Antibody drug conjugates (ADCs) are a rapidly growing therapeutic class that leading data and analytics company GlobalData forecasts will generate more than $45bn in revenue by 2030.

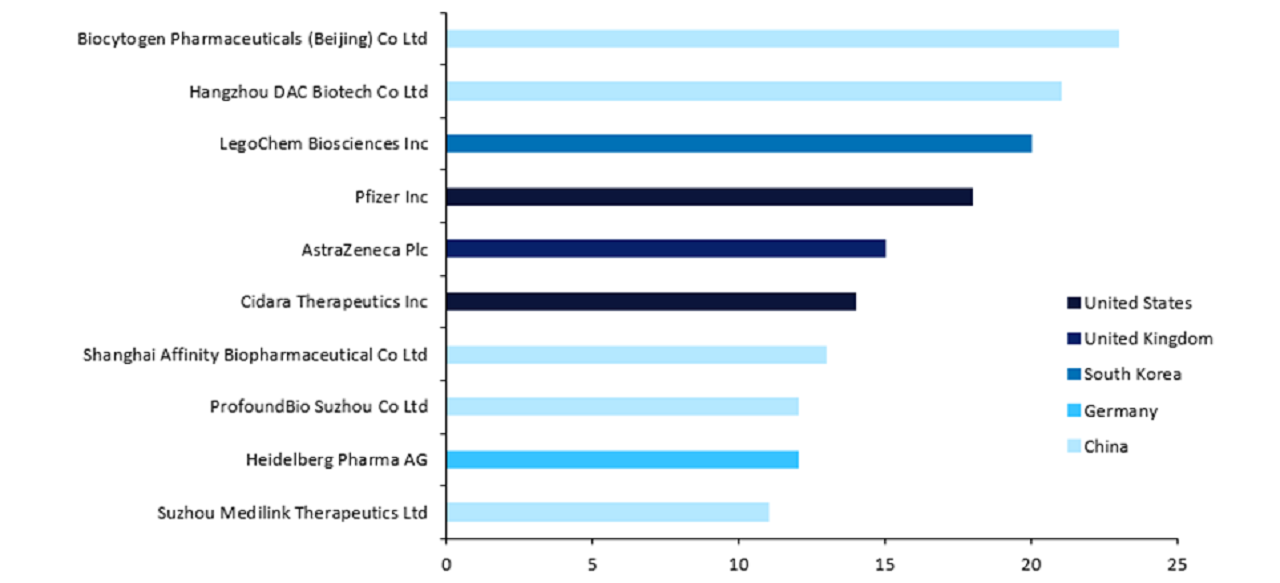

Chinese companies are leading the ADC trend, accounting for half of the top ten developers, as they seek to capitalise on potential returns.

The significant level of Chinese innovation and presence within the new cancer therapy space underlies the country’s emergence as a key player within the ADC market.

ADCs combine the specificity of monoclonal antibodies with the potency of cytotoxic drugs, via a linker, to selectively target and eliminate cancerous cells.

This antibody-directed killing of cancer has the potential to substantially increase the outcomes of current cancer therapies such as chemotherapy.

ADCs are not a new technology, as there are currently 17 approved ADC drugs, which generated $8.5bn in 2023.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataHowever, recent advancements in linker technologies and conjugation methods have revitalised interest in this space.

As such, ADCs are leading a new era of targeted cancer therapy, with sales forecast to increase by 433% and generate more than $45bn in revenue by 2030.

Biocytogen Pharmaceuticals is the leading company by active pipeline ADC count, with 23 active ADCs in development.

However, its drugs are yet to reach clinical stages, as six are preclinical and 17 are in the discovery stage.

Alternatively, ProfoundBio is in eighth place by active pipeline ADC count with 13 drugs.

This company has developed two distinct proprietary linker-drug technology platforms, and is the most advanced out of all of the Chinese companies, with three drugs in Phase II.

One of its drugs, Rina-S, is a potential best-in-class ADC that was granted Fast Track designation by the US Food and Drug Administration in early 2024 for the treatment of ovarian cancer.

Hangzhou DAC, Shanghai Afinity, ProfoundBio, and Suzhou Medilink are headquartered within the Yangtze River Delta region in China.

This region is home to some of China’s top research institutions such as Zhejiang and Shanghai Jiao Tong University, and it is one of the most economically advanced and prosperous areas of China.

These factors play an important role in attracting talent and investment, enabling innovation within pharmaceutical research and development.

ADCs are a rapidly growing drug class, with forecast revenues soaring to more than $45bn by 2030.

The prime location of these companies offers a rich ecosystem of academic institutions, attracting both talent and investment.

The associated high levels of innovation by these Chinese companies in a drug class that is gaining prominence mirrors the region’s emergence as a powerhouse within the pharmaceutical space.