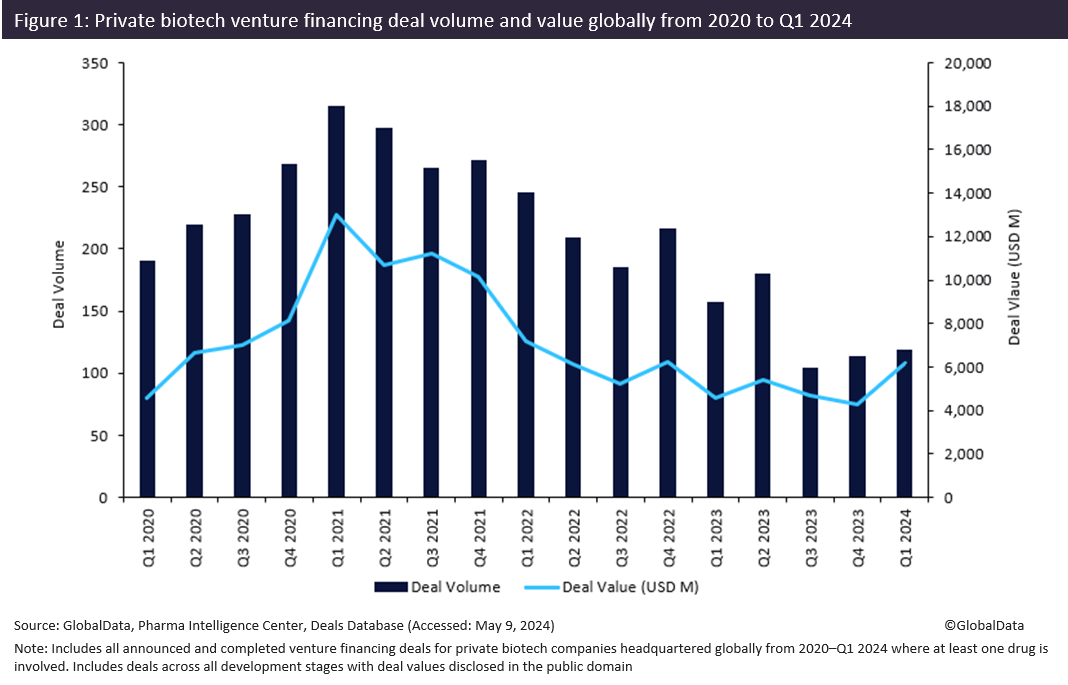

Private biotech venture financing saw a 46% increase in total deal value in the first quarter (Q1) of 2024 compared to Q4 2023, according to GlobalData’s Pharma Intelligence Center Deals Database. This signals progress towards recovery in venture financing as investor confidence improves, as shown in Figure 1. In 2022 and 2023, private biotech venture financing experienced a downturn in investment driven by macroeconomic challenges. High interest rates and inflation contributed to investors becoming more cautious in biotech venture financing.

However, in 2024 investor optimism has increased due to the expected lowering of interest rates as inflation slows, which in turn would reduce the cost of capital. Therefore, an increase in venture capital investment in private biotech companies is expected to continue.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataPrivate biotech venture financing deals in Q1 2024 were marked with an increase in larger funding rounds compared to Q4 2023. This reflects the improved venture capital sentiment away from previously being more selective in favouring smaller funding rounds to investing more in larger funding rounds.

In addition, there was a notable increase of 109% in venture financing for Phase II and Phase III deals in Q1 2024 compared to Q4 2023, as shown by GlobalData’s Pharma Intelligence Center Deals Database. This suggests that investor interest is shifting more towards late-stage clinical developments in efforts to reduce risk, as was previously seen with early-stage biotechs in 2021.

Furthermore, Q1 2024 saw increased investor interest in antibody-drug conjugates (ADCs) and radiopharmaceuticals. Venture financing for ADCs saw a more than fivefold increase, surging from $98 million to $568 million from Q4 2023 to Q1 2024. Notably, the largest venture financing deal reported in Q1 2024 was Tubulis, a biotech company headquartered in Germany, which secured $139 million in Series B2 funding to support the clinical evaluation of its next-generation ADC lead candidates, TUB-040, targeting ovarian and lung cancers, and TUB-030, targeting solid tumours. Similarly, innovative radiopharmaceuticals are positioned for sustained growth, with venture capital investment surging more than 330% in Q1 2024 compared to the same quarter of the previous year.

Since 2022 the volatility and downturn in public markets saw a decline in biotech initial public offerings (IPOs). However, as the economy and stock markets stabilise with the re-opening of the IPO market, investor confidence is improving. There is a promising outlook for increased venture funding within the biotech industry. The influx in funding would continue to support private biotechs to advance drug research and development efforts.