A US bill that aims to prevent Chinese manufacturers from accessing US federal funding and keep US taxpayer dollars out of “foreign adversary biotech companies of US national security concern” names Chinese biotechs, including WuXi, as targets.

On 7 March 2024, the US Senate Homeland Security and Governmental Affairs Committee advanced a bill by 11-1 to the full Senate floor, which would prevent pharma companies from using certain foreign manufacturing and trial service providers for security reasons.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataThe bill, dubbed the BIOSECURE Act, specifically targets the major Chinese biotech and genomics companies WuXi AppTec (Shanghai, China), WuXi Bio (Jiangsu, China), BGI Genomics (Shenzhen, China), MGI (also Shenzhen), and MGI subsidiary Complete Genomics (San Jose, US), and claims these companies pose a risk to US national security by “engaging in joint research with, being supported by, or being affiliated with a foreign adversary’s military, internal security forces, or intelligence agencies.”

On 13 March, the Biotechnology Innovation Organization (BIO) announced it was parting company with WuXi AppTec after the business proactively ended its membership.

In an about-turn, the BIO now openly supports the BIOSECURE Act, whereas in February its CEO wrote that the bill “represents a serious hazard for the biotechnology industry in its current form” that “portends significant unintended consequences that would immediately and negatively impact the biotechnology sector in the US.”

In early March, the US chair of the House Select Committee on the Chinese Communist Party (CCP), Mike Gallagher, wrote an open letter to the US Attorney General, requesting an examination of “lobbying” by the BIO on behalf of the CCP and WuXi Apptec.

After the legislation was unveiled in January 2024, WuXi quickly defended its position and claimed the bill contained misleading descriptions of its CEO, Zhisheng Chen, and that he was not a US national security threat.

WuXi added that Chen has not worked at or been compensated by any military-affiliated institution and as much as 65% of WuXi AppTec’s 2023 revenue came from US-based customers.

In WuXi’s 2023 Annual Results presentation it stated that the pre-emptive designation of WuXi AppTec as a named “biotechnology company of concern” may result in a certain impact on the company’s ability to work with customers that do business with the US government.

The company says it has been actively working together with its advisors to set the record straight and advocate for changes to the proposed legislation.

If passed, the legislation would impact the manufacture of medicines for the US market.

WuXi AppTec and WuXi Bio manufacture 19 biosimilar and innovator drugs approved in the US, according to GlobalData’s Pharma Intelligence Center Drugs by Manufacturer database.

These drugs include Vertex Pharmaceuticals‘ (Boston, US) Trikafta/Kaftrio and BeiGene’s (Grand Cayman, Cayman Islands) Brukinsa.

BGI Genomics, Complete Genomics, and MGI provide products and technologies that serve the genetic sequencing, genotyping and gene expression, and proteomics markets.

These companies have little direct involvement with the development and manufacturing of drugs.

The BIOSECURE Act would also prohibit federal loans and grants to any entity that uses biotechnology equipment or services from one of these entities in performance of the government contract.

It would majorly affect US companies’ ability and desire to contract with biotechnology companies from China, Hong Kong, Russia, Iran, Cuba, and North Korea, although existing sanctions already preclude trade with several of these countries.

The proposed legislation is a significant hurdle for the biotech manufacturing arena in China.

Many major pharmaceutical companies rely on these Chinese manufacturers to reduce costs.

WuXi, one of the world’s largest biologics manufacturing networks, has reported successful investments in recent years, including plans for significant investment at its site in Massachusetts, US.

WuXi AppTec and its subsidiaries operate 13 manufacturing facilities, according to GlobalData’s Contract Service Provider database.

WuXi and other companies named in the bill have made it clear that if the bill becomes law, US patients will suffer, due to the number of drug manufacturing partnerships WuXi has.

Even if the bill does not become law, pharma companies could soon look at their supply chains and de-risk to distance from having connections with China.

Megan Van Etten, deputy vice-president of Public Affairs at PhRMA, told GlobalData PharmSource that “we are committed to working constructively with [US] Congress to help protect national security and make sure patients are not unintentionally impacted with potential drug shortages or disruptions to clinical trials.”

The proposed legislation is only the latest bill raising geopolitical tensions between the two countries by trying to limit China’s presence in the US.

In 2022, the US Senate passed bipartisan legislation to boost US domestic supply chains and reduce reliance on China for pharmaceutical supplies.

This month, Iovance Biotherapeutics (San Carlos, US) stated in its financial year 2023 annual report that it may be unable to sufficiently expand its manufacturing capacity to meet demand.

WuXi manufactures doses of Amtagvi for Iovance.

“Current geopolitical tensions with China may impact our ability to expand manufacturing capacity at our contract manufacturer, WuXi. Recently, the Biden administration has signed multiple executive orders regarding China. One particular executive order titled Advancing Biotechnology and Biomanufacturing Innovation for a Sustainable, Safe, and Secure American Bioeconomy signed on September 12, 2022, will likely impact the pharmaceutical industry to encourage US domestic manufacturing of pharmaceutical products,” the company said.

The House Select Committee and the House Energy and Commerce Committee plan to hold further meetings to discuss other legislation that would potentially ban relations with foreign companies and stop US companies from sending data, including clinical trial data, to China and elsewhere.

However, bills such as these will make it difficult for the pharma industry to develop and manufacture medicines, given the large reliance on Chinese companies for clinical research and manufacturing support.

Investments already slowing before news of the bill

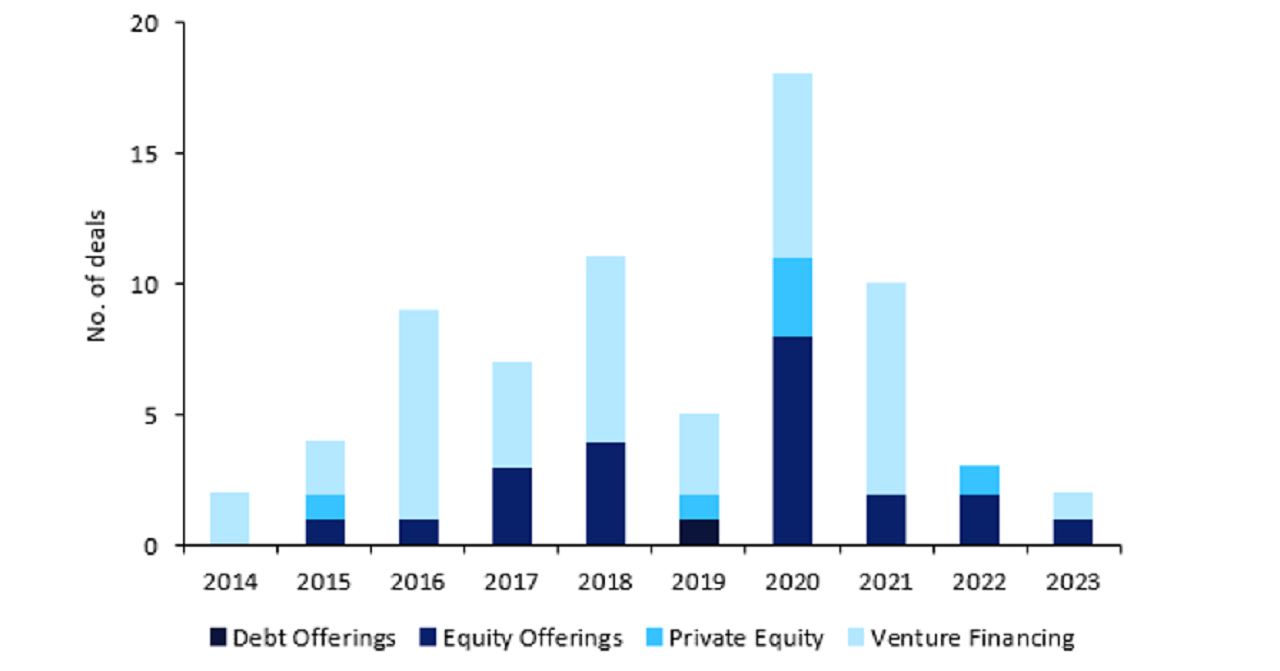

Capital-raising deals for the five named companies were already falling in 2022 and 2023: rising inflation and interest rates during this time acted as a deterrent, with investors showing an increasing reluctance to take on debt.

The bill will deter international investment further.

After news of the bill surfaced, Chinese biotech stocks fell to their lowest values since early 2020, and when more details emerged on 7 March 2024, WuXi AppTec stocks fell as much as 21% while its sister company WuXi Biologics Cayman dropped 19%.

Chinese biotech stocks have not fully recovered from the fall, as of 15 March 2024.

This article was updated on March 25 to include the following statement from Iovance: “The Iovance 2023 annual report disclosure you referenced in the article was an overall risk disclosure to investor audiences; based on the current landscape and anticipated demand, we do not anticipate any significant impact of the BIOSECURE Act on our ability to manufacture and meet demand for Amtagvi if it, or an amended version, becomes law. Our manufacturing facility, the Iovance Cell Therapy Center, is built to support several thousand patients annually. We are comfortable with our internal capabilities to address anticipated near-term demand from patients, and we are currently working to expand our existing facility to more than double capacity.”