Morocco’s pharmaceutical sector will undergo a major change as the country prepares for the introduction of a new drug pricing reform. Minister of Health and Social Protection Amin Tahraoui unveiled a new draft version featuring significant amendments to the original Drug Pricing Decree (No. 2-13-852) of 2013. These revisions propose more frequent periodic reviews of registered drug prices, a new flat rate for generic pricing, adjustments to manufacturers’ profit margins, and a limit on the number of generics per originator product. According to Tahraoui, pharmaceutical trade unions and pharmacists’ associations have been informed that the decree will be finalised soon and will be submitted to the Government Cabinet for approval. Amid continued unrest in Morocco’s pharmaceutical sector, deep-rooted concerns and widespread opposition to the draft version threaten its successful implementation.

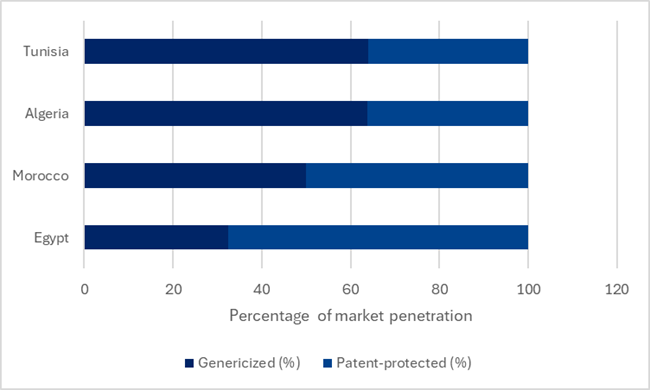

The revised decree places a particular emphasis on generic medicines. Generics are increasingly dominating Morocco’s market due to their affordability and growing demand. According to GlobalData’s Price Intelligence (POLI) database, genericised products make up almost half of the domestic market, with a sizeable market for innovative medicines, compared to its neighbouring markets, as seen in Figure 1.

Figure 1: Genericised versus branded market penetration

In an attempt to stifle what the government views as “unnecessary competition” in the local market, it plans to introduce a new limitation on the number of generic drugs per originator product for the first time. Under the new regulation, the ministry is seeking to cap the number of generics marketed in Morocco to five generics per reference originator. This cap is part of a broader strategy to promote domestic pharmaceutical production. It could introduce a level of protectionism, such that domestically produced generics could be given preference when granting marketing authorisations, when more than five applications are submitted for a single originator drug. While the cap may encourage domestic generic manufacturers, limiting the number of generics risks undermining price competition and constraining access to a broader range of affordable treatment options.

Under the original Drug Pricing Decree, generic drugs are priced based on a minimum rate of reduction (MRR) applied to the originator drug’s price. The required minimum reduction percentage is regressive; the more expensive the originator, the greater the decrease. Moreover, the price of generics in Morocco is indirectly impacted by international reference pricing (IRP). The new reform proposes new drug pricing regulations for generics, which will mainly impact manufacturers’ profit margins. The new rule stipulates that generics must be priced up to 30% less than the originator medicine for the first generic. This amendment will particularly affect medicines listed in the T3 and T4 categories, which include high-cost drugs, most of which are to treat chronic conditions such as cancer and hepatitis.

This is accompanied by the decision to reduce the drug price review period. The reform suggests reviewing drug prices every three years, instead of the current five-year period stipulated under the 2013 decree and according to IRP regulations. Under the original rules, prices of drugs set using IRP must be reviewed and revised every five years.

In a price-sensitive market such as Morocco, these changes can have multiple impacts. For example, the reform will improve patient access to essential generic medicines, particularly those for chronic diseases. However, a mandatory 30% reduction in the price of generics will impact both generic and innovative drug manufacturers by reducing their profit margins, potentially discouraging market entry or leading to supply shortages, thereby limiting the availability of affordable generics in the long term. Moreover, in a market where pharmaceutical innovation is already limited and heavily reliant on imports, the regulation may further strain local manufacturers that lack the financial resilience of multinational companies.

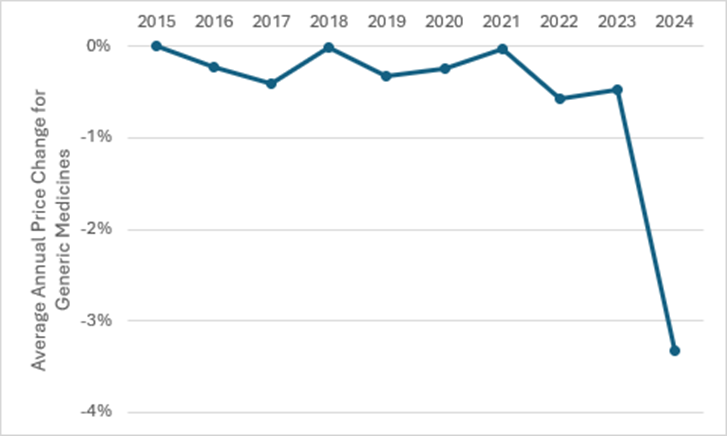

Mandatory price reductions and more frequent reviews are expected to accelerate price erosion, continuously driving prices downwards. Over the years, the average annual price change for generic medicines has fluctuated, but a general downward trend has been observed since 2021, based on data from GlobalData’s POLI service. The large change in 2024 is due to several major price reductions which targeted originator, biosimilar, and generic medicines.

Figure 2: The average annual price change for generic medicines in Morocco over a nine-year period

The average price change for generic medicines in 2025 is expected to be high, as the government also announced a reduction in the prices of more than 8,656 generics. The decision is expected to contribute to annual savings of Dh1.69bn ($186.4m) for the state health insurance funds and Dh509m ($56.1m) for patients. Despite this, pharmacists expressed dismay about the decision, citing the price disparity of medicines marketed in Morocco compared to neighbouring

countries in the Middle East and North Africa (MENA) region. According to multiple sources, drug prices in Morocco are generally higher than in neighbouring markets. For example, the price of Roche’s (Switzerland) breast cancer drug Herceptin (trastuzumab) 150mg (one dose) in Morocco is Dh4,261 ($473), compared to E£7,846 ($161) in Egypt, according to an analysis of GlobalData’s POLI database. The huge disparity in drug prices between Morocco and neighbouring MENA markets will likely fuel dissatisfaction among both patients and industry stakeholders.

Likewise, pharmaceutical trade unions have claimed that the new pharmaceutical pricing framework “threatens the economic balance of local pharmacies and threatens national drug security”. The frustration is due to the fact that the government did not make amendments to the pharmacists’ profit margins in line with the new changes in the manufacturers’ profit margins. Despite the targeted protests and opposition to the reform, the government is unlikely to make further major amendments. All that remains is for the government cabinet to approve the decree.

This blog was modified on 16 September 2025 to clarify the amendments to the price linkage regulations.

This article is produced as part of GlobalData’s Price Intelligence (POLI) service, the world’s leading resource for global pharmaceutical pricing, HTA and market access intelligence integrated with the broader epidemiology, disease, clinical trials and manufacturing expertise of GlobalData’s Pharmaceutical Intelligence Center. Our unparalleled team of in-house experts monitors P&R policy developments, outcomes and data analytics around the world every day to give our clients the edge by providing critical early warning signals and insights. For a demo or further information, please contact us here.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData