Multiple myeloma (MM) therapeutics comprise a multi-billion dollar market, among the most valuable in oncology. This is a result of intensive research efforts that have produced regimens that have prolonged patient survival, most of which are a combination of a proteasome inhibitor + an immunomodulatory drug (ie. lenalidomide) + a steroid ± an anti-CD38 antibody. Since the frontline treatment setting is dominated by these regimens, pharma companies have focused on the development of new drugs in the relapsed/refractory (R/R) setting. The B-cell maturation antigen (BCMA) is preferentially expressed by mature B-cells and is considered a classic MM-specific marker, making it one of the most attractive targets for new therapies.

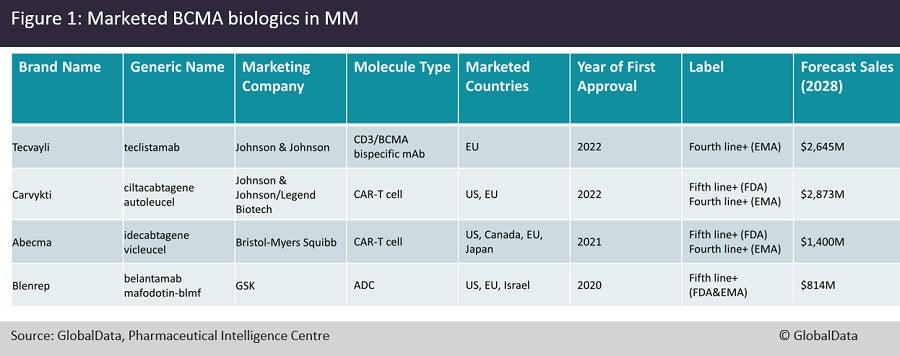

Last month, the European Medicines Agency’s (EMA) approval of Johnson & Johnson’s (J&J) anti-CD3/BCMA bispecific antibody Tecvayli (teclistamab) marked the fourth anti-BCMA biologic to enter the R/R MM market. Previously, J&J’s/Legend Biotech’s Carvykti (cilta-cel) and Bristol Myers Squibb’s (BMS) Abecma (ide-cel), anti-BCMA chimeric antigen receptor (CAR) T-cells, were approved by both the EMA and the US Food and Drug Administration (FDA) for R/R MM. The first anti-BCMA product to enter the R/R market was GlaxoSmithKline’s antibody-drug conjugate (ADC) Blenrep (belantamab mafodotin-blmf), gaining FDA approval in 2020.

The approval of multiple BCMA biologics, while being great news for patients, complicates the treatment paradigm significantly due to lack of any data comparing one against the other and raises numerous questions about treatment sequence. Should CAR-T cells, or antibodies be used first? Does Blenrep have an efficacy advantage over Tecvayli? Does relapse on one BCMA agent mean resistance to the rest, through antigen escape? The product labels do not help either; the FDA has approved all such agents for use at the fifth line of therapy or later, while the EMA has adopted the stance of fourth line of therapy or later use for these agents (Figure 1).

On the basis of overall response rate in early phase trials, the two CAR-T products Abecma and Carvykti seem to have the upper hand, factors such as manufacturing challenges, duration of response, and access to specialist academic centres could restrict their use and tilt the balance in favour of the more easily administered Tecvayli or Blenrep. However, the lack of mature overall survival data for either agent means physicians will have to select therapy based on attributes other than long-term efficacy. According to GlobalData’s consensus analyst sales and forecast database, Carvykti is forecast to achieve the highest sales of the anti-BCMA biologics class, with $2.9 billion global sales expected by 2028, followed by Tecvayli with $2.6bn, which would mark a huge win for J&J in the MM space.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData