Every January, US medicine list prices are updated—i.e., the wholesale acquisition cost (WAC) and average wholesale price (AWP). Historically, these annual updates have brought widespread price increases, especially among major brands.

This pattern continues to be seen in 2026. According to the GlobalData service Price Intelligence (POLI) & HTA, more than 800 originator molecules still posted price hikes to their WACs and AWPs. Consequently, prices of originator medicines (both on- and off-patent) increased in January 2026 by an average of 7%, well above the 2.79% consumer inflation rate reported by GlobalData for 2025.

Notable price increases include Sanofi (France) and Regeneron’s (US) Dupixent (dupilumab), which increased 10%, and AbbVie’s (US) Skyrizi (risankizumab), which increased 13%. One of the highest price increases was from Sprout Pharmaceuticals (US) for its medicine Addyi (flibanserin), which increased by 110.6%.

A new paradigm shift and signal in the US: sharp list price cuts for selected brands

Drug pricing has been under intense scrutiny in the US for a couple of years. In August 2022, President Biden signed the Inflation Reduction Act (IRA), which granted Medicare the authority to reduce drug costs through negotiated pricing.

Separately, President Trump has also pursued multiple initiatives aimed at lowering drug prices through the application of international reference pricing (IRP), the Most Favored Nation (MFN) Policy, and a direct-to-consumer pricing mechanism.

Under this context, medicine prices are facing increasing pricing pressure—and early 2026 is one of the first notable periods where the list price has appeared to decline for originator medicines.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataData from GlobalData’s Drug Pricing (POLI) & HTA dataset shows that, in January, list prices fell for 50 originator molecules across 56 brands, with an average reduction of 42%—a substantial shift from the typical annual January trend.

The majority of these price cuts are seen for off-patent originator medicines. For instance, Boehringer Ingelheim (Germany) dropped the prices of Atrovent and Spiriva by around 35%.

The role of Medicare’s Maximum Fair Price (MFP)

Under the IRA, negotiated Maximum Fair Prices for Medicare Part D drugs are being implemented on a phased timeline:

- Ten drugs with MFP pricing effective in January 2026

- 15 additional drugs will follow in January 2027

- Another 15 are scheduled for 2028

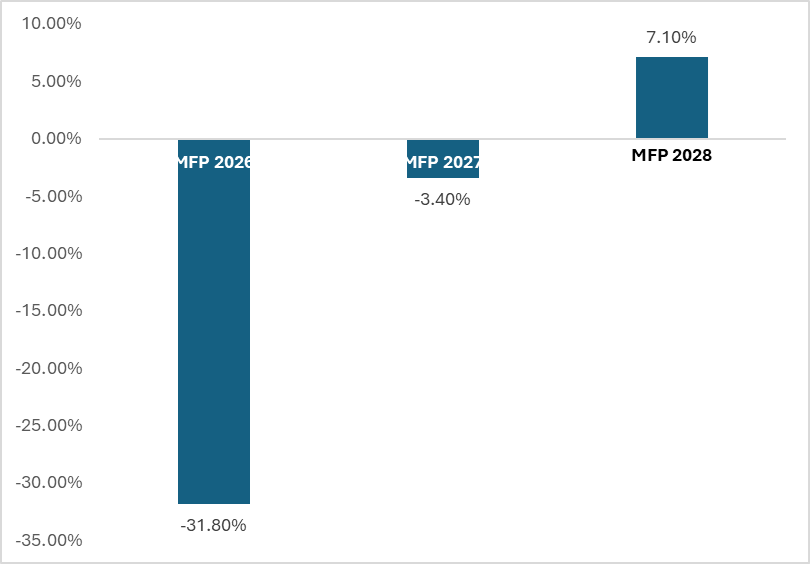

Below is a summary of the average list price changes (WAC price) for medicines with an MFP that has been negotiated for 2026, 2027, and 2028.

Figure 1: Average WAC price change (January 2026) grouped by products and when the MFP price comes into effect.

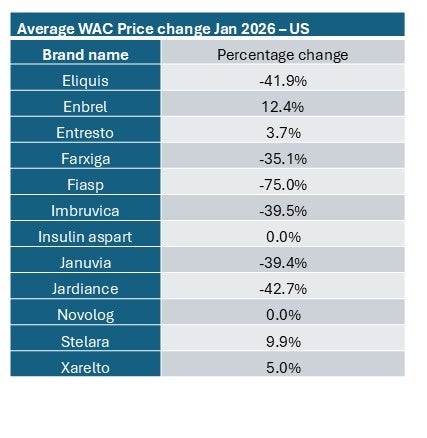

Furthermore, eight of the brands included in the list of medicines for which the MFPs have been negotiated by the Centers for Medicare & Medicaid Services (CMS) experienced large price drops in their list (WAC) price. As seen in the table below, price cuts impacted mostly the medicines for which MFP prices came into force in January.

Six out of the ten medicines for which an MFP was negotiated in 2026 experienced a price drop at the list price level. For instance, Fiasp (Novo Nordisk, Denmark) experienced a 75% price drop to its WAC price this January. The full list is available in the table below.

Table 1: Average WAC price change for MFP selected products

- Two out of the 15 medicines selected for 2027 lowered their list prices in January: Janumet (metformin, sitagliptin) and Linzess (linaclotide), by 40% and 48%, respectively. Based on current trends for 2026, list prices are likely to decline further once the 2027 prices take effect.

Companies agreeing to negotiate prices under MFN have not seen WAC price declines

The Trump administration reached MFN agreements with 16 pharmaceutical companies. Despite these negotiations, all 16 companies increased the list prices of some of their products. These companies include: Pfizer, Amgen, Bristol Myers Squibb (BMS), Boehringer Ingelheim, Genentech, Gilead Sciences, GlaxoSmithKline (GSK), Merck & Co. (MSD), Novartis, Sanofi, AstraZeneca, EMD Serono, Novo Nordisk, Eli Lilly, Johnson & Johnson (J&J), and AbbVie.

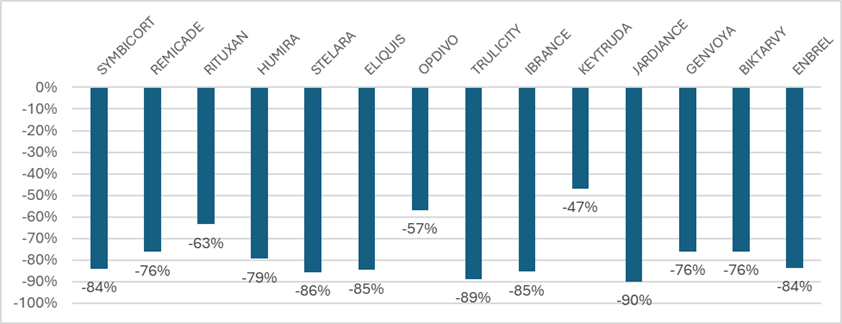

Although the negotiated prices reportedly differ significantly from the WAC prices (as shown in the figure below), two key points emerge:

- List prices (WAC) have not been reduced

- The negotiated prices primarily apply through a direct-to-consumer (DTC) model, meaning the main beneficiaries are typically uninsured US citizens who can access lower out-of-pocket prices.

Figure 2: Percentage difference in MFN price compared to December 2025 WAC price of the 14 popular Medicaid drugs

In addition to the MFN policy, the Trump administration is continuing to pursue lower costs for drugs covered under Medicare Parts B and D, as well as Medicaid. To that end, new programs based on IRP have been introduced: GENEROUS for Medicaid, GLOBE for Medicare Part B, and GUARD for Medicare Part D. Under these programs, CMS would purchase eligible medicines at reduced prices. To encourage manufacturers to negotiate MFN pricing, companies that agree to an MFN price would be exempt from the Medicare IRP models.

Historically, the US pharmaceutical market has largely operated under free pricing. While this remains broadly true today, it is clear this dynamic is changing. Multiple initiatives designed to reduce drug prices are already in place. Although their full impact has yet to be realised, early signals are emerging—most notably, list price cuts for drugs included under the IRA framework. In addition, the Trump administration reportedly negotiated MFN deals with 16 of the 17 companies it approached, suggesting a willingness among manufacturers to engage with government concerns.

At the same time, these policies have drawn criticism, with some stakeholders arguing that the new approaches lack transparency. The coming months will be pivotal, and GlobalData expects the impact on prices to become gradually more apparent.