacturing organisation (CDMOs) with large manufacturing capacities, expertise, and flexibility are being seen by biotechs as a viable option for manufacturing this key API (Figure 1).

Four major developments of the last decade are fueling the demand for pDNA.

1. mRNA-based therapeutics are coming of age

The unprecedented scale of the COVID-19 pandemic propelled the development and approval of mRNA vaccines. Within a year of the pandemic, two mRNA vaccines for SAR Cov2 were approved in 2020(3) — first by BioNTech SE in partnership with Pfizer and second by Moderna in partnership with NIAID’s VRC. The speed and flexibility provided by mRNA vaccines are now being leveraged in many other infectious diseases and therapeutics areas, such as cancer, genetic disorders, and metabolic disorders(4).

2. Viral vectors are taking center stage in gene therapy.

Engineered viruses have become crucial vectors in gene therapy, with adenovirus (Ad), adeno-associated virus (AAV), and lentiviruses (LV) demonstrating efficacy in safe and efficient gene delivery. Their precise mechanisms make them essential tools, driving advancements in targeted genetic medicine.

The development of adeno-associated virus (AAV) as a leading vector for gene therapies marks a significant milestone in the field of genetic medicine. Among the various viral vectors employed in cell and gene therapies, AAV has emerged as a prominent choice due to its safety and efficient gene-delivery capabilities. Recent advancements in the use of AAV-based vectors, including three approvals, 100+ ongoing clinical trials and increased patent filings, highlights its prominence in the gene therapy landscape.

The unique attributes of AAV, along with its small size and nonpathogenic nature, make it an attractive gene shuttle for pharmaceutical companies seeking to expand their therapeutic portfolios. The process of developing AAV vectors involves cloning AAV genes and vector genomes into plasmids and facilitating genetic manipulation for specific therapeutic purposes.

3. CRISPR-based gene editing is driving next-generation gene-edited-cell therapies

The discovery of clustered, regularly interspaced short palindromic repeats (CRISPR) and the CRISP-associated (Cas) proteins has revolutionised the genetic research field and redefined approaches to gene therapy (5).

CRISPR was first discovered in the sequences of DNA from E.coli and described in 1987 by Ishino et al. from Osaka University (6). Continued research and interest in cell and gene therapy, finally led to FDA approval for the first gene therapies for sickle cell disease in December 2023(7). The approvals are for Vertex Pharmaceuticals and its partner CRISPR therapeutics Casgevy (exa-cel). Casgevy uses CRISPR-based genome editing to ‘knock out’ the regulator that stops blood stem cells from making fetal hemoglobin (HbF). The edited cells are then engrafted into the patient’s bone marrow.

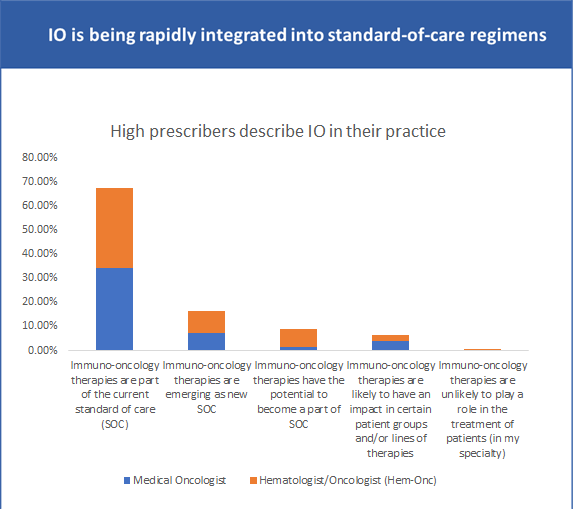

4. Growing interest in Immuno-oncology (IO) therapies

According to a GlobalData survey in May 2023, physician respondents treating cancer patients said they used immuno-oncology therapies in a majority of the cases (8). This demand for IO therapies is another factor driving the need for high-quality pDNA.

Challenges in pDNA manufacturing for precision therapies

The challenge with gene therapies is that many are designed for a small number of patients. This makes it impractical for individual companies to invest in large-scale, capital-intensive manufacturing equipment. CDMOs, who cater to the requirements of multiple companies and develop platform processes to achieve the much-needed economy of scale, are being seen as a possible solution.

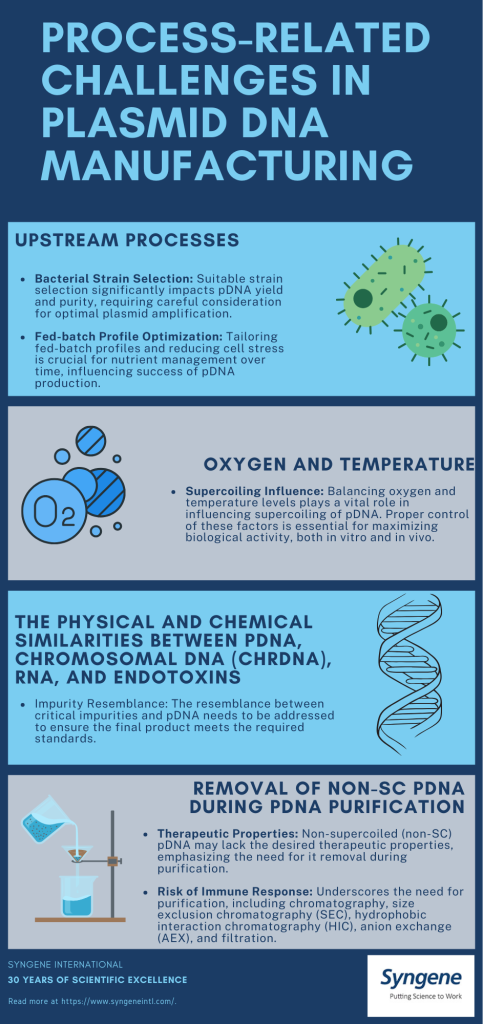

The yield and purity of the production processes depend on various factors, including the choice of bacterial strain and the feeding strategy used.

Challenges in custom manufacturing approach to pDNA

There has been a broad shift in the pharmaceutical and biotech industry towards more sustainable and ethical practices, such as using non-animal products for manufacturing. CDMOs play a crucial role in accommodating these requirements and developing manufacturing approaches that align with client needs.

Further, many aspects of the purification process, including cost, yield, purity, grade, and speed, must be evaluated and often tailored to a customer’s specific needs. This level of customisation is essential to meet the unique demands of precision therapies, which often target rare diseases or specific genetic mutations.

Prioritizing quality pDNA in Precision therapies

Regulatory agencies, such as the Food and Drug Administration (FDA) in the US and the European Medicines Agency (EMA), have set stringent criteria for manufacturing APIs for cell and gene and precision therapies. These criteria are intricately linked to the intended application of pDNA, whether it serves as an active pharmaceutical ingredient (API), as in the case of DNA vaccines, or functions as an intermediary raw material – i.e., in the production of viral vectors or mRNA.

As a result of these criteria, manufacturers need to adopt a risk-based approach to ensure the entire process adheres to the appropriate grade and phase requirements. This approach encompasses meticulous documentation, comprehensive validation, and rigorous traceability measures. The emphasis on quality extends beyond the pDNA employed in the manufacturing process; it includes the influence on the quality of the ensuing viral vectors or mRNA, which constitute indispensable components within the domain of gene therapies.

Why Syngene for pDNA manufacturing

Global CDMO Syngene offers the complete cGMP mRNA manufacturing process from producing high-quality plasmids and in vitro transcription (IVT) mRNA process to lipid nanoparticle (LNP) formulation and Fill/Finish.

They offer expertise in scaling processes to cGMP levels, employing robust analytical methods, and developing highly efficient manufacturing processes.

Role of CDMOs in pDNA manufacturing

pDNA plays a pivotal role in precision therapies. Its versatile nature as a carrier of therapeutic genes is empowering researchers and clinicians to target specific genetic anomalies — paving the way for personalised treatment approaches.

By partnering with CDMOs, biotechs can overcome pDNA manufacturing challenges including those posed by small patient populations, and the exacting standards of regulatory agencies to bring innovative precision therapies to market with speed.

To learn more about Syngene’s cGMP mRNA manufacturing process, download the free case study here.

- I. Maragkou, 1st December 2023, The future of cell and gene therapy manufacturing, https://www.pharmaceutical-technology.com/features/the-future-of-cell-and-gene-therapy-manufacturing/

- October 2023, Cell Therapy Market Report, Precedence Research, https://www.precedenceresearch.com/cell-therapy-market

- Pfizer, 9th November 2020, Pfizer and BioNTech Announce Vaccine Candidate Against COVID-19 Achieved Success in First Interim Analysis from Phase 3 Study, https://www.pfizer.com/news/press-release/press-release-detail/pfizer-and-biontech-announce-vaccine-candidate-against

- Qin, S. et al. (2022) ‘MRNA-based therapeutics: Powerful and versatile tools to combat diseases’, Signal Transduction and Targeted Therapy, 7(1). doi:10.1038/s41392-022-01007-w.

- F. Uddin, C. M. Rudin, T. Sen, 7th August 2020, CRISPR Gene Therapy: Applications, Limitations, and Implications for the Future, National Library of Medicine, National Centre for Biotechnology Information https://www.ncbi.nlm.nih.gov/pmc/articles/PMC7427626/

- I. Gostimskaya, 15th August 2022, CRISPR-Cas9: A History of Its Discovery and Ethical Considerations of Its Use in Genome Editing, National Library of Medicine, National Centre for Biotechnology Information https://www.ncbi.nlm.nih.gov/pmc/articles/PMC9377665/#:~:text=CRISPR%20%E2%80%93%20clustered%20regularly%20interspaced%20short,1987%20by%20Ishino%20et%20al

- R. Barrie, 11th December 2023, First gene therapies for sickle cell disease secure FDA approval, Pharmaceutical Technology https://www.pharmaceutical-technology.com/news/first-gene-therapies-for-sickle-cell-disease-secure-fda-approval/

- GlobalData, 12th May 2023, Immuno-Oncology (IO) – Thematic Research, https://www.globaldata.com/store/report/immuno-oncology-theme-analysis/