The Trump administration’s Centers for Medicare and Medicaid Services (CMS) have announced the final prices for the second round of 15 drugs negotiated under the US Inflation Reduction Act (IRA).

The drugs for the second round of Medicare Part D negotiations were announced at the beginning of 2025 – notably including Novo Nordisk’s high-demand weight loss drugs Wegovy/Ozempic/Rybelsus (semaglutide). According to the CMS, the selected drugs accounted for $42.5 billion in total Medicare expenditure, or around 15% of the total Part D gross covered prescription drug costs in 2024. In the same period, out-of-pocket (OOP) costs for these drugs totalled $1.7 billion.

The Trump administration has called the second round of negotiations a success. CMS administrator Mehmet Oz had stated that the second round of negotiations resulted in significantly better outcomes in Medicare Part D programme than before. Deputy Administrator for CMS, Chris Klomp, explained that the success in the second round of negotiations was due to the Trump administration’s threat of leaving negotiations if a deal was not reached. Without an agreement under the IRA, participating pharma manufacturers would either face a high financial penalty or withdraw their drugs from the Medicare and Medicaid programmes.

Negotiations range up to 85% price reductions

The published price reductions for the 15 drugs range from 38% to 85% of their list prices. The negotiated prices may also be applied differently across dosage forms and strengths. The largest price cut after negotiations was Merck & Co’s Janumet/Janumet XR (metformin + sitagliptin) at 85%. The next highest price reductions were for Boehringer Ingelheim’s Tradjenta (linagliptin) and GSK’s Breo Ellipta (fluticasone + vilanterol), at 84% and 83% respectively. On the opposite end, the smallest price cut was for Teva’s Austedo/Austedo XR (deutetrabenazine) at 38%. The new prices will come into effect on 1 January 2027. CMS calculates that if negotiated prices were in effect during 2024, the savings achieved would have resulted in $12 billion and 44% lower net spending. When the negotiated prices go into effect in January 2027, CMS is expecting $685 million in OOP savings for Medicare beneficiaries.

While the Trump administration has been celebrating the success of the IRA negotiations, criticism from the pharma industry continues to mount. The pharma industry has continually called the IRA “price setting” and has argued that the price negotiations have not resulted in lower OOP costs for patients. A Pharma industry group, Pharmaceutical Research and Manufacturers of America (PhRMA), has emphasised the possibility of the price negotiations having negative long-term impacts on research and development. In addition, multiple lawsuits launched by the pharma industry are still ongoing in attempts to repeal the IRA, though with little success.

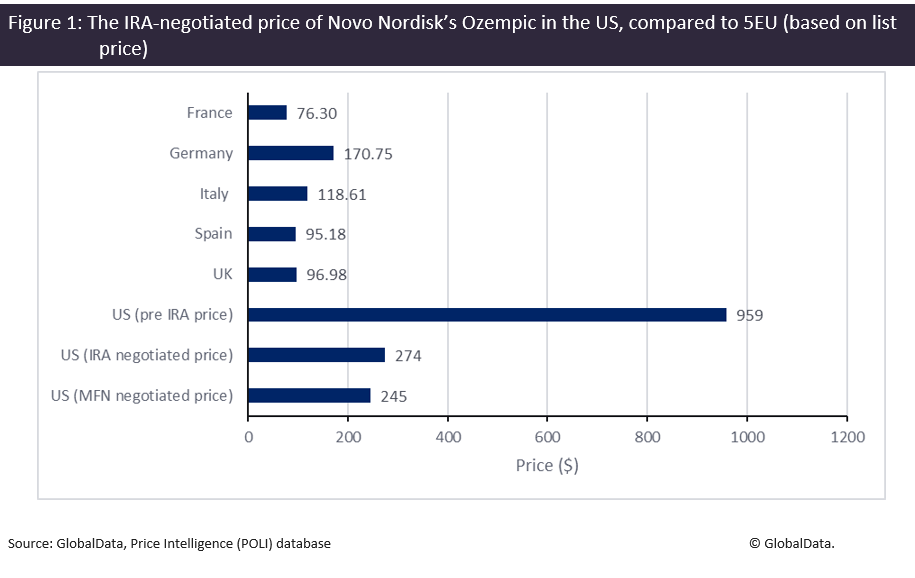

Using GlobalData’s Price Intelligence (POLI) database, the negotiated price of Novo’s Ozempic in the US was compared to the five major European markets (5EU – France, Germany, Italy, Spain and the UK), as seen in Figure 1.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData

Clash of price between IRA and MFN

Much like the first round of IRA price negotiations, there is still uncertainty on how much impact the IRA negotiated prices will have on Medicare, given the drugs are already subject to confidential rebates and discounts negotiated by providers of Medicare Part D health plans. In addition, questions have been raised on how the Trump administration’s Most Favored Nation (MFN) executive order for Novo’s GLP-1 therapies, and future drugs negotiated under MFN, will impact the IRA negotiated price. In early November 2025, Novoformed an MFN agreement with the Trump administration for its weight loss therapies, offering Wegovy to Medicare for $245 per month from 2026. This price is lower than the $274 negotiated for Ozempic/Wegovy/Rybelsus under the IRA. Since the release of the IRA negotiated prices, CMS had explained that the MFN prices would supersede the negotiated prices under the IRA. This signals that any future MFN deals made with other pharma companies will supersede future rounds of IRA price negotiations. By 1 February 2026, another 15 drugs will have been announced for the next round of IRA Medicare price negotiations.

This article is produced as part of GlobalData’s Price Intelligence (POLI) service, the world’s leading resource for global pharmaceutical pricing, HTA and market access intelligence integrated with the broader epidemiology, disease, clinical trials and manufacturing expertise of GlobalData’s Pharmaceutical Intelligence Center. Our unparalleled team of in-house experts monitors P&R policy developments, outcomes and data analytics around the world every day to give our clients the edge by providing critical early warning signals and insights. For a demo or further information, please contact us here.