Despite China producing a significant proportion of the world’s API supply (mostly small molecule), it manufactures relatively few biosimilar and innovator drugs and no cell and gene therapies for the western markets of Europe and the US despite investments and an increasing number of startups to improve innovative manufacture. China will continue to take steps towards becoming as competitive in high-value innovative pharma as it is in the generics industry, with The Wall Street Journal reporting Chinese biotechs raised $1.6tn through 568 venture financings last year, up from $11bn in 418 deals in 2020.

The Chinese government announced its ten-year ‘Made in China 2025’ strategic plan in 2015, which aimed to make the country a global leader in several high-tech industries. These industries unexpectedly also included biotech, which was not a particularly strong area for Chinese manufacturing, which is more recognised for generics production. Since 2015, the government has greatly increased its investment and support for biotech to stimulate innovation in the sector. Advanced biologic production involving cell and gene therapies is currently limited but concentrated in Eastern China in provinces such as Shanghai, Zhejiang and Jiangsu for US FDA-approved sites.

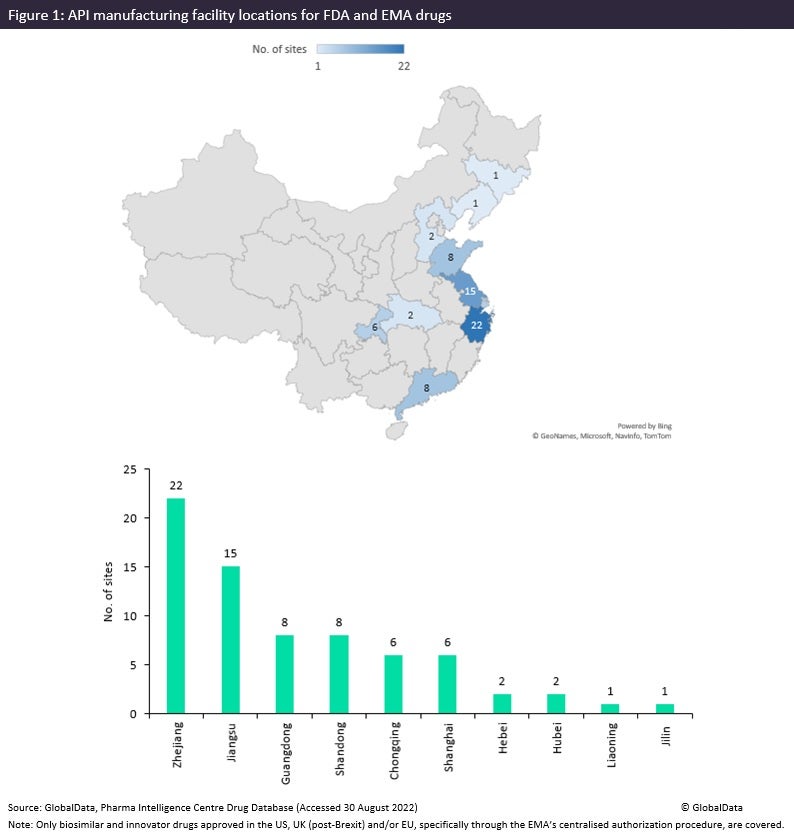

The Chinese pharma manufacturing industry is renowned for its generic API manufacturing. It is therefore to be expected that there are a far greater number of Chinese sites for API manufacturing for FDA and EMA innovator and biosimilar drugs than for dose manufacturing and packaging. The figure below is taken from an upcoming GlobalData PharmSource publication called China Contract Manufacturing: Ambitions and Outlook and shows that the manufacturing sites for innovative and biosimilar drugs approved in the US and Europe are focused around the eastern provinces—namely, Zhejiang, Jiangsu, Shandong, Liaoning, Jilin and Shanghai—which are considered the major pharma manufacturing powerhouse. Guangdong is based in the south and has a comparatively strong number of manufacturing relationships producing innovative FDA and EMA drugs.

Chinese pharma manufacturing sites are involved in the production of blockbuster drugs, such as Vertex Pharmaceuticals’ (Boston, Massachusetts) Trikafta/Kaftrio, Gilead Sciences’ (Foster City, California) Veklury, and even AstraZeneca’s (Cambridge, UK) Vaxzevria, a recombinant vector vaccine for Covid-19. Veklury’s API is being manufactured by Esteve Huayi Pharmaceutical (Zhejiang, China) and Flamma (Bergamo, Italy) in east coast sites. WuXi STA Shanghai’s (Shanghai, China) site produces APIs for Trikafta/Kaftrio, while WuXi Biologics Cayman’s (Jiangsu, China) Jiangsu site is involved in the API manufacturing for Vaxzevria.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData