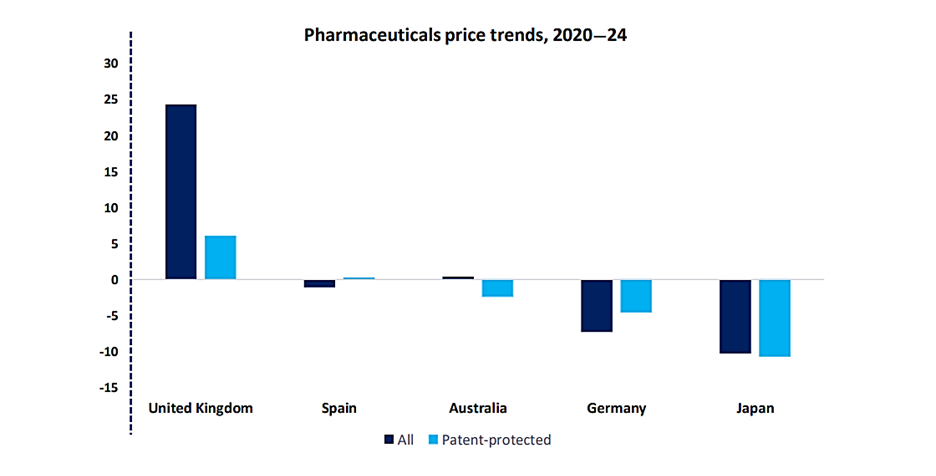

A recent survey for GlobalData’s “State of the Biopharmaceutical Industry 2025” report, conducted at the end of 2024, found drug pricing and reimbursement constraints represent the biggest concern for pharmaceutical industry decision makers over the coming year. Over a quarter cited it as a negative trend afflicting the sector. It beat geopolitical conflict, ongoing political uncertainty in the USA and inflationary pressures to make first place. On average, drug prices have risen in a mere handful of markets over the past five years. Increases tend to be driven by innovative products, such as cell and gene therapies (CGTs), and the higher share of biologics among new product launches. Most major markets use direct price controls for drugs, keeping drug prices below general inflation. However, this means manufacturers are forced to cut costs to maintain margins, for example through offshoring roles to lower-cost countries and dialing down R&D investment.

Andrew Green is Executive Principal in the Insights, Evidence and Value consultancy arm of clinical research organization ICON. He describes pricing pressures as a “constant theme” in the industry. “There’s downward pressure on price for pharmaceutical products for a number of different reasons,” he says. “Some of these are socioeconomic, like the ageing population meaning there’s a bigger group of people needing to be treated by reimbursed medicines. There’s healthcare reform in various markets, with some countries, for example China, evolving their healthcare systems and looking to reimburse more medicines, widening the group of patients that become eligible for them… And there’s always going to be pressure on healthcare budgets, which means that companies have to show much more explicitly the value of their medicine to decision makers.” These are complex dynamics, with no two markets reimbursing medicines in exactly the same way. Pharmaceutical companies need to be aware of the major challenges ahead for reimbursement to adopt flexible strategies that can address them.

Major challenges – and their consequences

What are the major frontiers in the battle to remain competitive amid growing pricing pressures?One, alluded to above, relates to government pricing policies. In the US, for example, 2022’s Inflation Reduction Act empowered regulators to negotiate prices for high expenditure, single source drugs without generic or biosimilar competition, and imposed rebates on price hikes above inflation.[1] And in May 2025, President Donald Trump signed an executive order directing drugmakers to lower the prices of their medicines to align with what other countries pay.[2] The order, which gives manufacturers under a month to hit the new price targets, threatens further action if companies do not make “significant progress” within stated timelines. These moves aim to make drugs more affordable – but the fallout for pharma revenues could be stark once they come into force. In Europe, too, price controls are tightening. The UK dramatically raised the revenue rebates drug companies must pay on NHS sales; they will rise to 24% in 2025 from 21.9% in 2024.[3] In the EU, negotiations continue over proposals that could slash market exclusivity for new drugs and introduce penalties for firms that fail to roll out novel therapies across the bloc.[4] Such reforms reflect intensifying political pressure to rein in drug prices – and an uncertain landscape ahead for manufacturers.

Payers and health technology assessment bodies are also exercising greater scrutiny over therapies’ value for money. If these agencies identify an unfavorable cost-benefit ratio in a drug’s price, reimbursement may be denied or only granted after deep discounts – placing more pressure on manufacturers to cut prices. Even after approval, payers may deploy tools like formulary exclusions and step therapy to steer patients toward lower-cost alternatives. And these challenges are exacerbated by widespread use of international reference pricing – the practice of governments capping drug prices by referencing what other countries pay. Almost all European countries employ external reference pricing, creating a web of interlinked price ceilings. It means manufacturers face global downward price pressure and are forced to adopt defensive launch strategies. One recent study of EU countries found that reference pricing was responsible for about half of all launch delays in a basket of lower-income European markets, as firms waited to introduce products until a favorable pricing environment was secured.

Pricing pressures are especially acute for generic drug manufacturers, with generics driven down substantially in many markets over recent years. In the US, for example, consolidation among buyers has granted them massive leverage to demand steep discounts. Data show US generic manufacturers’ margins declined steadily in the late 2010s, with further subsequent tightening. The story is similar in Europe: many countries use regulation to set generic reimbursement prices at very low levels. Over time, inflation has outpaced price updates, eating into manufacturer profits. Low prices benefit payers in the short run, but long-term challenges are fomenting around the viability of supplying affordable drugs under such conditions; recent years have already seen shortages following drug discontinuations caused by low profitability, a trend that will only ramp up if prices continue to fall.[5]

This cocktail of problems has brewed up major tension between affordability and future innovation in the industry. Price and reimbursement pressures today are impairing firms’ ability to invest in tomorrow’s cures. Zooming in on the data can shed some light on the implications of these challenges for pharmaceutical firms.

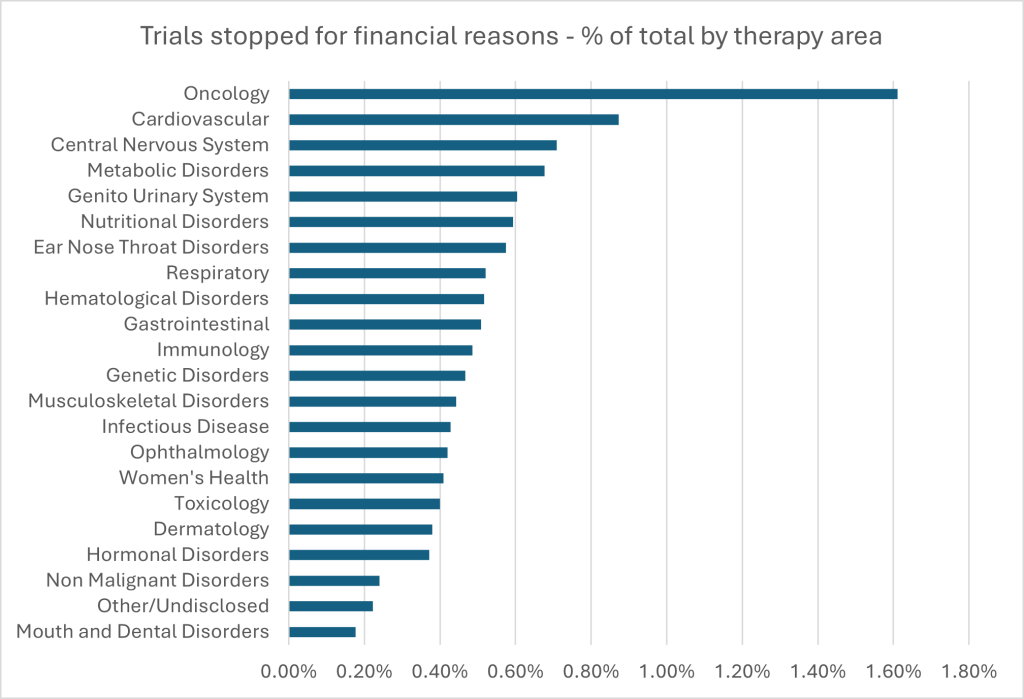

GlobalData’s clinical trials database contains data on drug trials that have been withdrawn, suspended or delayed for financial reasons. With over 1,700 trials (still a relatively small percentage – 1.6%) halted out of more than 108,000, oncology accounts for the largest absolute and relative contribution to financial discontinuations. Interestingly, some smaller therapy areas such as nutritional disorders, ear nose and throat disorders, and genetic disorders also show moderate rates of financial discontinuation, despite their lower overall trial volumes. This may indicate limited commercial incentives or less robust funding support. In contrast, areas such as mouth and dental disorders and non-malignant disorders exhibit the lowest percentages of trials stopped for financial reasons. These differences do not appear to correlate directly with the total number of trials in each area. Pressures around drug pricing and the likelihood of reimbursement (or lack thereof) undoubtedly contributes to financial risk, particularly in high-cost or niche therapies, where future market access is increasingly uncertain due to lack of improvement in clinical outcomes from current standards of care.

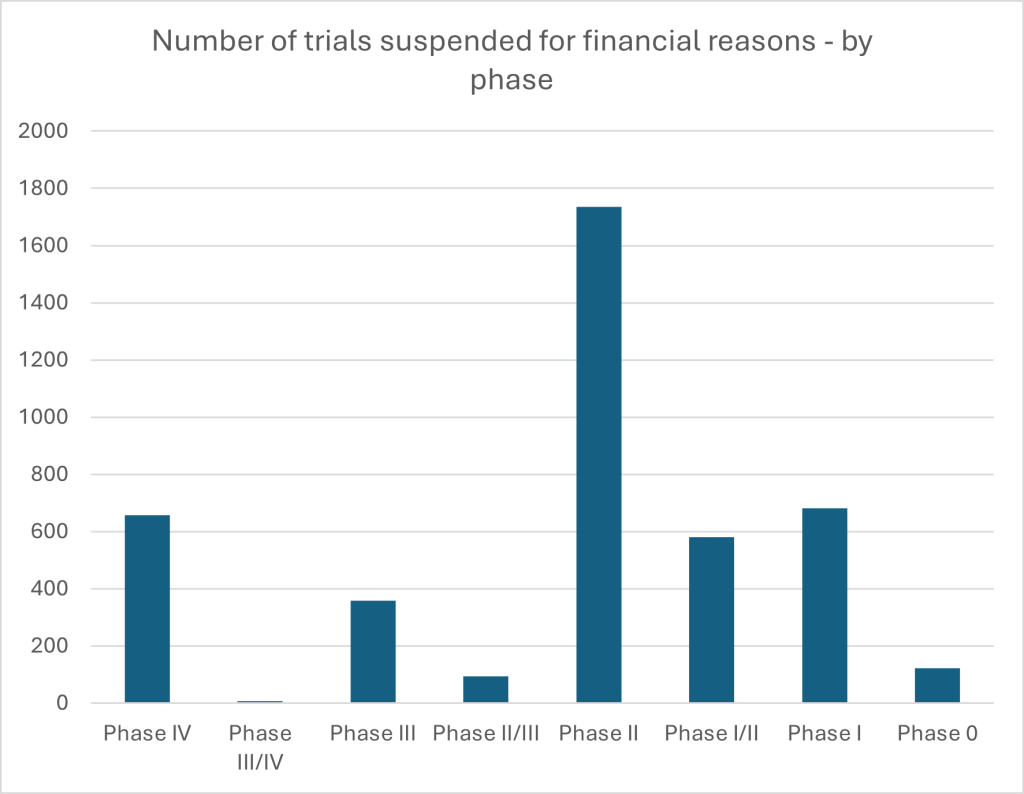

Figure 3: Drug trials withdrawn, suspended or delayed for financial reasons by phase. Source: GlobalData.

This picture is sharpened when turning to data on financial discontinuations by trial phase. Phase II sees the highest volume of pauses, with 1,735 trials affected. This may reflect its particularly resource-intensive and uncertain nature, where early efficacy signals are being tested but substantial investment is still required before reaching more commercially promising phases. But the notable number of discontinuations in Phase IV – which occurs post-marketing – suggests that, even after a drug reaches approval, financial viability remains a prohibitive concern. It is a finding aligned with broader concerns in the industry that a combination of escalating development costs and growing uncertainty around future drug pricing and reimbursement are colliding with firm capacity to innovate effectively. Particularly in high-cost therapeutic areas or crowded markets, the risk that a product will not be adequately reimbursed, even if it achieves regulatory approval, may be prompting sponsors to halt development altogether.

The long-term outlook – and how to respond

How should pharmaceutical firms respond to the new and seemingly growing hurdles they face? With budgets tightening across healthcare systems and payers demanding more value for money, strategic thinking is an imperative. With the vast majority of pharmaceutical revenues generated from a handful of markets – the US, the EU-4,f the UK, China and Japan – servicing the remainder yields enormous operational burdens with comparatively modest returns. Rather than dilute their resources across dozens of small and administratively challenging territories, successful companies are now concentrating on the few that matter most, building reimbursement plans and pricing negotiations around revenue-dense regions. Smaller and mid-sized companies, according to Andrew Green, remain in an “aspirational” mindset; they need to learn from the ruthless pragmatism of their larger counterparts when seeking markets for new drugs.

If market selection is one dimension in the battle for sustainable revenue, data is another. Payers are increasingly relying on real-world data to assess both the effectiveness and value of treatments. The near future may see them demanding access to companies’ raw clinical data to run their own models, powered by AI, before reimbursement is granted. The implications are clear: pharma firms must anticipate greater scrutiny and be prepared to demonstrate value at an increasingly granular level. “Payers could start using AI to retrospectively interrogate real-world data and say: ‘Actually, this drug only works well in a subset of the population’,” suggests Andrew Green. “That could shrink a large proportion of your reimbursed population.” The consequences could be profound. Reimbursement criteria may narrow retrospectively, slicing entire segments of the treated population out of coverage. Pricing too may be re-negotiated in light of new insights – further wresting bargaining power from manufacturers.

To meet this evolving reality, manufacturers must embed commercial thinking earlier in the development process. Divisions between research teams and their commercial counterparts still pervade the pharmaceutical world. As Andrew Green says: “You need to start with the end in mind. If you’re spending tens of millions on a clinical trial, you’d better be sure you’re generating the evidence that payers will want to see in ten years’ time.” Clinical trials are designed to meet regulatory approval – but it’s commercially critical that they generate the evidence required to justify a sustainable price.

This is where partners like ICON – a global provider of clinical and commercial strategy support – are stepping in. ICON works with firms from early-phase development onwards, helping them define the opportunity landscape for their assets, scenario-plan for future pricing environments and design clinical trials that will resonate with both regulators and payers. They have a track record of going beyond merely surmounting regulatory hurdles, helping their partners secure sustainable reimbursement in a shifting marketplace. That means identifying competitive threats, anticipating changes in exclusivity, and preparing the kind of value demonstration that will matter ten years from now.

A modest investment in market access strategy during early development can unlock far greater returns when a drug is finally ready to be marketed, cracking down on post-development delays that have become all too common. As the industry confronts increasing pressure to deliver value, those that succeed will be the ones who can adapt – and ICON can help them do it. Watch the webinar to learn more.

[1] https://www.whitecase.com/insight-alert/where-things-stand-drug-pricing-halfway-point-2023

[2] https://www.reuters.com/business/healthcare-pharmaceuticals/trump-says-he-will-cut-drug-prices-by-59-2025-05-12/

[3] https://www.fiercepharma.com/pharma/pharma-group-blasts-uks-statutory-drug-rebate-scheme-days-after-lauding-landmark-deal

[4] https://www.reuters.com/business/healthcare-pharmaceuticals/eu-proposal-may-accelerate-pharma-innovation-decline-industry-group-says-2023-11-06

[5] https://kpmg.com/kpmg-us/content/dam/kpmg/pdf/2023/generics-2030.pdf