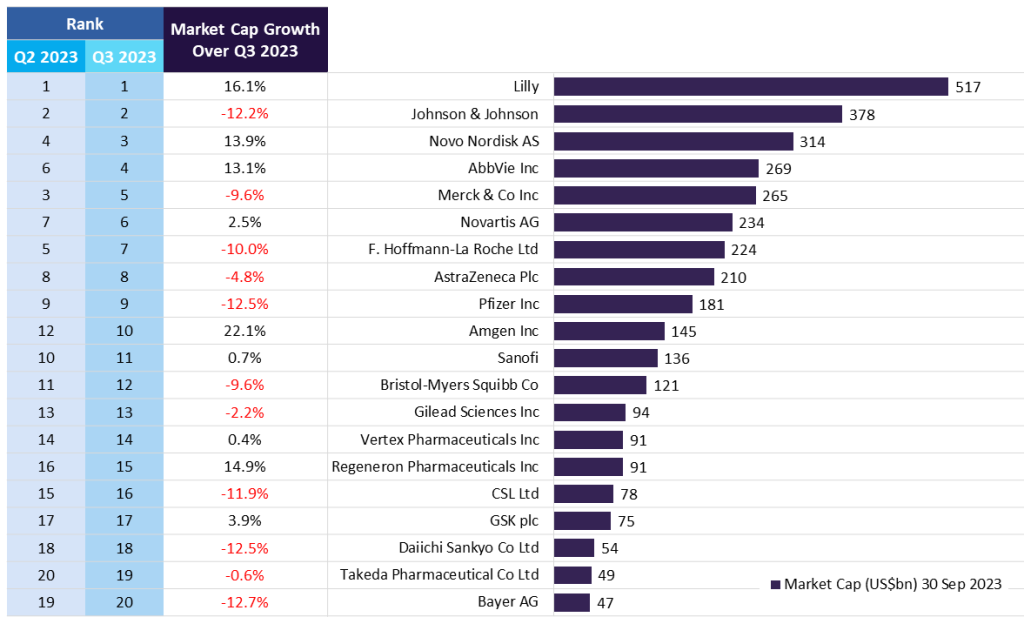

Leading biopharmaceutical companies are reshaping their strategies in light of the US Federal Government announcement on 29 August 2023, regarding the first drugs subject to Medicare price negotiations under the Inflation Reduction Act (IRA). This is reflected in the top 20 global biopharmaceutical companies reporting a fluctuation in their market capitalisation over Q3 2023, demonstrating the industry’s response to evolving regulations. These fluctuations have resulted in an aggregate marginal market capitalisation increase of 0.2% from $3.56tn in Q2 2023 to $3.57 trillion in Q3 2023, reveals GlobalData, a leading data and analytics company.

Amgen witnessed the largest market capitalisation growth of 22.1% over Q3 2023, fueled by its improved Q2 earnings, revenue, and $27.8bn acquisition of the rare-disease drugmaker Horizon Therapeutics, completed on 6 October. This acquisition will strengthen Amgen’s presence in the anti-inflammatory drugs market as the company now encompasses a portfolio of first-in-class rare inflammatory disease drugs such as Tepezza (teprotumumab) and Krystexxa (pegloticase), used to treat thyroid eye diseases and chronic refractory gout, respectively, as well as Uplizna (inebilizumab) for neuromyelitis optica spectrum disorder.

Lilly maintained its leading position as its market capitalisation surpassed $500bn while Novo Nordisk, currently dominating the diabetes and weight-loss market, saw a market capitalisation growth of 13.9% over Q3 2023, which saw the company move up to third position in the list.

Both Lilly’s and Novo Nordisk’s market capitalization growth over Q3 was boosted by the success of their weight loss drugs. Lilly’s injectable drug Mounjaro (tirzepatide) reported promising late-stage trial results in SURMOUNT-3 and SURMOUNT-4 and drug analyst consensus forecasts anticipate global sales of $27.3bn by 2029. The positive data strengthens Lilly’s position in the weight loss drug market and positions the company as a competitor alongside Novo Nordisk’s Wegovy (semaglutide) and Ozempic (semaglutide). In response to soaring demand, Novo Nordisk is implementing sales restrictions to keep up with the market needs as sales of Wegovy and Ozempoic achieved global sales of $1.06bn and $3.1bn, respectively, in Q2 this year.

Regeneron reported a market capitalisation growth of 14.9%, primarily attributed to the FDA approval of its high-dose Eylea (aflibercept) for eye diseases, a VEGF fusion protein, that reported $1.5bn in global sales in Q2 this year, according to GlobalData’s Pharmaceutical Intelligence Center Drugs Database. Eylea is approved for the treatment of three eye diseases: wet age-related macular degeneration, diabetic macular oedema, and diabetic retinopathy.

Bayer saw a market capitalisation decline of 12.7% in Q3, which was owed to the company’s agriculture division, unrelated to its pharmaceutical business. While Daiichi Sankyo also witnessed a fall in market capitalisation owed to datopotamab deruxtecan, an investigational TROP2-directed antibody-drug conjugate jointly developed with AstraZeneca that had raised concerns regarding safety and effectiveness in its initial Phase III TROPION-Lung01 readouts. However, not only did datopotamab deruxtecan demonstrate promising results in the recent TROPION-Lung04 trial but also in Phase III trials of TROPION-Breast01 towards the end of Q3. This will likely have a positive effect on its stock price in Q4 2023.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataJohnson & Johnson’s market capitalisation decline of 12.2% was largely attributed to the announcement of Medicare’s first drug price negotiations. Notably, the first ten drugs subject to negotiation include Johnson & Johnson’s Imbruvica (ibrutinib), Stelara (ustekinumab), and Xarelto (rivaroxaban), which had combined drug sales of $15.98nn in 2022. However, the upcoming price negotiations set to take effect in 2026 are anticipated to have a minimal financial impact on drugs that are already expected to see declining revenue and profits due to imminent patent expirations, such as Stelara in the next decade.

Top biopharmaceutical companies, including Johnson & Johnson, are grappling with the consequences of the first US drug price negotiations, an effort by the government to cut its healthcare spending. Companies with drugs undergoing price negotiations will need to mitigate any adverse effects from lower negotiated prices. Leading companies will also need to address the financial implications posed by pricing pressures and seek innovative ways to replenish revenues as the US drug market reshapes.