Contract packaging company PCI Pharma Services (Philadelphia, PA, US) has begun its official bidding process for a sale valued at $2.5B. The buyer can expect to own one of the top packaging service providers that have a global presence and is well equipped to handle lucrative deals for specialised clinical packaging and high-containment oncology drugs. The company already has more than 100 contract service agreements for innovator therapies including blockbusters sold by AbbVie Inc. (North Chicago, Il, US) and Gilead Sciences (Foster City, CA, US).

PCI Pharma Services is owned by private equity Partners Group AG (Philadelphia, PA, US), which has been exploring a sale since February. PCI was last sold by Frazier Healthcare Partners (Seattle, WA, US) in 2016 for over $1B. Since then, PCI Pharma Services has acquired further manufacturing facilities in North American, EU, and Asia-Pacific markets, and has expanded its clinical packaging business through acquisitions of Sherpa Clinical Packaging (San Diego, CA, US), Pharmaceutical Packaging Professionals (Melbourne, Australia), Millmount Healthcare (Stamullen, Ireland), and Bellwyck Pharma Services (Toronto, Canada). Although the company lacks a presence in emerging markets such as India and China, which have strong growth potential, the company’s valuation has improved markedly over the last four years and Partners Group AG can resell it for a significant profit if an interested party can be found.

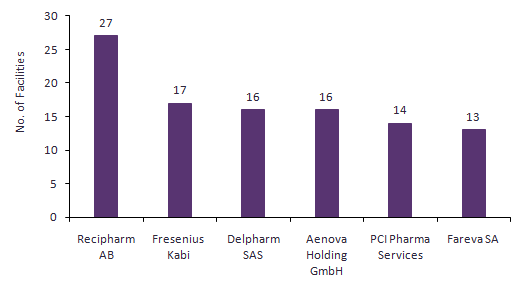

PCI is in the top five dedicated CMOs by number of commercial packaging facilities (Figure 1). A much larger proportion of PCI’s facilities are packaging-related than at comparable companies such as Recipharm AB (Stockholm, Sweden) and Delpharm SAS (Boulogne-Billancourt, France), which are stronger in commercial dose manufacture and integrate their packaging with their dose contracts rather than offering stand-alone packaging like PCI. In terms of contract packaging specialists, PCI’s closest competitor is Sharp Packaging Services (Allentown, PA, US), which has eight commercial packaging facilities and fewer clinical packaging facilities than PCI Pharma Services. Another comparable packager, Constantia Flexibles Group GmbH (Vienna, Austria), was acquired by Wendel SA (Paris, France) from One Equity Partners (New York, NY, US) and the H. Turnauer Foundation for $2.82B in March 2015, so it should be feasible to find a buyer for PCI at $2.5B.

PCI’s 14 commercial packaging facilities are located in the US, UK, Canada, Germany, Ireland, and Australia. These facilities serve the US, EU, and Asia-Pacific markets. A high number of clinical packaging and containment facilities add to the value of the company’s service offering. Clinical packages are typically customised for specific clinical trials and only a small number of batches are produced to meet the need of the clinical trial. Clinical packaging requires specialised capabilities that commercial packagers do not typically possess. PCI does not provide packaging for inhalational products or tissue and cell therapies, although these specialities represent a minority of currently marketed products.

High-containment facilities are required to manufacture products for which inadvertent or sustained exposure is very dangerous, such as cytotoxic drugs used in the treatment of oncology. Current trends imply that there will be strong demand for high-potency and cytotoxic drugs in the future. The GlobalData PharmSource Bio/Pharma CapEx Trends – 2019 Edition report shows a high level of interest from pharma companies and CMOs in constructing or upgrading facilities with high-containment facilities.

Figure 2: PCI Pharma Services’ Total Facility Capabilities.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData

Source: GlobalData, Pharma Intelligence Center Contract Service Provider Database (Accessed: 22 July 2020)

Notes: Counts include subsidiary facilities of Bellwyck Packaging Solutions Inc and Pharmaceutical Packaging Professionals Pty Ltd.

Figure 3 highlights the CMO’s predominant involvement in packaging activity. The vast majority of US and EU drugs outsourced to PCI Pharma Services are for packaging rather than dose manufacture. PCI Pharma Services packages several blockbuster drugs such as AbbVie Inc.’s Imbruvica (ibrutinib), as well as Gilead Sciences’ Biktarvy (bictegravir sodium + emtricitabine + tenofovir alafenamide) and Gendevra (cobicistat + elvitegravir + emtricitabine + tenofovir alafenamide fumarate). If PCI is acquired by another private equity firm, the new owner will seek to further enhance its capabilities and value, such as adding inhalational or tissue and cell therapies packaging capabilities, particularly as there is a high level of industry interest in the latter. However, PCI already has a large portfolio of manufacturing and packaging contracts, and whether those clients will benefit or suffer from the sale will depend on how the company develops under new management.

Figure 3: PCI Pharma Services’ Involvement with US and EU Innovator Drugs.

Source: GlobalData, Pharma Intelligence Center Contract Service Provider Database (Accessed: 22 July 2020)

Notes: Counts include subsidiary facilities of Bellwyck Packaging Solutions Inc and Pharmaceutical Packaging Professionals Pty Ltd.