Traditionally, insulin receptor (IR) targeting drugs have dominated the type 2 diabetes (T2D) landscape. However, driven by the success of recent glucagon-like peptide 1 receptor (GLP1R)-targeting drugs, there has been a surge in the number of active pipeline drugs addressing this target. These findings suggest a transition away from the traditional IR to the GLP1R as the target of focus for innovative T2D therapies.

T2D is characterised by insulin resistance and relative insulin deficiency. This condition disrupts glucose metabolism, resulting in high blood glucose levels and a variety of effects thereafter, such as an increased risk of stroke and diabetic neuropathy. Affecting more than 450 million patients worldwide, T2D is the most prevalent form of diabetes.

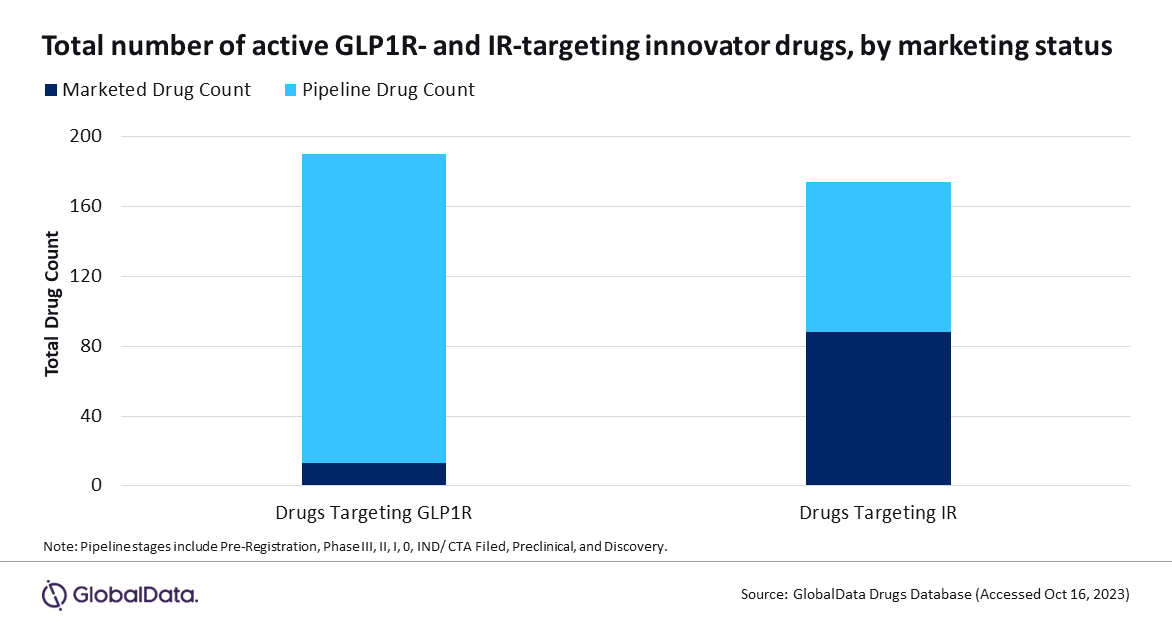

IR’s role in T2D is well-defined. IR activation results in a complex intracellular signalling network, which ultimately regulates glucose metabolism by stimulating glucose uptake. As such, there are 86 marketed agonists acting on this receptor. These make up 40% of all marketed T2D treatments, more than double the drug count for any other target. In contrast, agonists targeting GLP1R make up only 6% of marketed treatments. GLP1R activation results in downstream intracellular events, leading to increased insulin synthesis and enhanced glucose-dependent secretion of insulin, which ultimately reduces blood sugar levels.

However, compared to currently marketed treatments, IR is not the front runner in the T2D pipeline. Here, there are 163 drugs targeting GLP1R, more than double the count for IR-targeting drugs (Figure 1, above).

This data indicates a shift in the T2D landscape. Despite current market dominance, IR-targeting treatments no longer seem to hold the T2D spotlight. Instead, the surge of pipeline drugs suggests companies have redirected their attention to GLP1R. Effective T2D management by GLP1R activation is achieved via high receptor concentrations in pancreatic tissues, which effectively reduces blood sugar levels, leading to lower blood pressure and reduced hypoglycemia incidence.

The recent blockbuster success of the GLP1R agonists Ozempic (semaglutide) by Novo Nordisk and Mounjaro (tirzepatide) by Eli Lilly has likely influenced the current T2D pipeline. Ozempic generated global sales of $8.5bn in 2022, whereas Mounjaro, which received approval in 2022, is forecast to overtake this, generating over $27bn in 2029 alone.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataIn light of Ozempic’s success, Novo Nordisk has six active GLP1R drugs in its T2D pipeline. Both LAI-287 + semaglutide and cagrilintide + semaglutide (Cagrisema) are in Phase III clinical trials and possess the highest likelihood of approval (LoA) scores among innovative T2D drugs, with 54% and 52%, respectively, according to GlobalData’s Likelihood of Approval tool.

Both treatments are fixed-dose combinations involving semaglutide and are estimated to launch in the EU by the end of 2025, with US launches the following year. In particular, Cagrisema is forecast to be a blockbuster, generating nearly $8bn in revenue in 2029.

Due to the current success and the forecast future success of GLP1R-targeting treatments, the T2D landscape is expected to undergo a significant transformation. As time progresses, we can expect the marketed T2D landscape to shift, with GLP1R-targeting treatments overtaking IR-targeting treatments to dominate the market.