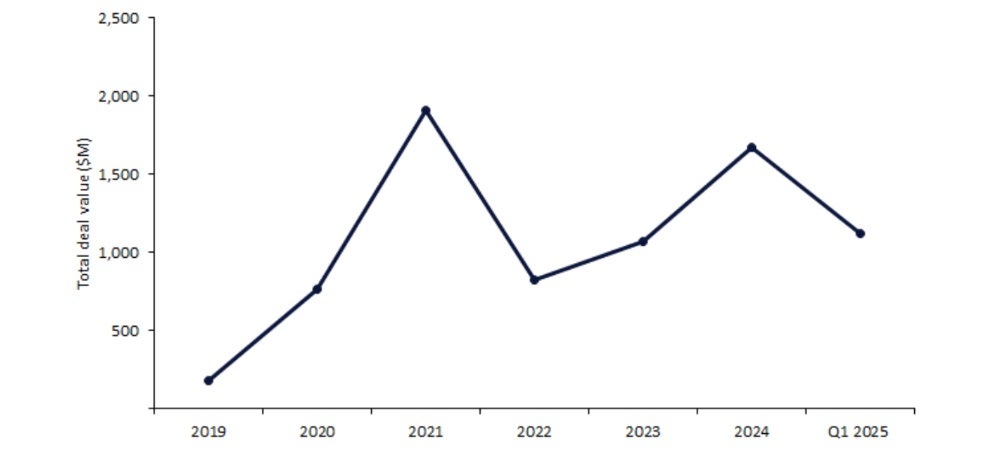

UK biopharmaceutical companies saw a surge in venture financing for innovator drugs in 2024, with double the total deal value from 2022: $827m in 2022 to $1.7bn in 2024. This growth trend appears set to continue, with the total deal value in the first quarter (Q1) of 2025 already reaching a total of $1.1bn – a two-fold increase from $542m raised in Q4 2024, according to leading data and analytics company GlobalData’s Pharma Intelligence Center Deals Database.

Global biopharmaceutical venture financing reported downturns in 2022 and 2023, but the UK demonstrated resilience with sustained year-over-year (YoY) growth, signalling investor confidence in the UK as a hub of scientific excellence. In 2021, British Patient Capital launched the Life Sciences Investment Programme, a £200m ($269m) initiative that aimed to attract at least £400m in additional venture financing for UK-based life sciences companies. In May 2025, the UK government announced an initiative to boost domestic funding, known as the Mansion House Accord, under which leading pension providers committed to investing 5% of their funds in private UK-based companies, including those in the biotech industry. The Mansion House Accord is anticipated to unlock $25bn of investment for UK businesses by 2030.

The venture financing raised in Q1 2025 involving innovator drugs was largely driven by two ‘mega-rounds’ – Isomorphic Labs with $600m and $411m with Verdiva Bio, highlighting an increase in investor selectivity, concentrating available capital into a smaller number of companies with high commercial potential.

Furthermore, US investors were involved in almost the totality of the $1.1bn of the total venture financing deal value raised in Q1 2025 by UK biopharmaceutical companies, compared to UK investors’ involvement of only $112.7m. The UK BioIndustry Association raised concerns that a dependency on US capital could prompt companies to relocate to the US and limit the reinvestment of returns into the UK biopharmaceutical sector, weakening its long-term growth.

The UK biopharmaceutical industry continues to attract investor interest. However, investor appetite may be impacted following the UK government’s decision, announced in March 2025, to increase the Statutory Scheme payment rate for branded medicines from 15.5% to 32.2% for the second half of 2025, with those under the 2024-28 Voluntary Scheme for Branded Medicines Pricing, Access and Growth increased to 22.9% for 2025. An anticipated increase in costs associated with these drug pricing policy changes could deter companies from developing drugs in the UK, which may slow UK-based innovation and reduce patient access to medicines. Sustained growth in venture financing and boosting domestic investment will be critical for translating UK-based innovation into commercial success.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData