At CPHI Barcelona 2023 and Phacilitate 2023 conferences, experts noted the uncertain times from a funding perspective and called for closer integration between manufacturing, storage, and logistics for cell and gene therapies, as well as maintaining manufacturing flexibility.

Manufacturing of cell and gene therapies is a complex process that requires precise planning to ensure timely completion and a cost-contained procedure, as well as tracking systems to ensure the right temperature during the transport process.

Manufacturing is the main cost driver for cell and gene therapies: the complexity of correctly using cells or viral vectors to create a therapeutic is far greater than that for conventional drug production. However, even transportation of the therapy is costly due to the low-temperature requirements.

In a CPHI Barcelona 2023 session called “Cell & Gene therapies: Addressing Manufacturing Challenges to Accelerate Innovation” (25 October 2023), Marc-Olivier Mignon, chief commercial officer at Seqens (Lyon, France), discussed the difficulties of producing these novel treatments. Very few manufacturers will provide services for the entire lifecycle of these products, and so, different organisations must collaborate.

Mignon said: “This partnering is very important to be integrated all along the way. Let me give you an example: if you take Axi-cell [Yescarta (axicabtagene ciloleucel)], the cells that you are taking from the [patient] centres are fresh cells, which means that a physician […] needs to give a call to Gilead and say, ‘I would like you to produce an Axi-cell batch for this patient.’ Then Gilead says, okay, on this date, we have a slot for you… So it means that you have to organise all your patient journey to make sure that on this day, during the morning, you deliver the cells fresh for Gilead.”

He continued: “If you look at the Novartis CAR-T cell [Kymriah], they are taking frozen cells, which means that you can take [the patient’s genetically reprogrammed cells] weeks or months before… it comes [at a] cost because it’s frozen in a lot of different centres, you have issues with quality, you have issues with deviations, you have issues with the quality of the cells.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData“When you start to build your manufacturing process you need to have the endpoint in mind. And that’s the reason why you need to partner very closely with your commercial, with your market access, with your medical, with your manufacturing, with your development teams to make sure that the product you’re going to test now is going to [be of sufficient quality].”

“We are living in really uncertain times right now, from a funding perspective”

Speaking at the Advanced Therapies Europe – Phacilitate conference in Portugal on 7 September 2023, in a session called “Addressing Viral Vector Manufacturing Challenges: From Development to Commercialisation,” Tobias Brandt, Senior Scientist, Viral Vector Process Development at CSL Behring (Melbourne, Australia) stated that on top of the usual time, cost, and quality considerations for manufacturing, flexibility is a top priority:

“I think it depends on the product, the specific characteristics, the goals, but I would add on top of those three, flexibility. We are living in really uncertain times right now, from a funding perspective, a commercialisation perspective, regulatory requirements perspective. And so, when considering stricter transactions [for cell and gene therapies] versus standard science, I think we also need to take into consideration how much flexibility to have from the start, I think that’s also an important variable.”

According to GlobalData’s Drugs by Manufacturer database, 33% of API manufacturing is outsourced for marketed cell, gene, and gene-modified cell therapies; this figure is 27% for dose production.

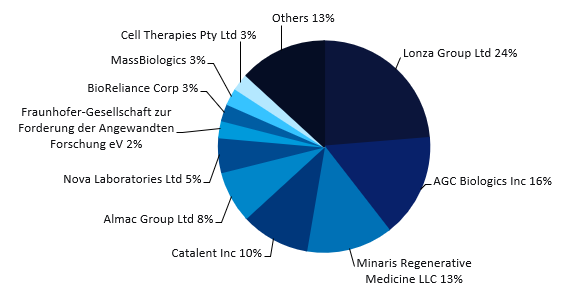

Figure 1 (above) is from GlobalData’s November 2023 webinar called ‘Cell and Gene Therapy 2023 – Understand the major trends that have dominated the industry throughout 2023‘. Lonza (Basel, Switzerland) has the highest number of publicly disclosed commercial manufacturing contracts for cell and gene therapies. These include Novartis‘ (Basel, Switzerland) Kymriah and bluebird bio Inc‘s (Somerville, MA, US) Zynteglo and Skysona, which are used for hematological cancers, beta thalassemia, and adrenoleukodystrophy, respectively. Lonza also has 23 publicly disclosed contract manufacturing agreements for pipeline-stage cell, gene, and gene-modified cell therapies.

The in vivo gene therapy supply chain involves the production of the therapeutic gene, packaging of the therapeutic gene into a vector such as a viral or liposomal vector, and direct delivery of the genetic materials into the patient’s targeted tissue.

The (ex vivo) gene-modified cell therapy supply chain involves cell extraction, transfer to the manufacturing site, cell isolation, cell activation (transfection by vectors such as by viral vectors or non-viral methods such as plasmids), cell expansion, cell harvest, filling, lyophilising, and packaging the final vialed product, and transfer and delivery to patient; after altered cells are injected, they produce the desired protein or hormone.