Every two years, South Korea adjusts the national health insurance (NHI) prices for existing listed products based on the actual transaction price (ATP) mechanism. This cost-constraint strategy ensures that NHI-listed prices align with the actual market prices.

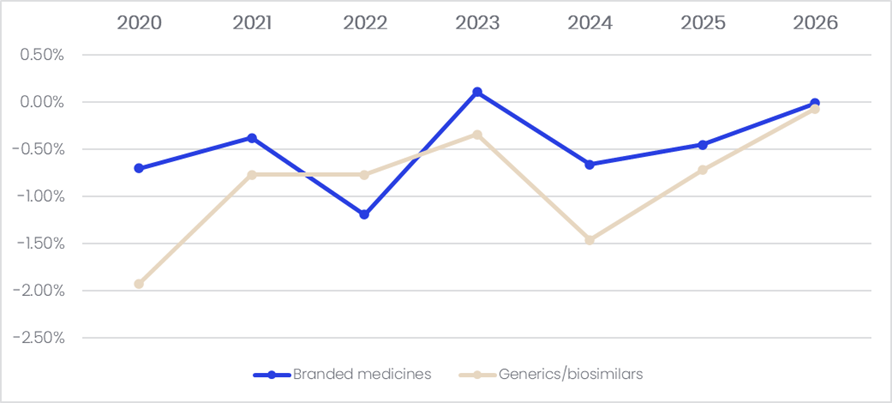

In the most recent price review (January 2026), a total of 4,000 drugs, including branded drugs, off-patent products, and generics, were subjected to the biennial, ATP-based NHI drug price adjustment. According to GlobalData’s Price Intelligence (POLI) database, the average annual price reduction rate among patent-protected branded drugs and generics / biosimilars were nearly -0.5% and -1.0%, respectively.

Figure 1: Average annual price change, South Korea, 2020-2026

While the ATP repricing applies to all drugs with large price gaps between market and NHI-listed prices, a significantly larger proportion of products than other repricing mechanism, the mechanism’s usefulness has been questioned due to its

extremely low average price reduction rate. Ultimately, it has been less influential on NHI drug prices compared to other repricing mechanisms. South Korea’s other repricing mechanisms, which are conducted outside the biennial cycle, include

repricing triggered by generic entry and price-volume agreements (PVAs), price adjustments due to indication expansions, and drug price re-evaluations based on current clinical needs and new clinical evidence. Furthermore, PVA repricing and indication expansion repricing are done on a rolling basis. Historical data showed that patent-protected branded drugs and generics were subjected to up to an average of -0.26% and -0.28% price cuts, respectively, every two years during 2020–2026. This was likely caused by the other repricing mechanisms or voluntary price reductions. Overall, the ATP repricing system caused a less than 2% reduction on the average NHI price, and its impact has been nearly abolished lately.

To address the issue of the ATP repricing scheme’s effectiveness, the Ministry of Health and Welfare (MoHW) is discussing a new repricing mechanism based on the market drug prices to replace the current ATP system as a part of the country’s overarching new comprehensive reform on the drug pricing and reimbursement system, which is scheduled to be implemented on a stage-by-stage basis from early 2026 to 2028. This includes a new drug price review period where the timeframe of indication expansion repricing and PVA repricing would be unified and conducted in April and October each year.

The latest proposal on the comprehensive reform of the drug pricing and reimbursement system was released in December. The MoHW claimed that the proposal would include incentives to support domestic drug development. For example, the MoHW is considering increasing the willingness-to-pay (WTP) thresholds for severe and rare disease treatments. Although the national health technology assessment (HTA) agency does not publicly confirm the drug reimbursement thresholds, it is believed to be lower than the threshold recommended by the World Health Organization (WHO), which is one to three times larger than the national gross domestic product (GDP) per capita. Additionally, the scope of the Dual Drug Pricing System, potentially renamed the Flexible Drug Pricing Agreement System under the new framework, will be expanded. The government also promised to shorten the reimbursement review process for rare disease treatments.

However, domestic firms are strongly opposed to the reform proposal. Their primary concern is the price reduction increases on off-patent drugs and lower initial NHI-listed prices for generics. Under the current repricing mechanism, first generics are priced at 59.5% of the originator’s pre-expiry NHI-listed price. Meanwhile, the originator will receive a 30% price reduction in the first year of the first generic entry. Further price reductions will be made to effectively set the NHI prices of originators and generics at the same level and cap them at 53.55% of the pre-expiry listed price.

Under the new proposal, the cap will be lowered from the current 53.55% to 40%, while companies with larger R&D investment in new drug development will be eligible for more favourable repricing rules for their off-patent products. The proposed repricing rule for off-patent and generics would have more impact on local middle- and small-sized drug developers, since overseas and large pharma companies in South Korea have better funding ability to increase their R&D investment to meet the criteria for more favorable repricing rules. Local drug developers have warned that the new repricing rule will significantly deteriorate the profitability of long-listed and generic products, affecting their funding flow and ability to develop new drugs.

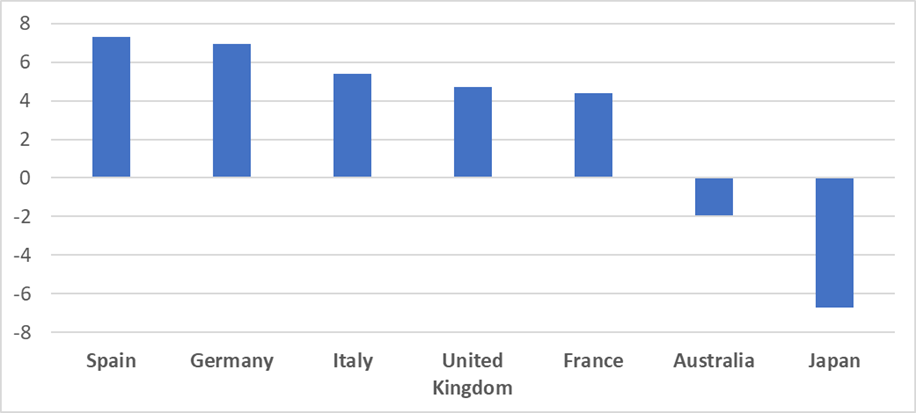

Although the new drug price and reimbursement reform signals an increasing risk for companies to generate profits from off-patent products, the drug price erosion among patent-protected drugs in South Korea may be moderate compared to other major Asia-Pacific (APAC) markets. According to GlobalData’s POLI database, the five-year price trend for patent-protected drugs on ex-manufacturer prices in Japan was a 6.72% reduction, while Australia showed an average reduction of 1.94%. Leading European markets—Spain, Germany, Italy, the UK, and France—showed price increases on average over the last five years. The average five-year price reduction rate in South Korea, based on the NHI listed price, was 2.2%. While the NHI list price is equivalent to a retail price, it is likely that South Korea has less price erosion for patent-protected products compared to its neighbouring country, Japan, which also applies market price-based repricing, but on a yearly basis, plus an additional repricing mechanism applied off-cycle.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataFigure 2: Average five-year price trend for patent-protect medicines, major European and APAC markets

South Korea has been selected as one of the reference countries for US President Donald Trump’s Most Favorable Nation (MFN) drug pricing policy, which is a form of international reference pricing. Since South Korean NHI prices are typically lower compared to those of other reference countries, manufacturers could be less likely to launch their innovative products in South Korea at an early stage, or seek reimbursement in the country, as this may affect the prices of their products in the US.

This article is produced as part of GlobalData’s Price Intelligence (POLI) service, the world’s leading resource for global pharmaceutical pricing, HTA and market access intelligence integrated with the broader epidemiology, disease, clinical trials and manufacturing expertise of GlobalData’s Pharmaceutical Intelligence Center. Our unparalleled team of in-house experts monitors P&R policy developments, outcomes and data analytics around the world every day to give our clients the edge by providing critical early warning signals and insights. For a demo or further information, please contact us here.