India is known as the ‘pharmacy of the world’, producing a substantial quantity of generic drugs globally. However, its lax regulatory oversight has resulted in persistent drug recalls and scandals that have stained the country’s manufacturing reputation.

Following the linking of Indian-made cough syrup to hundreds of infant fatalities in 2022, India’s Health Minister Mansukh Mandaviya announced on 11 July this year that all pharmaceutical companies in the country will have to implement mandatory good manufacturing practices (GMP) and that these standards will become stricter after further amendments to India’s GMP rules.

Major international pharma companies operating in India already adhere to GMP standards, as they export their products to highly regulated markets, but the rules will apply in the next six to 12 months to thousands of additional domestic pharma facilities.

India’s Central Drugs Standard Control Organization (CDSCO) declared that 3.9% of all 1,306 drug samples tested during July 2023 were not of standard quality, a slight increase from 3.7% in June.

Specifically, the CDSCO flagged 51 drug samples from several large Indian manufacturers, including batches of Alkem’s Clavam (amoxycillin and potassium clavulanate), and Maxheal Pharmaceuticals’ Maxflux (flucloxacillin).

Maxheal’s site in Nashik, Maharashtra, which produced the faulty drugs, is approved by the European Medicines Agency for other drugs; Maxheal did not respond to our enquiry regarding for what markets the faulty batch was intended.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataA full list of affected products can be found here.

Some of the faulty drugs were also found to be fakes. One batch was labelled as Urimax-D (tamsulosin hydrochloride and dutasteride tablets) and claimed to have been produced at Cipla‘s site in Salcete, Goa.

A Cipla spokesperson told GlobalData PharmSource that “we would like to clarify that the impugned batch of Urimax-D that was declared as spurious by CDSCO was not manufactured by Cipla.”

Similarly, Sun Pharma’s Rosuvas (rosuvastatin) tablets were also eventually found not to have been made by Sun Pharma.

For years, Indian pharma companies, including Bharat Biotech, have urged the government to centralise drug regulations under the CDSCO, replacing state-level agencies, to ensure ‘one quality, one standard’ for Indian-made drugs.

Reassurance about quality control will be important both in the domestic market and to protect the international reputation of Indian-made pharmaceuticals, which has been damaged after alleged fatal side effects from Indian-manufactured cough syrup in 300 children in Cameroon, Gambia, and Uzbekistan.

Cough syrup deaths

Many children’s deaths in recent years in Cameroon, Gambia, and Uzbekistan are alleged to be linked to contaminated Indian-manufactured cough syrups.

In December 2022, the WHO found that the cough syrups were contaminated with diethylene glycol and ethylene glycol. All were manufactured by medium-sized Indian companies, including Marion Biotech and Maiden Pharma, which have now been suspended.

Some cough syrups were made in India and imported to Gambia via Atlantic Pharma. The Gambian government reportedly revoked Atlantic’s import license after an investigation implicated the imported paracetamol resulted in the deaths of 70 children.

The government is now reviewing its laws on the granting of importation licenses as a result. Reuters also reports that the Gambian government is exploring legal action against Maiden Pharmaceuticals and has hired a US law business.

Gambia is considering engaging with the Indian government to seek civil redress on behalf of victims’ families.

Although the Indian authorities have closed Maiden’s Haryana facility, the Indian government has not officially confirmed that these syrups were linked directly to the children’s deaths in Gambia.

This legal development could rekindle scrutiny of Indian pharmaceutical products across Africa, especially as it comes shortly after issuing safety alerts in Liberia and Nigeria for some of these products.

Increased regulatory scrutiny

In August 2023, Mandaviya announced that all pharma companies operating in the country will have to implement mandatory GMP standards within six to 12 months, depending on the companies’ size.

Companies valued above $30.2 million will be given six months to comply while pharma companies below this value – classed as micro, small, and medium entities (MSMEs) – will be given 12 months, according to the newspaper the Indian Express.

Out of the total 10,500 pharma manufacturing facilities in India, 8,500 belong to the MSMEs category, according to official figures.

The minister argued that these changes will provide a “smooth transition” to implement the recently amended Schedule M of India’s Drugs and Cosmetics Rules, which governs pharma GMP standards in the country.

Major changes in the revised Schedule M include the introduction of quality risk management, product quality review, pharmaceutical quality systems, qualification and validation of equipment, stability studies, and specific requirements for the manufacturing of hazardous products.

Large Indian pharma companies already adhere to GMP standards as a condition of exporting to markets such as the EU and US, including periodic inspections of manufacturing facilities.

India is also a major exporter of medicines to low- and middle-income countries which require WHO-GMP certification: GlobalData’s Contract Service Provider database shows there are 1,351 contract manufacturing facilities in India with WHO-GMP certification.

This leaves thousands of Indian facilities that, until now, did not have to conform to GMP standards, and which will need to swiftly modify practices.

Although India is a large producer of generics, it also manufactures innovative drugs for international markets.

GlobalData’s Drugs by Manufacturer database shows that Indian sites manufacture 184 innovator and biosimilar drugs for the US and Europe.

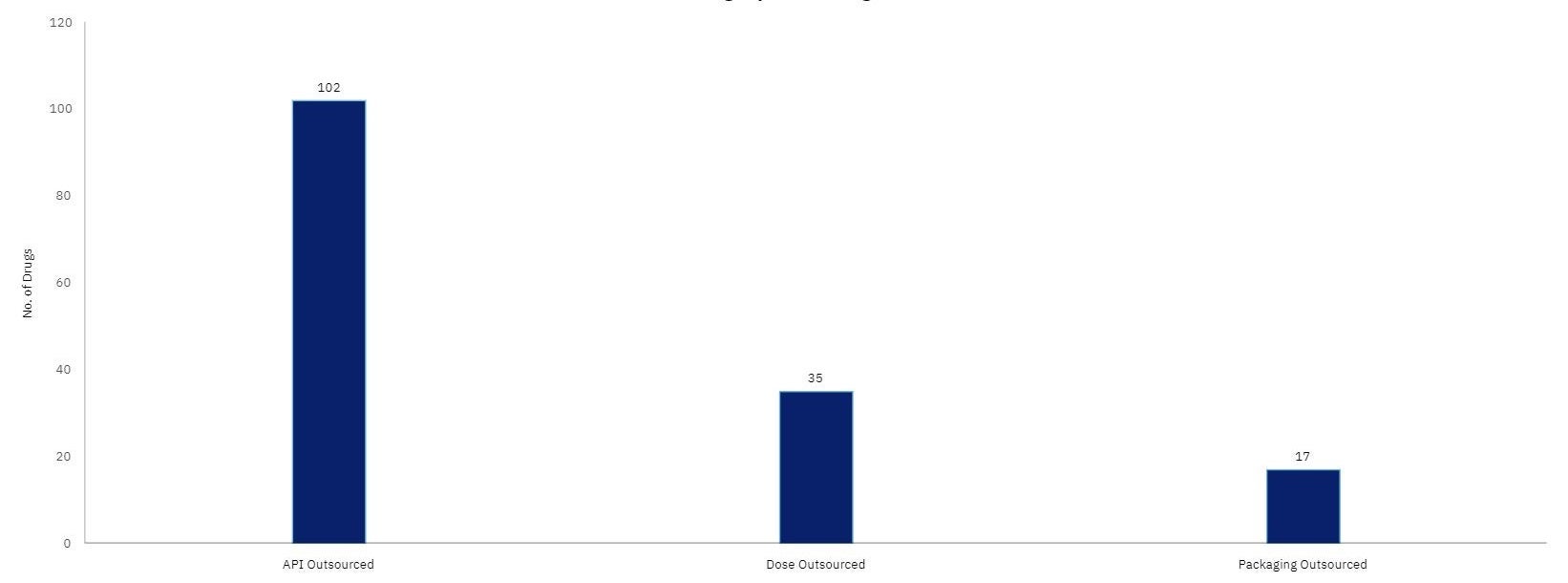

Most of the outsourcing of these products is related to API manufacturing.

Indian sites produce blockbuster drugs such as Pfizer’s Comirnaty and AbbVie’s Humira.