Catalent’s (Somerset, NJ, US) CEO has admitted to the company’s “disappointing” and “poor performance” over the past quarter, and dropped expected annual revenue for FY2023 by $450m. The company plans to slash CapEx and other costs to recover and has replaced many of its executives.

In an investor call on 19 May, Catalent reduced its annual net revenue forecast by approximately 10% compared to its February predictions. CEO Alessandro Maselli said the CDMO would delay filing its Q3 FY2023 10-Q for a fourth time.

The executive cited production problems at three facilities, the post-Covid cliff, macro biotech funding challenges, and flaws in forecasting, but added that the company’s problems are “temporary and addressable” and were not caused by cancelled orders. Catalent has enough drug stock to meet immediate customer demand, he added.

Maselli told investors: “I’ll cut to the chase. This is not at all the call we expected to have now, and we are not at all where we expected to be. Our financial performance and operational execution have all fallen significantly short of our expectations and our February forecast, and we accept responsibility for disappointing you.”

He added that these problems led the CMO to significantly reduce its FY 2023 predictions, from the previously forecast $4.625bn-$4.875bn in net revenue to $4.25bn–$4.35bn, and adjusted EBITDA from $1.22bn–$1.3bn to $725m–$775m.

What are Catalent’s manufacturing problems?

On 19 May, Maselli explained the production challenges that are affecting Catalent’s bottom line:

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData- Low productivity and high costs at finished dose manufacturing facilities in Bloomington, Indiana, and Brussels, Belgium. Catalent delayed cost reduction plans to spend money on corrective actions following faults found by regulatory inspections of biologics manufacturing earlier in the year.

- Catalent’s Covid-19 investments are coming back to bite it: it has pandemic-related raw material inventory reserves soon to expire and write-offs together worth $55 million.

- Switching manufacturing lines from Covid-related products to other products has been more complicated than expected. Tech transfers to non-COVID products in Bloomington should finish in H2 2023. At the height of the pandemic, Catalent’s Bloomington site won contracts to produce Moderna’s (Cambridge, MA, US) and Johnson & Johnson’s (New Brunswick, NJ, US) Covid-19 vaccines, and Regeneron’s (Tarrytown, NY, US) Covid-19 monoclonal antibody Regen-Cov.

- Scaling up commercial volumes of gene therapy in Harmans, Maryland, US was delayed because Catalent needed a new enterprise resource planning (ERP) system. Catalent said it installed the system in early May and is now ramping up production.

- Maselli also cited non-manufacturing factors in Catalent’s poor performance and incorrect forecasting, especially a revenue cliff as the pandemic recedes: Catalent’s Covid-related sales will decline by more than 50% compared with last year, he said, and will be even lower in 2024.

Recovery plans

Maselli stressed that the company is on its way to recovering from poor results. The CEO, who took over in July 2022, will remain in place. In the last three months, Maselli appointed Ricky Hopson as interim CFO, Ricardo Zayas as head of biologics, and Sridhar Krishnan as head of the continuous improvement programme.

The company’s recovery plan involves an “enterprise-wide restructuring programme with a goal to double our previous commitment of $75m to $85m annualised cost savings… We expected the annualized impact of these activities to be roughly $100m,” said Maselli. Catalent is also severely limiting future CapEx following large bills for recent facility expansions in Harmans, Bloomington, and Anaheim, which Maselli said will pay off in coming months when the sites reach greater use, leading to $6.5bn in annual revenue. Catalent has contracts for ten products recently approved by the FDA and expected to launch soon, he said. Catalent recently announced manufacturing deals with Novo Nordisk (Bagsvaerd, Denmark) and Samsung Bioepis (Incheon, South Korea).

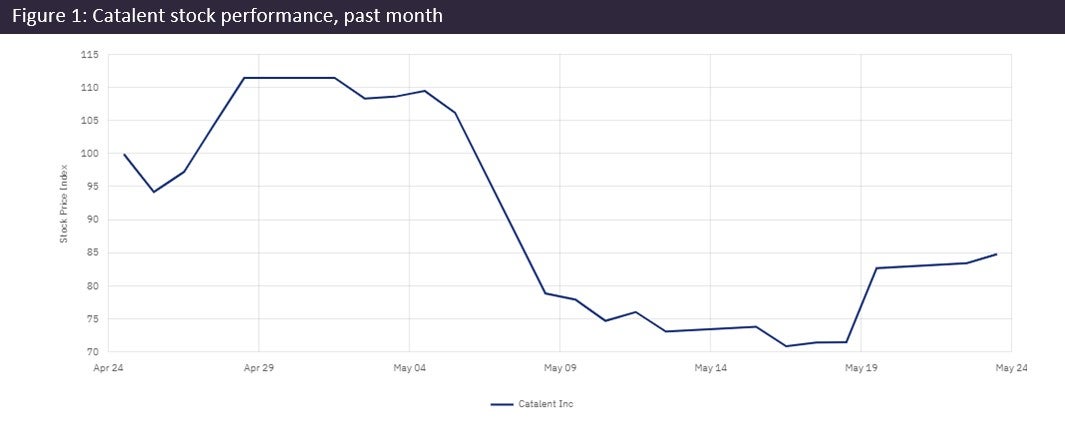

Catalent stock was up again by Monday, after a ten-day dip during investor uncertainty (Figure 1). Broker reports described Catalent’s troubles as mostly recoverable, although questions remain about adjusted EBITDA for FY 2024. The CEO did not give a date for releasing Q3 results but added, “It should also not be taking us this long to finalise our financial reports.”