Even giant pharma companies with large internal production capabilities are leaning on outsourcing to meet market demand for huge numbers of injectables, including high-value biologics and Covid-19 vaccines, according to a GlobalData analysis. Large (market cap $10–100bn) and mega-cap (market cap >$100bn) sponsors also require contract manufacturers and packagers with specialist injectable capabilities in the case of cell and gene therapies, as shown in the report titled Contract Injectable Packaging Trends in the Bio/Pharma Industry (August 2022).

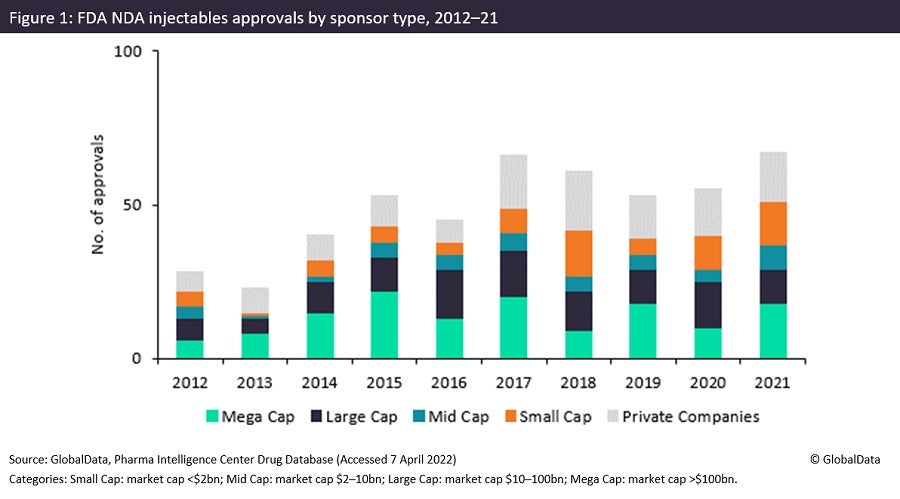

The number of US Food and Drug Administration (FDA) injectable drug approvals for large and mega-cap pharma sponsors tends to be greater than that for small-cap (market cap <$2bn) and mid-cap (market cap $2–10bn) companies. This trend was borne out in last year’s approvals, although new drug application (NDA) approvals were relatively high in 2021 for small-cap and mega-cap drug sponsors compared with historic standards. Injectables are more complex than oral solid dose drugs and so require more costly manufacturing capabilities, which only larger companies tend to be able to afford. A lack of small and mid-cap companies among marketing authorisation holders is not normally good news for contractors, but even large and mega cap sponsors require outsourcing partners in certain conditions.

The number of approved products sponsored by small, large and mega-cap companies increased between 2020 and 2021. The trend of small-cap approvals increasing is potentially advantageous to CMOs, given that smaller companies are unable to invest in their own facilities or enhance their own capabilities and so historically rely more heavily on outsourcing. For small-cap company sponsors, the number of NDAs last year is the second highest recorded, with the highest occurring in 2018. As with non-injectable approvals, mid-cap companies tend to account for the fewest approvals as a group, a consistent theme over the last ten years.

Why do large and mega-cap sponsors outsource?

Certain innovative products like cell and gene therapies have a limited pool of staff and expertise that can engage with their production; large CMOs have been acquiring these capabilities in recent years and, again, large and mega-cap sponsors will require these services, according to an upcoming GlobalData report, Contract Pharmaceutical Dose Manufacturing Industry: Composition, Size, Market Share and Outlook – 2022 Edition.

Larger sponsor companies can also choose to dual-source their manufacture (using both in-house and outsourced production) and can use contractors as an additional site in a multi-site supply strategy that increases supply chain security and offers backup capacity. This is especially the case in an age of supply chain disruption caused by the pandemic and the Russian-Ukrainian war. Outsourcing may also be pursued if it is more favourable in terms of time and/or cost. Contract packaging of cell and gene therapies also requires specialist capabilities, and contractors manufacturing dose often also provide the packaging as part of an integrated approach.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData