Drug shortages are worsening globally, leaving patients without access to essential medications, and healthcare providers struggling to find alternative treatments.

Many governments are now intervening to prevent escalating shortages by stockpiling certain essential drugs, investing in domestic pharma manufacturing, or allowing price increases for generics to encourage their production.

Drug shortages are increasing for yet another year, according to the Pharmaceutical Group of the EU, which represents pharmacists.

The shortages are impacting both high and low-value drugs (such as antibiotics) alike, the group stated in an annual report.

EU-level policy to combat the problem is unlikely to make much difference in 2024, GlobalData analysts say.

Drug shortages are plaguing other countries.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataAs demand for obesity-related treatments surges, the supply of glucagon-like peptide-1 receptor (GLP-1R) agonists is not expected to return to normal until at least the end of 2024.

These shortages are shaping the contract manufacturing organisation landscape. Novo Nordisk (Bagsværd, Denmark) has been struggling to meet the demand for its GLP-1R agonist products, notably Ozempic and Wegovy, and is in the process of acquiring Catalent to improve its supply.

The US Food and Drug Administration (FDA) and European Medicines Agency have reported shortages of these drugs, and Australia’s Therapeutic Goods Administration and Health Canada are advising doctors not to start new patients on them due to the global shortage.

US generic shortages and political interventions

In the US, generic drug shortages are affecting patient access to treatment, particularly for cancer patients, and healthcare providers are having to choose who to treat.

During a hearing on chronic drug shortages in February 2024, the US House Ways and Means Committee highlighted poor manufacturing quality as the leading driver of chronic shortages.

Jeromie Ballreich, a research professor at John Hopkins Bloomberg School of Public Health (Baltimore, US), proposed new legislation to require transparency in drug manufacturing; the withheld information makes it harder to identify supply chain vulnerabilities, he said.

Ballreich also proposed paying manufacturers to stockpile drugs, and boosting domestic active pharmaceutical ingredient (API) manufacturing.

The House Committee suggested that government intervention is required for generic prices to correct the market to “its natural competitive state.”

The current economic model leads to outsourcing manufacturing to cheaper countries to reduce costs and does not encourage domestic production, claimed the House Committee.

Further, during the meeting, politicians suggested policies to incentivise generic manufacturers to enter and stay in the market.

For example, some suggested higher payments for manufacturers who have resilient and transparent supply chains, or higher payments for complex generic drugs production.

The American Society of Clinical Oncology (ASCO) (Alexandria, US) and some pharma manufacturers have suggested that the low prices of generics are a reason for the drug shortages, by forcing generic manufacturers to discontinue production and exit the market.

The ASCO also suggested that Congress implement incentives to boost US manufacturing and encourage advanced technologies such as continuous manufacturing.

In February 2024, Democrats from the US House Oversight Committee sent letters to Teva (Tel Aviv, Israel), Pfizer (New York, US), and Sandoz (Zug, Switzerland) to ask why several of their drugs are in short supply.

The letters refer to Teva’s shortage of Adderall, Sandoz’s amoxicillin, and Pfizer’s (along with its subsidiaries’) production of common cancer drugs, including cisplatin, carboplatin, and methotrexate.

House Democrats noted that Pfizer has taken steps to attempt to mitigate the shortages of cancer medications, though the root cause has not been addressed, and also urged Pfizer to boost its output.

Up to 90% of hospital systems lacked consistent access to oncology medicines in 2023, the letter noted.

It also raised concerns about alleged price gouging by Pfizer.

Generic drug facility inspections globally could also end up worsening US shortages of several key medicines if they lead to halted manufacturing.

FDA commissioner Robert Califf told Reuters in February, “in a supply chain that’s not resilient, it actually increases the risk of short-term shortages, because if a manufacturing line goes down to fix a quality problem, there’s no reserve in the system right now.”

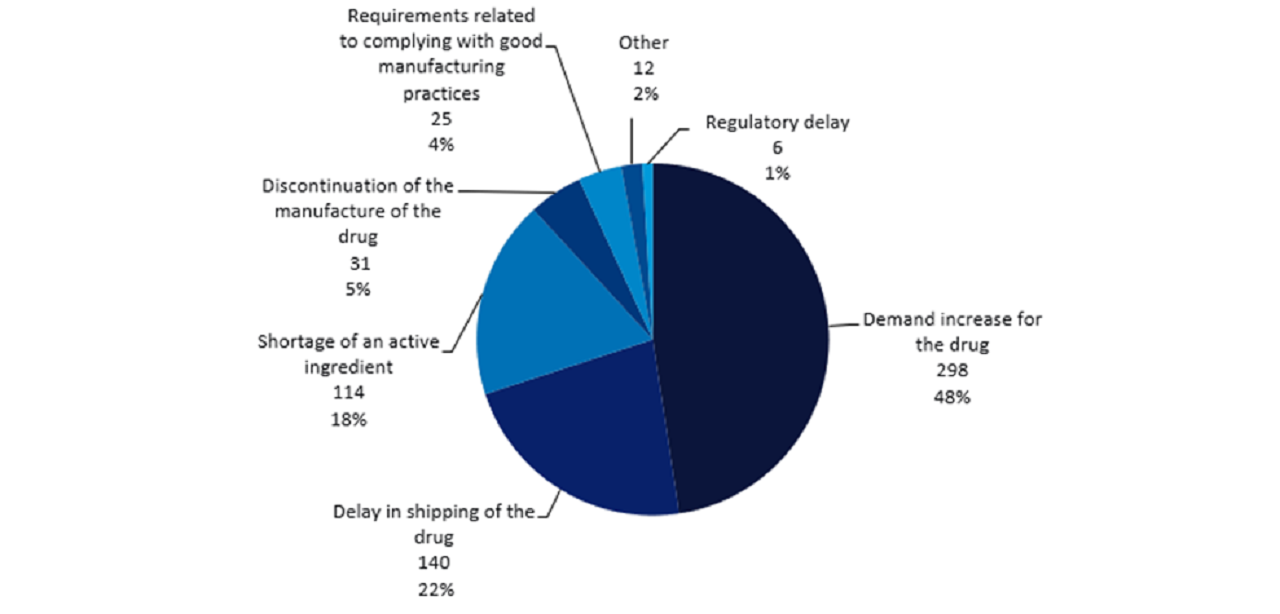

In the US, increased demand, shipping delays, and shortages of API account for 88% of current drug shortages where a cause is known.

Demand is especially high for anaesthetics and oncology drugs.

Japan, France, and Germany prepare for shortages

Japan’s Ministry of Health, Labour and Welfare will launch a drug shortage reporting scheme in April this year, according to the newspaper Yomiuri.

Manufacturers should report potential drug shortages within six months for antibiotics and immunosuppressants.

At the same time, France’s National Assembly (the lower house of its parliament) has voted to increase the financial penalties for shortages that can be imposed on pharmaceutical companies and suppliers.

The potential for wider regional conflicts may also exacerbate a drug shortage crisis in the future.

Germany’s Health Minister Karl Lauterbach recently announced plans with the country’s Ministry of Defense for a law to prepare Germany’s healthcare sector for the possibility of an armed conflict involving Nato allies.

In a press release, Lauterbach stated that it is vital to prepare the healthcare system for scenarios long considered unthinkable, emphasising that this was an important lesson of the Covid-19 pandemic.

Preparing for major crises is even more important after Russia’s invasion of Ukraine, Lauterbach commented, adding that Germany needs to be prepared for the possibility of involvement in a war, even though this appears unlikely at the moment.

Lauterbach stated that there needs to be preparedness at every level of the healthcare system in the case of a large number of injured people needing to be treated in German hospitals.

In the event of an attack on an ally, Germany could become a hub for treating injured people from other countries, Lauterbach proposed, pointing to the fact that Germany has already taken greater numbers of seriously injured Ukrainians than any other country since the conflict began.